Market Briefing For July 16

None dare call it treason' became a revived topic for discussion Monday, regardless of the ongoing limited liquidity flows to the stock market; as I did discuss again based upon the landmine versus goldmine earning responses to Q2 reports, which will be arriving with an accelerated flow this week.

If you monitored media closely you heard 'challenges' to Peter Thiel's latest allegations against Google, and demands for an FBI or CIA investigation, as relates to espionage and even treason. Before the media delved into it, in my first morning comment, I mentioned a specific instance of this; which had been a 'Project Drangonfly', which was their search engine designed for China, on their behest, and with backdoors built-in allowing for snooping.

'Loose Lips Sink Ships'

In this case, what irked me a bit was the obvious tilt by reporters to try hard to frame a guest (involved with the same venture-capital firm as Peter Thiel) by trying to put the allegations into a politically correct frame-work, avoiding the specifics I know they already knew; because CNBC had reported it back in 2018 (referring to Project Dragonfly and working with China's Army).

Now I realize that Peter's allegation may be timed during the negotiations of course with China (another reality-check along the lines of Huawei but very different in some aspects); and thus the timing may have political motives as well as being true. But the media tried to drop the context, and at one point briefly mentioned 'well they're not working on a Chinese search engine now' 'as if' that legitimizes everything else. First of all they refused Pentagon work and secondly they did not properly vet access to critical AI data algorithms, that China not only might, but effectively has, incorporated into Chinese AI systems; and Thiel's colleague mentioned that. CNBC ignored that and tried again to make it an area of controversy. It's not: treason is treason.

I was glad to hear this expanded upon; and the guest was right that Silicon Valley is generally aware of China's exploitation of our expertise as well as our great advanced educational capabilities, from which quite a lot of very experienced (not merely just-graduated) students of our universities go.

Loose lips do sink ships; and that's why Huawei was/is building back doors in devices; and perhaps why certain devices 'could eavesdrop on scientific discussions; not just for intellectual curiosity or to train system language.

In-sum: Chinese espionage is subtle; it's smart while being perverse; and it is fairly broad. Allegations regarding Google should absolutely be seriously investigated, because regardless of a trade deal, will remain competitive.

Google's lax oversight is a threat; more than others; but they are not alone. That's especially as regards policies that are questionable and may in-part be 'why' Apple stood up in favor of privacy. Apple warned about 'others' and the consistent eavesdropping (there should never be a Google Assistant or a device that uses Alexa in any secure, educational, or corporate facility since both systems have eavesdropping capabilities). Apple's warning is taken as marketing (which it is); but it's also very pro-American and counters the imaginary 'political correctness' of some other major firms in Silicon Valley.

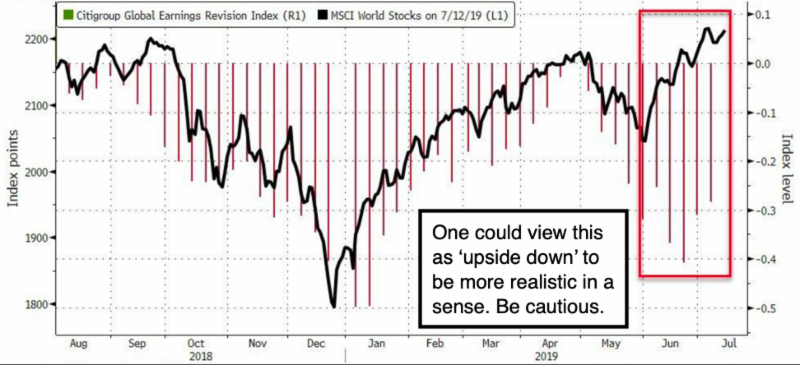

Liquidity in the market is really lower interest rates making stocks attractive on a relative basis; but they are at high levels fundamentally, and seasonals are not supportive, and should contribute to a wobbly S&P as time evolves.

The market may eagerly anticipate a Fed cut; however the bulk of benefits, such as from the tax cut and regulatory improvement, are receding issues. I should also point-out that buybacks have diminished as an impetus as well.

The preceding boost of growth actually trailed some of the non-recurring bull influences; and the market will have trouble if the financials don't perform in a more superior way; as they have most recently tried. Net-interest margins are an issue (and we may see more in the bank earnings later this week).

Markets are sort of 'risk-averse' now, and they should be. Safe harbors are the rage at the moment; and a barbell approach (safety, no leverage, and a bit of speculation in depressed small or mid-cap stocks) seems reasonable here; while short-selling generally remains risky ahead of a possible deal of course with China, which can have sharp short-term influences if it hits; or of course if it fell apart, the influence would seriously increase volatility.