Market Briefing For Jan. 6, 2020

Power-vacuum risks - are really at the heart of concerns regarding the tension in the Persian Gulf region (more broadly than just Iran vs. US). I have noted for years the Iranian efforts to undermine an independent or mixed Iraqi environment; where the only thing positive that Saddam did in the old days, was be the glue that kept Shia and Sunni apart (varying from how Qaddafi kept a cork in the bottle of North African emigration (a US debate on whether his removal was justified; as evil as he was).

For now we focus on a Persian (mostly Shia) / Arab (mostly Sunni) fight; of course that rivalry (or hatred) was insufficiently grasped long ago by a couple Administrations; nor was the handling of it post-the-Iraqi war. The 1st George HW Bush 'got it', which is why he halted Scwarzkopf's move to Baghdad short of total victory; because we would have 'owned' Iraq. It apparently didn't get grasped by his Son; and making matters worse, the occupation failed to put the police and army on 'our' payroll, similar to an approach used by General Macarthur in Japan or Patton in Berlin, after the war (feed their families, and they likely won't revolt against you).

Where that leaves us 'now' is an Iran that did permeate banking (the first of all areas they moved into, and which incentivized small businesses to be loyal) in Baghdad; and I noted objection to this years ago. And then of course the very same militias that attacked our troops around Basra, and introduced deadly IED's that penetrated our heavy armor, were the Iran-supported Shia that ultimately evolved into a component of the Iraqi security forces (because they let Shia in the Government); at the same time they 'sort of' fought with us against ISIS, which of course were/are mostly Sunni. Is it a basis of why the US shouldn't expect to tame them?

And perhaps (aside the pay-off money and political aspects with Iran) it was the participation of Shia militia fighting ISIS that held-off the US (we had a chance) going after vermin like Soleimani; which might reflect on the complacent surprise that we responded to Iran's expansionist efforts in Iraq, while ignoring Iran suppression of their own citizens. Hence how the zealots running Iran killed or imprisoned thousands of their citizens, and tried to influence Iraq that way too; with some opposition recently.

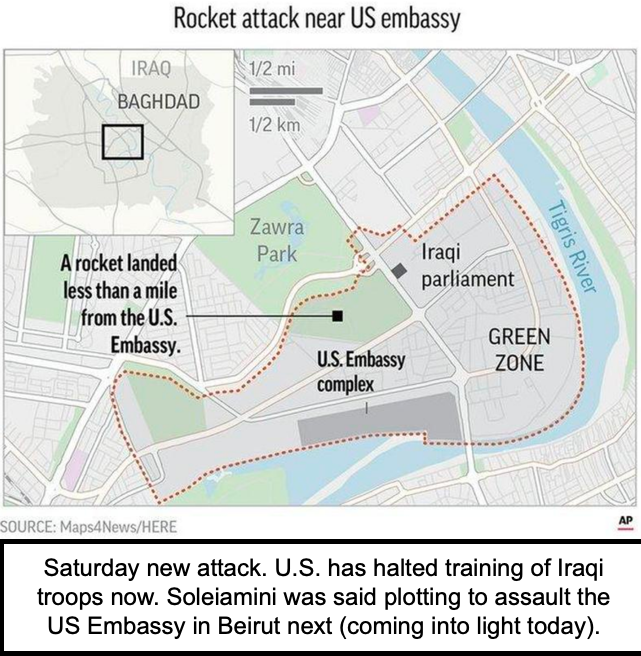

The point is that a power-vacuum already allowed Russia and Iran vast expansions of their influence in the region (especially Syria); partially as we disengaged; and perhaps they quickly got a bit too cocky. After all, if these terrorists were brazen enough to drive thru Baghdad, in a 2-car convoy (presumably Soleimani just arrived from Beirut, likely planning a similar challenge in Lebanon, which might be what we hear next week).. so they felt a degree of comfort in their Iraqi surroundings. For years I've mentioned the risk of Iraq becoming a vassal state or satellite of Iran; so that's really the challenge that has now taken center stage.

Bottom-line: Senators will get a classified briefing on all this early in the new week; and will likely better-grasp what led up to this. Probably this was less a diversionary effort related to the Impeachment or Election as some speculate; but rather a lack of understanding of how seriously the Iranians were really provoking the situation in Iraq, after we ignored their earlier provocations against our 'drone' or Gulf shipping, or the Saudi Oil facilities attacks, as everyone recalls occurring just a few months ago.

The market does not see this as such a long-term condition as it 'might' be. If the Oil futures market is correct, this isn't going to explode widely. But the United States also is convening (Lindsay Graham's remark isn't irrelevant) that 'if they wish to remain in the Oil business, they now need to stop harassing the U.S. and covertly or overtly hitting our allies'. That's a pretty direct threat beyond sanctions, do totally destroy their economy; and it's intended to deter them; but might not. Tactically it is assumed Iran doesn't want to physically provoke an invasion (nor do we have any desire to occupy the place, which would require millions of troops and be more comparable to WW 2 than anything recently seen).

If President Trump is counting on deterrence; it's however a big gamble as it's broadly assumed they will respond; as this goes beyond tit-for-tat. And that means the Oil futures may be underestimating the risk; aside of course the domestic energy independence, which is rather helpful now (I argued for it for many years, while politicians suppressed Oil). This isn't a case about 'climate change'; it's a reality of petro-politics and keeping the money 'in' North America; rather than flowing to the Middle East.

In-sum: the hierarchy of risks becomes more intense with regard to Iran but that's already been at the top of our geopolitical concerns. And sure, when you get people thinking it's Goldilocks time in markets; it's really a frothy period (at least in pricey FANG momentum leaders). Premature to draw conclusions about how this progresses, much less sorts out' sure. I'll touch on it a more in Video 2 (both videos Friday). And as this report is on Saturday (with more news covered in a couple graphics) I'll not do a Sunday special update unless matters deteriorate in dramatic way. In a sense my greatest fear is that Iran might try to hit an American official or military officer, as their version of a quid-pro-quo. We'll hope unable.

In-sum: the concern will be if so-called 'plausibly deniable' attacks by a slew of Iranian proxies occurs, anywhere in the world, rather than direct regional confrontation; now that the U.S. is deploying serious elements of the 82nd Airborne to the region (Kuwait mostly; with US Marines now in Italy preparing to fly to protect our Beirut Embassy if ordered).

This is less a political question of our wanting Iran to be dismembered in a sense (regime change which they believe we've sought for 40 years; a fact we're justified in after what they did with the Hostage Crisis or more) and really what happens elsewhere. Probably many responses ahead; in a sense because the 'official' that was targeted isn't viewed by radical Islamist's as one serious monster responsible for the deaths of hundreds of Americans as well as others. So to an extent the brazenness of Shia reflects their belief they were winning the proxy war with the U.S. as Iran expanded a degree of influence in Iraq and Lebanon.

The Pentagon had likely come to that conclusion too; hence something needed to shift that 'chemistry' (although in the very long run few expect us to stay there; but Iran will always be there; so there's a problem with that awful regime for a long time, unless wishful-thinking prevails with all the radicals tossed-out (highly desirable but unlikely). Also there's rumor that Soleimani was orchestrating a 'coup' against the ruling government in Baghdad and/or Beirut (which is essentially ungoverned; maybe the former Nissan Chief having fled Japan, wants to 'assemble' one); again no details. But seriously look at a map and Iran's intent if obvious (and it includes as mentioned long ago; a trans-desert pipeline to the Med.)

In any case the world and the outcome are more risky. Soleimani goes back to the Iranian Revolution; and was around even when the hostage crisis occurred. There's a case to be made that 'proportional responses' (which even Trump had previously stated as a reason not to attack after the drone shoot-down) were deferred this time for a reason; and that's a surprise that may be expanded on next week with a Briefing to the Hill.

