Market Briefing For Friday, May 31

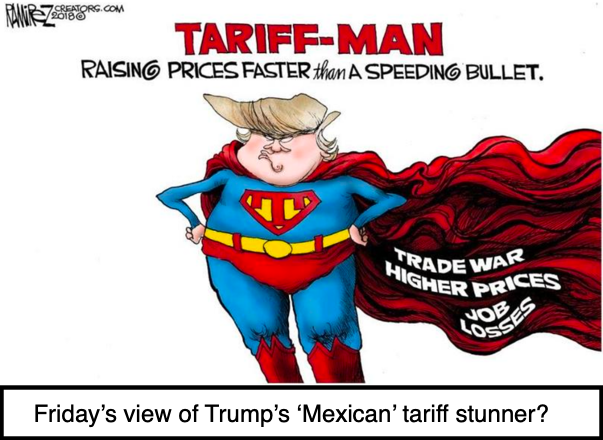

(Holy Guacamole... here we go again; Tariff-Man 'tweets' policies.)

Increasingly everyone recognizes 'things are just not quite right' with the stock market. One major institution described it thusly and I totally concur. It is however, problematic when some defer to sentiment, or merely a slowing growth trend (actually the GDP was a hair better than most estimates), or of course trot-out Fibonacci numbers as affirming further downside prospects.

Actually of course markets can move to lower levels 'if' the backdrop doesn't change. That's why you see net tactical exposure contract; and some of that just happens to be seasonal, as we've forewarned for a couple months was a set-up for sell in March (lightening-up), with expectations of a correction, but not catastrophe, in April and May.

April of course featured 'distribution under-cover of a strong S&P and DJ'; while the FANG & MAGA stocks came under pressure. What we have had now is not 'peak bearishness' as of yet; but an expected consolidation at minimum; with a market moving into potentially an 'indecision' pattern that very much relates to what happens going forward in terms of fundamentals.

That 'indecision prospect' is wrecked by the President's latest tariff move to arbitrarily levy imports from Mexico by 5% now and 25% by October, if they don't stop illegal immigration (?). More about that in the main video. Now we will see if this impacts the growing trend of Americans retiring 'to' Mexico (of course the risks of investing or banking there are well-known; and do matter depending on where one contemplates getting involved). Puerto Vallarta in my view was a great value and fun place; but so was Acapulco before lots of things 'changed' (cartels etc.). I have friends who bought in PV; love that AT&T wireless LTE is there; and they can work (as did I) 'as if' they were in California. The difference of course is they are not; and that's why I said I'd be more comfortable renting, not buying, if I were spending time there.