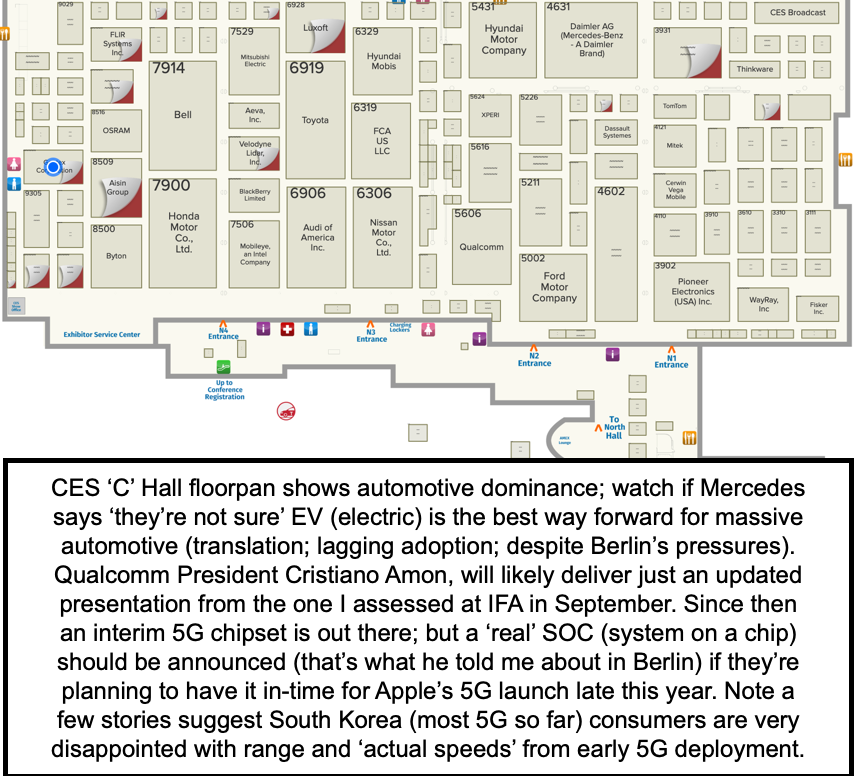

Speaking of next week; it's also CES. Starting Monday, I'll resume (as I already began a week ago) shared snippets from the 'trade show', with embedded comments. These will be interspersed within other topics, as CES now takes back-burner status compared to Middle East crisis, and market behavior that may occur for other reasons too. I make this point so new members understand graphics often won't correlate to adjacent commentary. Furthermore I'll try to provide less text and mostly focus on matters by video, especially regarding analysis or technical comments about the market. More below. Hunker down to enjoy the weekend!

(Next week we'll focus a lot on CES; although clearly other concerns take precedent.)

|

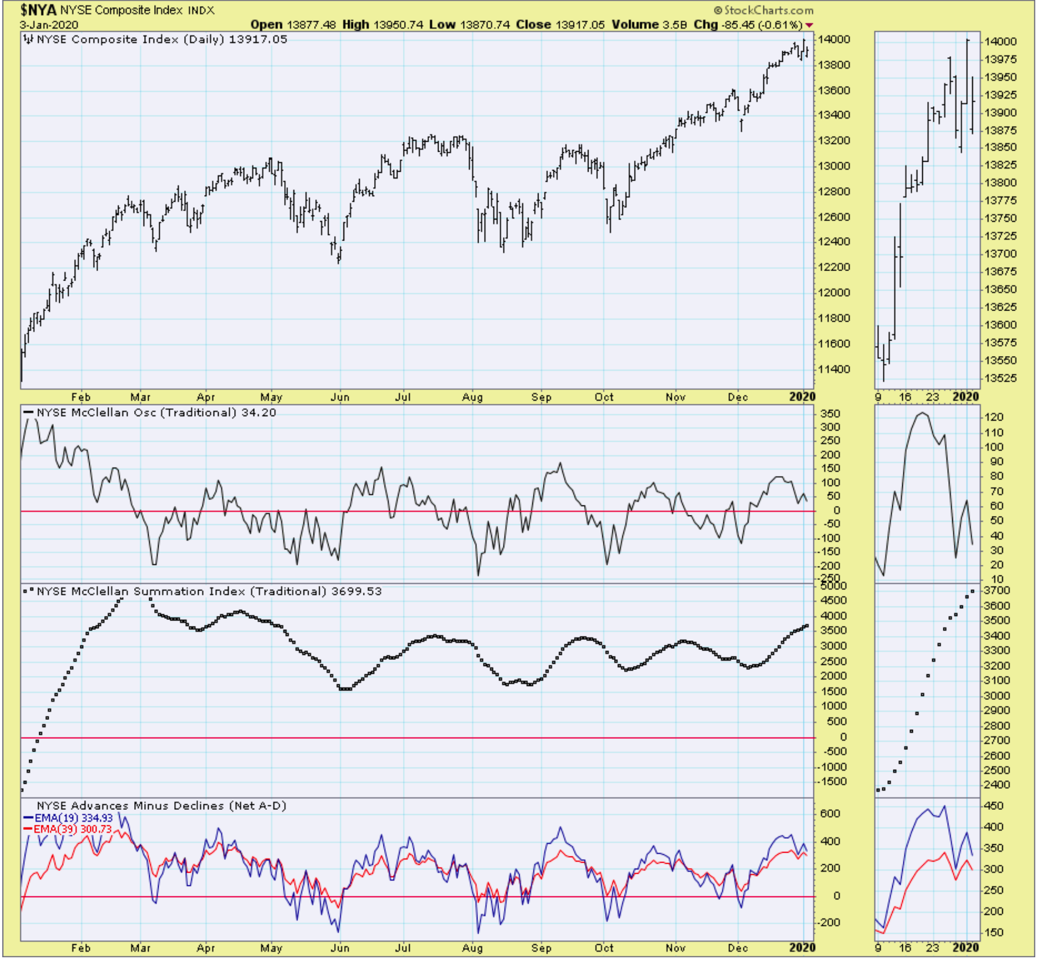

Daily action - saw S&P pattern evolve as suggested early on and even in last night's expanded comments: that being down; then run-in those who tried to sell and/or short weakness, prior to a defensive weekend as intraday rebounds were trimmed due to an absence-of-bids mostly.

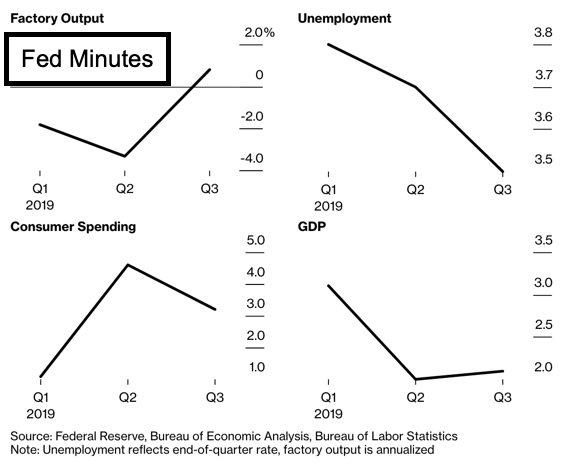

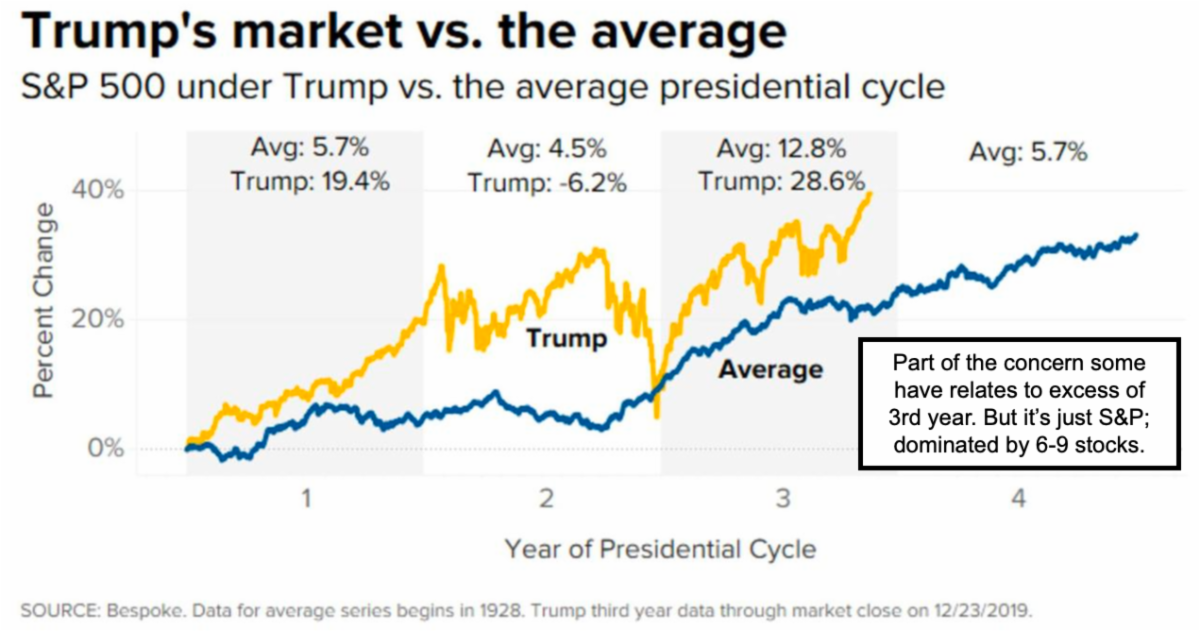

The incredibly strong overall uptrend in the S&P has possibly not gone to quite the extreme some think; even as a 'black swan' exogenous Iran event occurred. Meanwhile, we also got the Fed minutes, with officials signaling that interest rates wold basically remain on-hold through 2020; which was/is the primary factor underpinning this stock market.

Combine FOMO (fear-of-missing-out) chasers (we warned against S&P or FANG chasing) and the possibility (odd as it may seem) that a wider war might 'not' occur with Iran; but a trade deal may 'expand' further with the Chinese, and you have contrary thinking that might suggest higher yet; albeit not instantaneously. Definitely depending how things go.

The dispatch of thousands more troops to the Middle East this weekend, is either to make a point to Tehran, or just contingency preparations. I'm not exactly fond of the Saudi's (often noted); at least as relates to highly controversial aspects of that relationship. It's mostly based on Oil; so the threat to 'put Iran out of the Oil business', might just be what it takes for Iran to hold-off on closing the Straits of Hormuz; opting for more covert 'revenge'; plus China (who gets lots of Oil from the region) may press to Trump not to hit too hard, since Asia relies on Mideast Oil. We actually don't but the infrastructure to offset and distribute 'that much' oil to China is not yet mature enough; but it could be over time.

This is why U.S. energy-independence was and is so important. It also minimizes the typical knee-jerk reaction about consumer oil prices (as if that's all people worry about), and acknowledgement of opening reserve sources if needed. Sure; but we actually don't need to unless we're just the last resort having to supply Europe and Asia with American crude as well as LNG. Perhaps this crisis enhances a larger deal with China.

Conclusion: the United States is 'not exactly' already enmeshed in new quagmires; but it can become that. The Europeans may or may not pull out of the Iranian Nuclear Deal; but while not in a rush; they just might. I would look to France for leadership in that direction; as they have been a bit too chummy with Tehran (and thus have some leverage there).

Short-term global antagonists (as includes not just Iran, but North Korea or even China) see Trump's rather decisive move; so they probably don't want to test that further for now. Some are stunned by it in fact.

My take: this was all profound, but not equivalent to taking-out Admiral Yamamoto as he was flying in the Pacific; well after we sank their main aircraft carriers, at the Battle of Midway (which reversed the course of the Imperial Japanese Navy, and marked the war's turning point as well as the stock-market bottom of the entire War at that time in 1942).

But this was the guy who set Iran's policies in the region, so yes risks for sure are out there; and we'll see as the Shia fanatics absorb all of this. If Trump's calculations are only short-term (they have limited staff depth in the current Washington scene), it would not be stunning if (Art of a Deal perhaps?) he ultimately (back-channel perhaps) offers Iran 'an out' that's good for all sides. That's only if Trump sees that this could hurt him and I think there's reason to believe such thoughts already are circulating both in Washington and at the UN perhaps; even if nobody talks about it. For now there's definitely not a diplomatic opening to approach Iran, yet.

Smart political analysts believe Trump's instincts are more peaceful than many of his confidants or entourage, including Secretary Pompeo. Here I don't believe Trump seeks Obama's (curious) Nobel Peace Prize; but I do see all this as so 'counter' to his posture of 'getting out' of the Mideast entanglements, that he might settle for goals nobody contemplates.

I made a remark early Thursday; hours before 'targeted assassinations', when the Iran's head-of-state Khameni that "Trump can't do anything"; that Khameni should be careful; because that's throwing down a serious gauntlet to Trump; who just might show Iran exactly what he can do. We don't want to see open war with Iran; suspect we may not; and while for sure it's wise to order all (non-essential) Americans out of Iraq for now, it might just be that the 82nd Airborne will be aimed at securing stability in Iraq, not necessarily any expeditionary adventures with Iran.

This is sort of our 'Pretorian Guard' if you will. It won't be surprising that I tell you one family friend in the Ready Reserves finds himself on a Navy 'mobilization (online) portal'; potentially sourced for deployment.

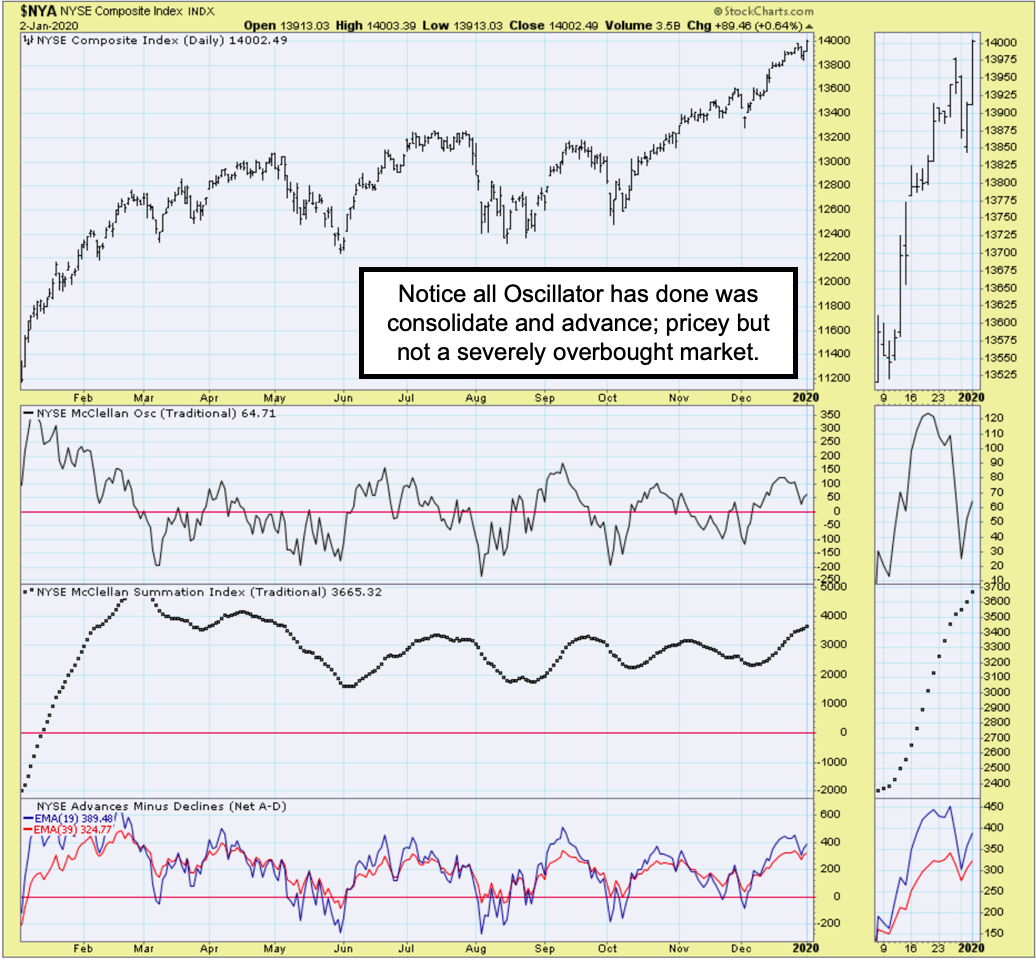

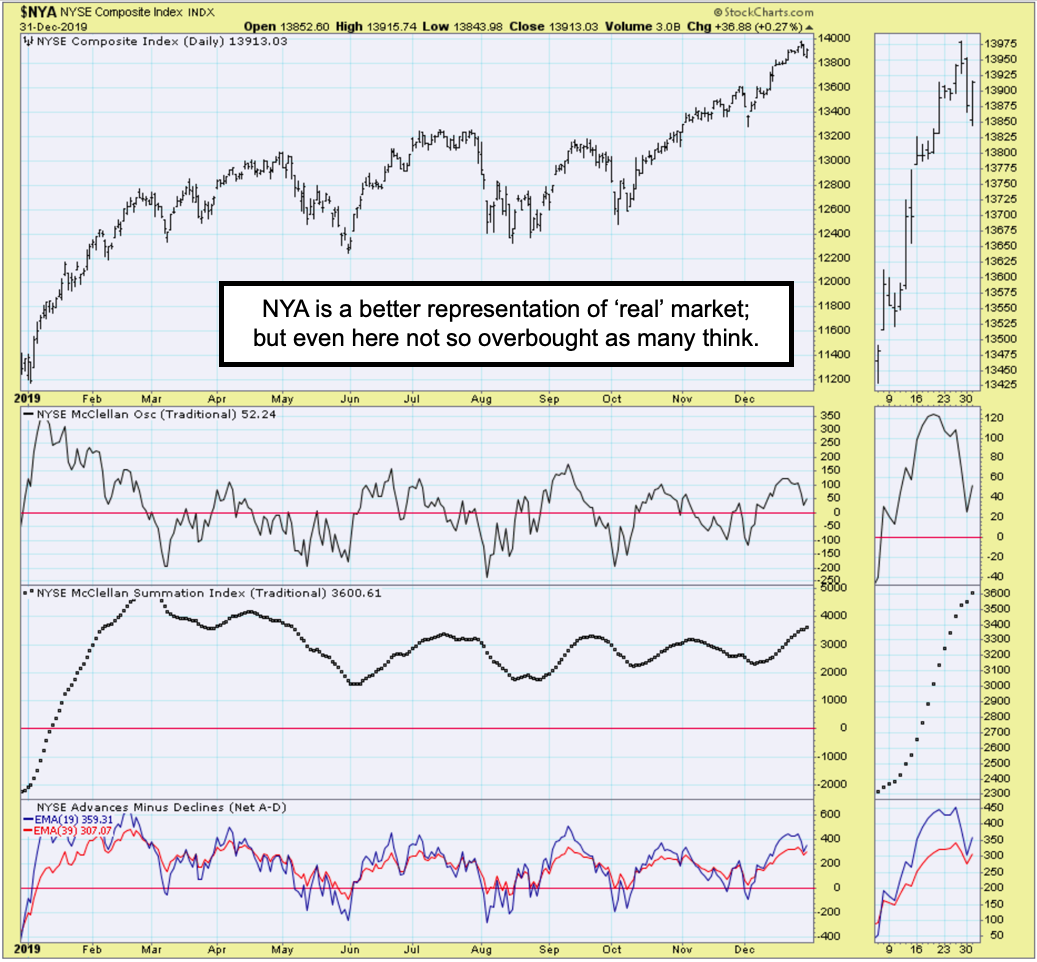

All this may do a favor for the market; by taking the edge off excess, and at the same time not doing much damage to the broad list that hasn't at all been at the helm of upward action over the past year (a reason we've not believed the overall market was 'really' not as 'jammed overbought' as technicians generally contended; although the S&P sure was frothy.

Overall; a 'black swan' swooped in; but we're not viewing this as some alarmists are. There's probably blow-back coming; regardless whether we actually neutralized an imminent threat (that might have been not in Iraq, but in Lebanon, which is where Soleimani factually flew in from).

Trump has shown a great deal of military restraint in his foreign policy. I am not convinced that it was merely his 'ego' after Khamani said 'Trump could do nothing' that kicked-in. And an attack on our Embassy by the organized Shia militia (or impending on in another country), are attacks on our Country. Iran 'probably' won't risk conventional war over this; but asymmetric risk is a real concern as everyone now knows.

The stock market will likely be a sort of trading range for the moment; as it wants to take a bigger hit, somewhat offset by oil, but also ahead of (at mid-month) the presumed China trade deal signing; and later Brexit. It's a full-plate to digest, and we'll nibble at all these areas over the month of course; with a modest focus on CES we've already begun.

Prior highlights follow:

Flash at Press Time: after preparing tonight's report below; I got an 'unconfirmed' report that tonight's rocket attack on Baghdad Airport in Iraq, killed the Iranian military (QUDS Force) head; the notorious General Solamani. Killed by his own supporters would be the inference. However, it sounds like a wishful-thinking stretch and pretty-extreme news story; assuming he could be freely in Baghdad and just happened to be hit? Although we know that Iran has advisory barracks 'in' Iraq, which purposely were 'not yet' targeted by the US Air Force strikes last Sunday. So we'll see. Interesting. It's going to be interesting to see if this starts a war, 'or' triggers a mass uprising of Iranian freedom fighters, who have been suppressed since the 'Green Revolution' attempt to throw-out the theocratic mullahs that have been running Iran since the Revolution.

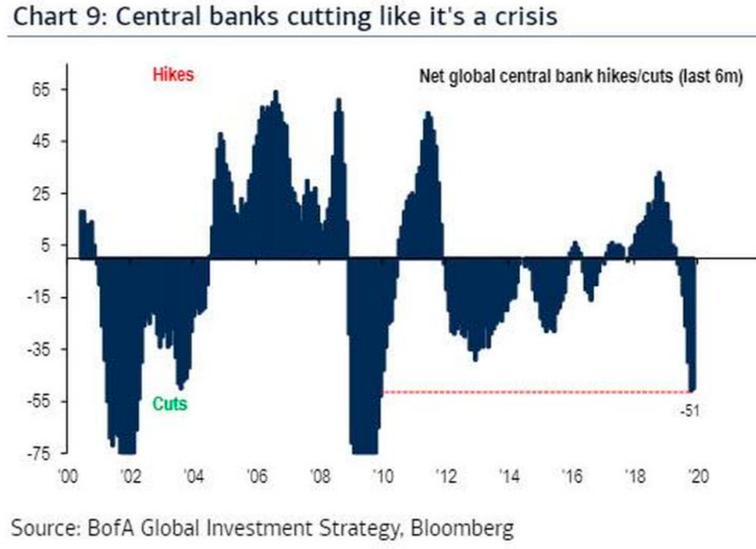

A robust start for 2020 - relies in-part on the promise of a China 'trade deal' signing on January 15th; and Beijing's PBOC (central bank) cut of their Reserve Requirements by 50 basis points (we heard on Tuesday a rate move was coming to help stimulate their economy).

Basically the market is running higher (perhaps too rapidly); but while it surges ahead (mostly Apple and a handful of others plus general relief I thought likely), and creates concern about worrying when markets start a year strongly, there is the 'worry wall side of that'.

That side of the 'wall' is the idea that President Trump is playing stocks with the expertise of a technician (and no I won't label Kudlow as one at the same time he knows his stuff). Nobody really talks much about this, and I'm unsure if Trump even consciously realizes he's making his own game; but I suspect he knows. How so? He focuses on the S&P.

We can debate the merits or duration of a 'breakout' or a 'melt-up' for the general market; especially since most who are optimistic now didn't believe me in recent months that this basically goes up until it doesn't; and that we'd get periodic shakeouts or even corrections; but no awful disaster, and certainly no financial catastrophe, at least for now. So now they like it; and some thing 'that' is a warning. Might be short-term but not beyond; and not much after the first signing of a China trade deal.

Why? Because dividing reconciliation with China into multiple phases in a sense keeps everyone hanging. Even if the Phase One is solidly more substantial than some speculated (Ag only for-instance, and it won't be An-only; but likely include energy too for-instance); there's more. I doubt Trump would have referenced 'visiting Beijing later' unless there was. In that sense, the strategy leaves room for the market to play with this thru 2020; and that's exactly how you get shakeouts but no Bear Market.

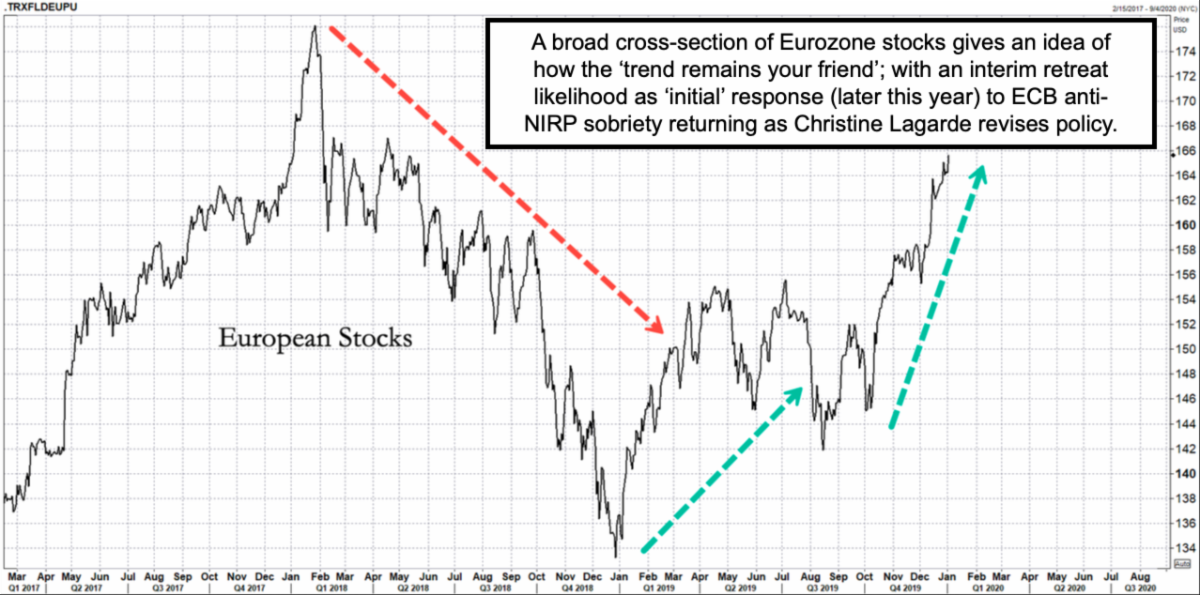

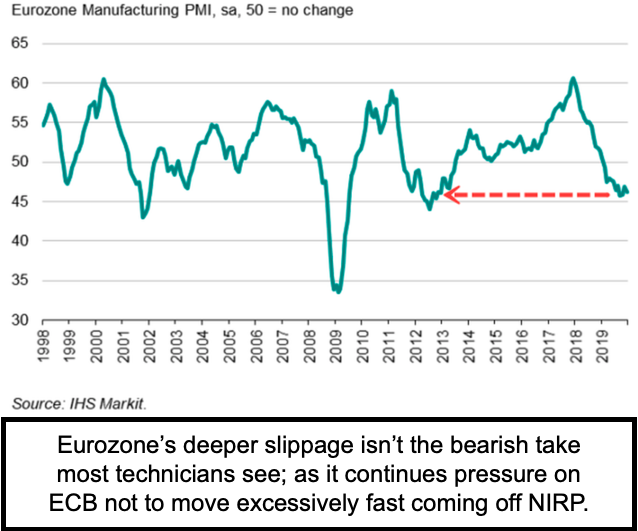

Also the argument about recession is nonsense; we're just starting the Roaring 20's (perhaps); and coming out of, not going into, a new slump. Europe trails in this regard, and so does China (which cut Reserve rates just today as we sniffed-out some rate cut coming a couple days ago). It was and is the United States that is lifting the global scene, as indicated likely more than a year ago ahead of the forecast transition. So it is that transition year just past, that completed a lot of the 'rolling adjustments' in many stocks and business sectors starting in the Spring of 2018; and for which we saw 'green shoots' emerge during the 2nd half of 2018.

In-sum: in general we're not saying big stocks are bargains (they're not of course); but with a broadening of the 'base' of stocks participating; it's not out of the question that of course a 'day of reckoning' arrives; but as we have a friendly (and frightened to do otherwise perhaps) Fed and an ECB interested in starting the retreat from the pain of negative rates; it's premature to assume anything like a final spike top is dead-ahead.

Sort of a peak (that resembles that superficially) may well present itself; but presuming China completes Phase One; and Iran doesn't attack us (I also assume Trump is smart enough to prepare but not preemptively attack Iranian targets to deter them -it's being rumored- because they'd likely respond in a sharp way rather than bend... so caution on all that); and presuming Little Rocket Man cools his jets (bad visual ..); well this can be a rotating market; but with an upward bias (?) for awhile longer.

Yes I don't dispute the idea that down-the-road a more disastrous, even creditmarket / debt-based risk presents itself, but history supports my suspicion that the macro risks will be talked about but not impact stocks broadly until we actually get 'the' blow-off spike. We're seeing a little bit of one now; but because of what I've just suggested; it may not be final at all. Look at the progression I outlined way back in the 1990's (and I'm delighted some of you are with us since then).

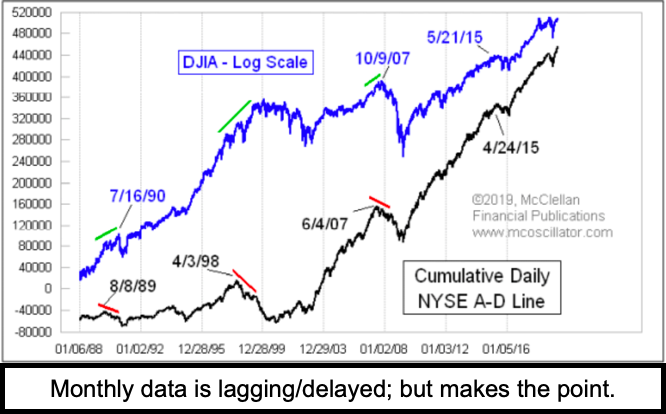

Back then you had 10% give or take sell-offs in the S&P and it worked higher thereafter. Each one of those was a buy-the-dips pattern; more or less what we've seen since indicating the cycle low last Christmas (I refer of course to 2018; not two weeks ago). Presuming that was what I said, a cycle low, this is then anything but a broad overbought market.

Bottom-line: I have argued this point for months; and few see it even now. They're out there talking recession; or valuation spike and that's not the case. That, in fact, was the cycle high, back in January of 2018.. two years ago (so wow feels like yesterday).

Thereafter had a rolling bear market outside of buybacks and nonsense as stocks corrected. Now we're in the midst of a new cycle and they think we're at the end of the old. Nope. It's going to pause periodically; but it's not over; and as I've said for months now, it could be the tailend of 2020 or even 2021 before we're needing to seriously consider that.

Also; with lots of year-end tax selling victims (the downtrodden masses of stocks, often depressed beyond necessity based on their businesses and prospects) rebounding somewhat, that helped the overall breadth in the last couple days of 2019 or of course here at 2020's start. Our vision has and remains clear (dare I say 20/20) about how the President is planning this; which is not to say it succeeds, but that's the strategy.

Near-term: details near the end of tonight's report about a rocket attack on Baghdad Airport. Earlier, Defense Secretary Mark Esper put Iran and its proxies on notice, saying the US is prepared to launch "pre-emptive action" if American troops and interests come under threat. Horns of a dilemma perhaps; but also perhaps the Chief Mullah believes it when he said yesterday that 'Trump won't dare do a thing'. In this case Khamani is poking the bear. I suspect he right that Trump doesn't want to but he also is not about to allow Benghazi-like situations.

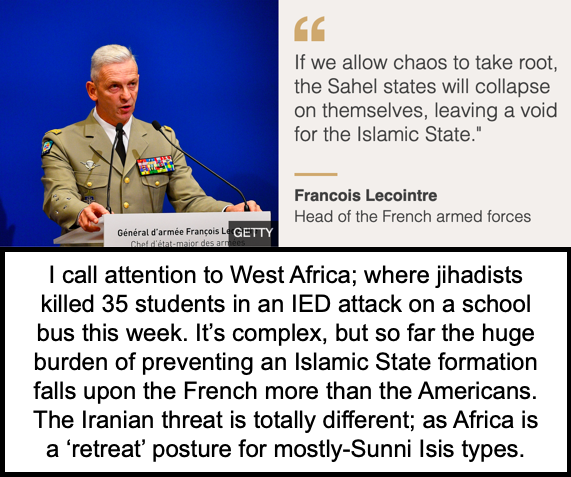

Speaking of, in Libya a Turkish Air Force plane was shot down; appears by Libyan rebels near Benghazi. Turkey is in the process of moving into Libya with troops, not long after they cut a deal to extend (their absurd) drilling rights to offshore Libya. (It's a move I criticized last week while favoring the aspect of 'corking' the flow of migrants out of North Africa; but Turkey's motives are dubious.) The Middle East is not cooling but it is a game-changer to have Iran provoke us via surrogates, and perhaps advise the Libyan rebels too. On top of that there was an Isis attack (by an affiliated group) in Nigeria.

So stay abreast 'if' any of this undermines the market, aside supporting Oil prices, which are unlikely to come down anyway; but not with this (of course the normal reason for firm Oil is as outlined; supply/demand and the China deal reviving hopes for some degree of global growth.

Update at 8:30 pm ET Thursday: now there's a second report saying that Abu Mahdi al-Muhandis, Deputy Commander of Hashd al-Shaabi and Qassem Solaimi Commander of IRGC killed in Baghdad. (Editor: keep in mind I scrambled to stay current as the Daily was finished just as these stories starting crossing the wires; I did my best to stay with it.)

(Macro) action - is not excessively focused on the alternatives outlined by everyone; most of whom did not concur (nor yet figured-out) whether or not my idea of the cycle low being just over a year ago; or significant cycle high (allowing for interim retreats) being way out in the future.

But in all humility; S&P can't constantly advance like today; although for sure I thought somewhat (brief brick-wall or not) it could because the 'universe of stocks' participating would broaden out. I started to review a long list of stocks that are downtrodden and capable of rebound; then I stopped; because that generally is not what we think investors should do in this Index / ETF / HFT era. A few individual stocks for sure; but most money managers at this point are viewing EFT's and Indexes (sort of a modern approach to avoiding deep research); and that's both a factor in pushing the market higher; while also a risk consideration 'eventually'.

So over the holiday (grrr) I took time to prepare a special write-up for a prominent National Service, and I'll share it (about Amarin) in a couple days; well before it's published. You already know the backdrop; and it's just a summary. Today a couple new members asked for an update as did an online site; so below is what I posted there after today's close as a bit of an update. The only part I think our members might not realize is the British Law aspect of how a buyout of Amarin might have to work:

If there's a buyout offer for Amarin, it could get interesting. As I've noted to our members (it's our stock of the year pick from last year; AMD was from the year before and it's been great) .. Amarin may consider a 'deal' but unless it changes what it outlined, English law would prevail; requiring 90% of common shareholders approve; rather than just 50% under Delaware US law. So, while I don't doubt they'd get that percentage at a sufficient price (institutions might well be happy to exchange shares with Pfizer, Gilead, Abbott or whichever big pharma was the acquirer); there might be an effort to suppress share price for exactly that reason; so the on-its-merits price stays low enough to allow wiggle room for a deal, or (ideally) a bidding war to put it 'in-play'. (I'm totally speculating about this.)

Sure, on its own it can grow gradually and more insurance will cover it (formularies or not at the year's start, because it reduces payments for cath-lab work, and so on, for patients on Vascepa for near a year or more). And Amarin would likely see 30+ as I've written as a minimum objective; but as the Irish guys have been pretty clever with this stock (such as favorable chatter before Goldman's secondary perhaps); who is to say that's not the case now (holding it back so whoever the/a suitor may be can get positioned favorably or at least enough so that the price isn't so high as to discourage them). F

Fewer salesmen hired than thought at this point (no shortage of applicants) and maybe a desire to minimize layoffs if they anticipate a deal is forthcoming sooner rather than later, is also hinting at some discussion at least with suitors. Impossible to know; which is why I've said it's just a question of how high, not whether AMRN goes higher. As to the legally (gold-digging?) generics (and that's not an unfair term as this isn't an overpriced drug like so many that ramped prices for sheer greed); generics are likely not an issue; but that of course for the Reno Court to decide (or the parties). Its enough 'possibly' to hold suitors off temporarily (Reno Hearing is Jan. 13). Competition; sure but even if Acasti gets a favorable 'Clinical Trial' outcome (pending this month too and I think prompted at least a question or two that I got); if they have to show an 'outcomes' trial, that's another period of possibly years (at least months) before 'time to market'. Vascepa finally got it's broad label approval after the multiyear 8000 patient REDUCE-It Trial, and FDA postponed it from earlier in the year until recently; keeping it off the 'initial 'formulary' for at least a few healthcare plans; such as the (oft-criticied Kaiser group in California). Open-enrollment is behind now; so some think that holds back subscriptions. We suspect growth regardless; and actually believe there will be pressure on Kaiser or other holdouts to get with this.

Amarin / Vascepa has 'at least' first-mover advantage; for now 'only-mover' advantage. Now we're 'in' at lower prices (mid-teens); hence there's some cushion. It trades pretty wide every day. While of course that reflects a changing of hands as ownership transfers from on-news high buyers, or of course very low-cost early buyers who now have a new tax year (taxes due in 2021) .. to 'new' holders and institutions; hence the average cost-basis increases, and that's a plus for those who don't want to make the (likely) mistake of selling a blockbuster stock far too soon. I understand the sell-half and hope-you're-wrong mentality; I've done it frequently; sometimes early (that was on Amgen where it tripled I took my gain and then it tripled again years ago)...in fact it's that drug co. that caused me to come-up with a sell part and let profits ride approach. For Amarin; sure I think there's some of that; but out of the way within days. Then, if the generic challenge is disposed of (if); we can envision a steadier move higher. VASCEPA does work; so if Dublin plays it right (and not 'too' clever); investors will discover it's likely a buy even here; not a sell.

Friday's market might encounter some resistance resulting from the overnight buildup in Middle East tensions. (Editor: this entire section was prepared either before and then a bit more as news began arriving.)

Meanwhile, units of the 82nd Airborne are moving to Kuwait (huge base there would takeover in-event Bahrain was for any reason unavailable or hit in an Iranian attack). So I totally understand a desire to stop the Shia efforts to control Iraq. The actual 'protestors' were protesting not us but the Iraq government's chumminess with Iran, and that's not reported in a thorough way by most mainstream media; as they were assaulted, in many instances, by the Shia militia while Baghdad's regime ignored it because they are 'too close' to Tehran, which they once fought for the 7 years most Iraqis remember well.

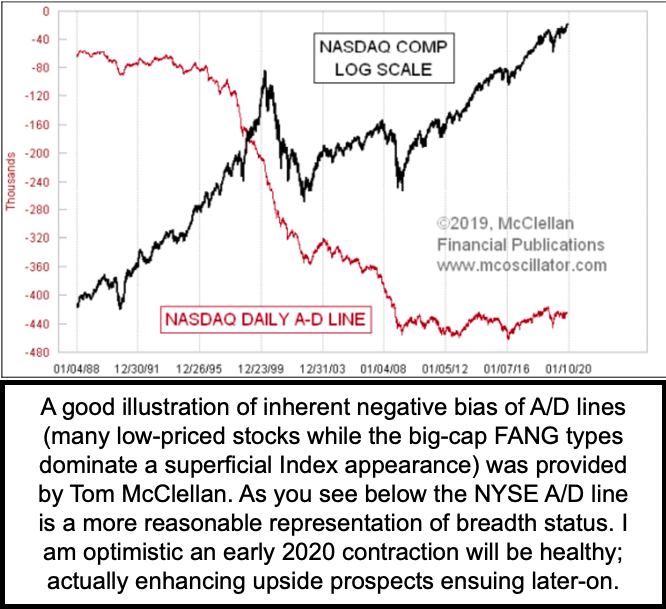

An 'absence of fear' - is being cited by many market observers, and in a surprising sense, by too many technicians and analysts, as they look at the late 2019 behavior; and measure it 'as if' it were only the S&P.

That's not to say there aren't stretched fundamentals; in the leadership area that's for sure. This has been a year of 'multiple expansion' more than growth of profits for even the momentum winners; not just most of the also-rans or laggards. It's hard to imagine a new year without more actual profitability; but few seem to imagine how diverse all this is.

If the downtrodden really catch up; if the China deal is more substantive than the naysayers suggest; if the Fed maintains a sort of neutrality; if there is no geopolitical hostile engagement; if the 10-year stays shy of 2.0%; well you see what I mean. There's an argument for onward and upward; but common sense suggests we be prepared for setbacks.

Nevertheless the setbacks may be in the form of corrections and again shakeouts (we identified a couple in 2019 and are looking for another in the very near-term; but it can be shuffled around by the timing of China signing; which now looks to be January 15th or so). Hence it depends. If the conflict in Iraq expands (I chat about that in the 2nd video a bit as it matters since the actual 'protestors' were suppressed by Iraq security and the Hezbollah Shia radicals were allowed to assault our Embassy); if Oil prices shoot up; if North Korea gets antsy; again variables. If none of that intervenes; well, the beat goes on in an Election Year.

I'll touch on all of that and more in a future report as things evolve. For now experience in the market suggests an open-mind and not labeling this as an 'automatic' run-into a brick wall of resistance, even though it is entirely possible that the FANG-type S&P leaders are doing that. It's just that pending China's signing (hints of market jitters appeared as the S&P didn't rally so hence Thursday's clue it was market exhaustion); at the same time end of the year 'balancing crosscurrents' defy analysis as to how those alone impact January's behavior.

In-sum: most overworked asset classes have unattractive returns, or at least less attractive percentage prospects given what has occurred over the year just past. However that means greater selectivity and care; at the same time with an eye on credit markets, because most managed portfolios (or algorithms) won't be thinking in common sense; but base moves off trends in-force (or levels broken) or simply the 10-year as a for-instance. Meanwhile tension with Iraq/Iran can actually help sustain Oil prices; and that for now is more of a positive than negative (for Oil), at the same time we're more optimistic about WTI in 2020 anyway.

This was a grand year for the S&P; a year of ignoring politics (not that they're unimportant; but so far were expected to be mostly noise..which won't be the case later in 2020); but not the Fed. And you just might be at an inflection point (not now but in a few months) where the growing economy meets revised ECB and ultimately Fed policies, and stocks do start to sniff-that-out; which is a good news on the economy might be a lesser stimulus for stocks; given that the market anticipated recovery in the now-over transition year, as I've often discussed. That however isn't to say some sectors can't advance while others cool their heels a bit.

I'm well aware that some stalwart market veterans either retired; got ill (sadly) or burned their hedge funds so bad by excessive bearishness.. resulting in a perception that 'veterans' can't be right and that somehow this is an infantile stock market for dreamy-eyed millennials only. Hah!

It is no such thing. It required a recognition of credit markets and a Fed ready to inject liquidity as needed; of a 'different' sort of investing style; of the downside (consistency while it works) that the algorithmic-driven management brings (even as I disdain the approach; I appreciate what it does to the markets for better and for worse).

And common sense that if analysts tell us (as they have for over a year) that 'high wealth individuals' are all selling and out of the market; that's encouraging, not discouraging, as I noted. If truly big money was out of the market; they can complain and moan all they want; but they already sold. The next thing they'll do I said a year ago is buy; the only question is when. So they waited until this Fall to 'chase' S&P, in some cases for peer matching; and in some cases desperate. It makes some sectors very expensive; while others are looking attractive (Industrials, Oil, even banks a bit, and some biotech). That is a reason I have in-mind for now; a rotation as we've discussed and nuances of which are evolving.

Bottom-line: will it be as simple as a 'continuation pattern' in 2020. No, I really doubt that. Aside the signing with China (sell the news possibly; depends on how substantive the deal is) the S&P is pressing too high.

Late tonight we learned that North Korea declared that Pyongyang is abandoning its moratoriums on nuclear and intercontinental ballistic missile tests, state media reported. Secretary Pompeo on CBS tonight says 'we hope' Chairman Kim would stick to his pledge; as we did with regard to heavy training with the South Koreans.

And of course the ramping on tensions with Iraq, which by virtue of just standing aside let the rabble Hezbollah march on our Embassy. I took time to watch videos they took threatening to kill any employee of the Embassy they find. In this case President Trump is correct that these are pro-Iranian; what is omitted is that the militias that fought Isis with us were pro-Iran all along; and that many of the former police and army were Sunni, and had gone over to the ISIS side during the early fights. I talked a bit about this in the intraday videos. It's tough; but government in Baghdad has never really been 'our friend', and although reinforcing the Green Zone is exactly what must be done for the moment; Trump likely 'gets it' in this case that the sectarian split there isn't easily fixed. (We flew 100 US Marines there from Kuwait earlier; more on the way.)

On this New Year's we'll pray for the safety of our troops and diplomats, as there will not be another Benghazi debacle (shame on one group for already saying that), as we'll address the market a bit more below.

(Macro) action - continues to view adjustments in this market as fairly reasonable; healthy; and as we retain cautious optimism going into the New Year; while ideally desiring an adjustment higher for small-caps as well as some of the steam concurrently coming-off overworked FANGs or similar stocks.

Yes when things look positive and risk appears low; be careful. But just as noted at clearly spiky periods 'last year', we astutely avoided selling short or seriously playing the downside, even when we properly looked for shakeouts and corrections.

That's because we looked for all of that to be part-and-parcel of overall 'new' uptrend behavior in the S&P, that we viewed coming-off a 'cycle low' at Christmas 2018. For most other stocks it was seen as a year of 'transition', and now we've evolving past that with technology and sure, the political aspects later next year (depends who the Democrats run in a sense). One thing we've said thru 2019 was not that it's unimportant, but that it was 'noise' from a market standpoint, meriting being ignored with regard to the S&P's pattern. That was an appropriate stance.

(For new members: we viewed late 2016 as a time to get 'in' the market if Trump won, with a 'to the Moon rally' and then proclaimed it spiked as well as ended in late January 2018, which it did 2 days after indicted. I then looked for a rotational 'rinse and repeat' (called a Maytag Market) for the year; which 'was' a sort of bear market for a majority of stocks.

I called for a collapse in the Fall of 2018 as soon as I returned from the tech show in Berlin. . . where I determined AMD would be supreme for the ensuing year if it dropped to 16-17, which it did... and I called for a market 'crash' that Fall. Got it and then proclaiming a capitulation and a washout literally on Christmas Eve 2018. Later determining that was a 'cycle low' and not 'just' a pullback in the prior uptrend, was key to our stance for the past year. That means 2020 is a continuation potentially, as opposed to stretching an old decade-long uptrend. It's important that one grasp the implications of 2020 being a phase within a new structure rather than simply stretching an old one. That are concerns though.)

Now, as we go into 2020, the domestic political (later) and geopolitical global (possibly sooner) issues become potentially more disruptive for markets. Although ironically, if the current tension with Iran turns-into a serious fight, then Oil prices might pop well above this 60/bbl area that we looked for when others were so negative on Oil (and we demurred).

Credit markets remain the key of course aside exogenous events; and a growth in earnings that isn't here yet; but is necessary to offset what's happened in 2019; which is 'anticipation' of a further multiple expansion that I consider unrealistic for the S&P, unless some of the heavy lifting is transferred to the broad list, thus not asking the overdone momentum leading crowd everyone knows to carry the weight of progression. 2020 won't likely be a full Goldilocks year; even if some that were negative a year ago seemingly envision that occurring through the year ahead.

Ushering-out an incredible 'fire & ice' decade - and entering a new era; while it shouldn't be defined by a calendar change, this time has a correlation to economic, political, social, geopolitical and even market patterns. The majority of dynamics had their seeds planted in 2019.

Roaring 20's or not (we'd prefer calm growth considering how the last of the 'roaring' 20's ended), this is the beginning of a projected time-frame that follows a 'transition year', which absolutely dovetails with 'change'. I do not mean small change (though the Greenbacks buying power has given the impression of being improved by cheap imports, while reality has reduced it's strength especially in healthcare and housing costs); in this case I mean transitions in many areas. We've touched on a few.

Housing is still unaffordable at the entry-level for most; and established homeowners are resisting moving; unless they are in heavily taxed and or deteriorating places like New York/ New Jersey, Northern California or so on. The trend is towards high-end properties continuing decline in the high-tax states, while States with low or no personal income taxes (and realistic property taxes) grow (Florida, Texas, Nevada, or so on).

If there's a risk of a real-estate flat-out crash, which would impact stock markets over time, it's probably China foremost; because even though (just this week) China is mandating more friendly lending policies in an effort to sustain growth (or limit decline), their entrenched 'command economic' style has not alleviated the 'ghost city' conundrum (a way to artificially create growth even when there's no demand for product).

At the same time wealthy Chinese continue struggling to get money out such as to Canada (especially Vancouver and Toronto); pushing prices up, necessitating a tax to dissuade that, and creating tensions among property owners, of course liking higher prices, but realizing where that can lead. (Just look at the mess that is the San Francisco Bay Area to see how high prices can devastate a proclaiming compassion or sense of 'community' among diverse populations that, on the surface, proclaim that's what they want to see develop.)

Bottom-line: the trade deal with China 'may' be signed as soon as this coming weekend. Fluid stories as to whether it's happening and who is going to be present. (Editor: now we hear it's January 15th.)

The idea of a 'brick wall of resistance has some merit in this structure, at least for the S&P; and is what I've discussed for awhile resulting from holders nailing gains in the big-cap leaders in the new tax year; while a broad assortment of laggards 'might' even advance concurrently.

Ineresting hints about early 2020 - are starting to appear; as nominal selling of hugely profitable stocks has not and/or will not 'really' crimp a surging market significantly. As stocks now settle in the 'new tax year', it is interesting to see how many big managers hold-onto their positions.

I think this may be slightly illusive (or premature) to emphasize as of yet because while gains (or losses) can be taken in the new year (sales for 'cash settlement' can be made up until Tuesday's end), lost of manager attitudes relate to 'mark to the market' pricing; and if they're measuring comparative performance (or representation), they may want to show a heavy presence right into New Year's. (Many investors will look at what they own, but not necessarily 'when or at what price' they bought into.)

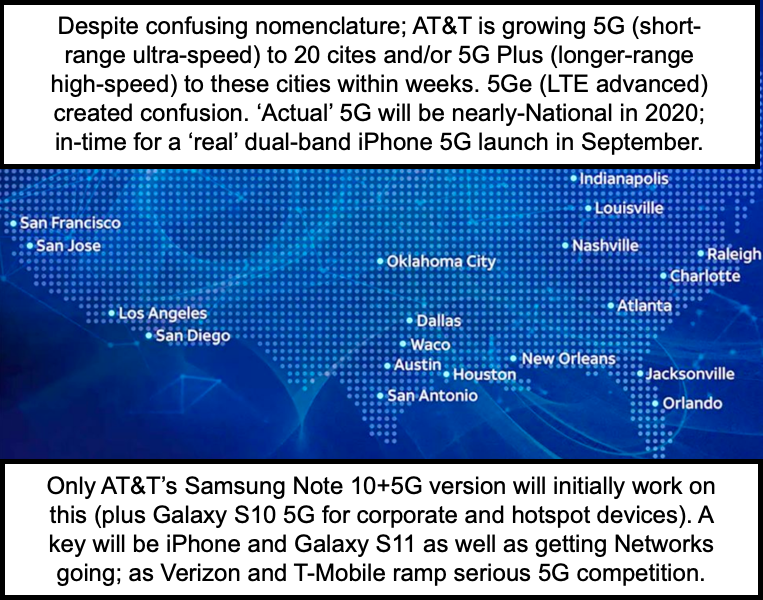

So you're getting some breakouts and short-covering combined with all this end-of-year crosscurrent activity; and this all happening just a week before we get into Press previews of CES that I'll be reviewing (though as I went to Berlin's IFA it's unnecessary to travel to Vegas again, and I do get the media info; most of which are products we've already seen). I think some things like GM's 'Bolt' without pedals or a steering wheel, of course will get attention; although I view that vehicle as controversial at least. 5G will be all over everything; but that's what we've anticipated would start rolling-out about now; and increasingly into 2021 as well.

Yes there are laggards that can do better next year; and others that are known but undervalued relative to their potential; and plenty overvalued stocks; or ones that are upgraded by analysts because of prominence, or capitalization, as impacts an Index or Average (Apple is the king of course of all of those). Stocks like Intel do not fully reflect the role they will likely emphasize in AI and AR, and it's true for Texas Instruments too. Financials may be suppressed, but not terribly exciting;as some Oil stocks at this point may offer a better combined return prospect.

Then there are situations like Amarin; fairly unique, a bit speculative of course, but even after moving up, retain significant potential (including takeout or buyout or partnership prospects, as well as simply growing). And existing favorites that doubled or tripled like AMD might just work higher, at least for now (but bargain day is behind for that). It's harder to find value especially as institutions levitate many stocks beyond what's really fair or reasonable valuations. That's especially so for FANG type momentum stocks. They can forge ahead for now; but remember what is called a 'Bigger Fool Theory'. Someone will be at the end of the line; as institutions, not so much individuals, press into big-cap players long after everyone knows the stocks, and the big money, has been made.

Of course everyone from Facebook to Google to Amazon fit the mode although some more so than others (Amazon depends primarily now on AWS... their Cloud and internet-support services; and that's where they might actually encounter more competition from Microsoft's Azure). Of course a break in the (often overpriced) big-cap stocks will impact what is called the lagging broader market; but even as prospects would be a pullback within-context of the primary uptrend; it could get interesting.

Then there are the higher dividend stocks that remain represented, until credit market competition appears closer (eventually). And AT&T is still attractive overall; and won't be impacted by the ultimate over-air ATSC 3.0 'revolution' I alluded too, which really benefits the extreme low-end of viewers/consumers, and will actually compel Comcast and others to 'up their game' with respect to quality carriage of signals (that's once it becomes evident that networks will broadcast in 4k and most big cable companies aren't yet carrying / distributing / supporting 4k or the Dolby Atmos soundtracks that most newer movies carry).

A year ago when I'd selected AT&T around 28-31; most market pundits dismissed my idea, with their arguing about debt-service and urging the purchase of Verizon instead. Well AT&T robustly outperformed, and I'm not opposed to Verizon (about a 4% yield); while AT&T is actually hiking their own dividend a couple cents (to prove the point that it's solid); so it's still a 5% or so return. Total return for the year was over 40%, and I think it's still a solid hold (and yes many pundits 'now' like it).

In-sum: while we see some perpetuated gains in healthcare, perhaps a bit more in semiconductors; or specialty situations; we increasingly will have an eye aimed at the credit markets and particularly the monetary policy 'reviews' and where that might lead for the EDB and our Fed.

Oil prices might rise and initially help mask a future distribution in other more-overvalued areas. The Fed does 'want' to see inflation (ironic they want it with lower rates... ultimately an impossible combination in 'real' serious growth, which is not broadly what we have so far); and there's the rub. In Europe they understand that higher rates would suggest the better times ahead (that's why Germans saved not spent more when it was curious interest rates fell so much); where in the U.S., 'consumers' (many think like consumers not responsible citizens) thrive on low rates and would probably curtail spending on signs of actual prosperity on a broader front. However, this is all something to assess as 2020 unfolds.

Speaking of assessing; as much as I'd prefer avoiding politics, there is likely no alternative to addressing it. In 2016, while Fed-related jitters were ongoing, I proclaimed that 'if Trump wins' it's to the moon. Well it was and you know how we assessed the 2018 rotation and cycle low of one year ago. That's all fine; but now what happens if Elizabeth Warren can't be nominated (today complaining about being low on funds); and if Bernie was actually the Democrat candidate?

Nothing could be more diametrically opposed to current Administration philosophies. While Sanders may have some 'seemingly good ideas'; they're not perceived as fiscally sound at all, even if some are doable. It also reminds us that most Americans that actually work for a living will think twice (or three times) before voting for higher taxes which he has repeatedly failed to back-away from. Even if they might do better overall (adjusted for health costs) the bulk of middle-age voters may not focus on that.. again just one of the variables to contemplate next year.

(Even though the current policy approach isn't doing so great either for infrastructure; and some of the Republican states cancelled insufficient Obama-era funding for a slew of useful projects like high(er) speed rail and intercity rail and thus money got shuffled elsewhere and so much remains uncompleted. It's appealing to some people only to focus on a domestic agenda; but a problem is growth relates mostly to innovation and development; which it's surprising some don't appreciate how it all came from computers, the space program, and so on.. and ideally will continue to do so; but not if we take a totally hunkered-down approach and I'm not referring just to trade or only focusing on social issues.)

(I actually caught a typo: I typed 'trendiness' and meant 'trend-lines'.)

Bottom-line: change is inevitable; but a new 'social' course isn't always well-received by the stock market; and could be more dangerous than a Fed hike; depending how things unfold. And again that is NOT to say it is necessarily bad 'for people'; but for the market's 'perception' at least as it might be initially. Pretty clearly the market would prefer a friendly Fed and consistency in policies; although 'even with' the present set-up I suspect they'll encounter problems down-the-line (starting with a shift in ECB policy perhaps; though even there officials are nervous and for sure the Fed recalls the reaction to their hike last year).

Conclusion: the liquidity-induced Fed-facilitated market continues; with a multiple expansion that's unlikely to be matched in 2020. That's not to say we won't go up; or that others won't catch-up (rotation); but it's not going to be a time to be complacently relaxed-at the switch, especially later in the year.

Conclusion is similar: there's no catalyst to warrant committing new funds as yet; although I expected 'recent' extensions, and leaned very clearly towards a China Deal coming; with initially higher S&P records. If anything I've been conservatively optimistic thru 2019 and reiterated the old sayings: 'don't fight the tape', and 'don't fight the Fed'.

It's all on-top of capturing the entire gain on the number 1 stock: AMD; and presumed additional gains ahead (over time) for Amarin. And this year the rocky start (fling sort of an S&P flail) followed immediately by a controversial undertaking in the Persian Gulf, has various aspects or outcomes that we'll try our best to follow as impacts markets.

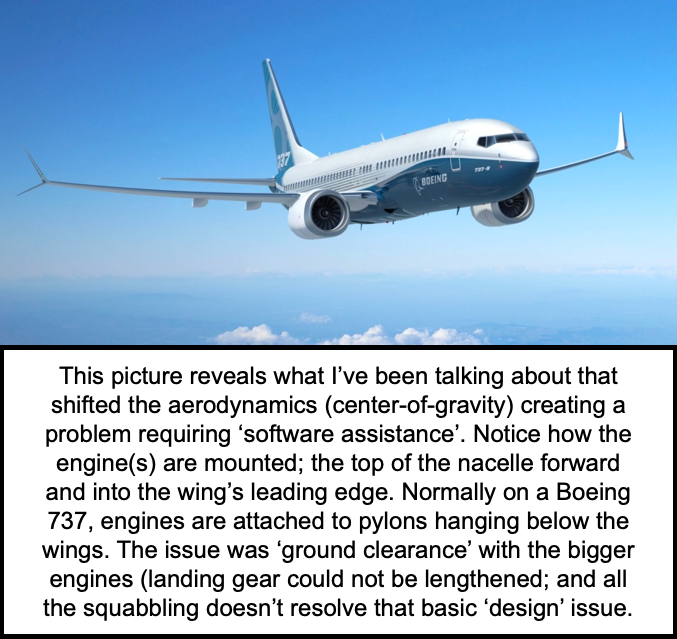

We remain circumspect while market stresses were notably alleviated by making a 'Phase One' deal with China (superficial or not); while of course near-term Middle East chaos throws a wrench into behavior of the market and more uncertainties to contend with ahead.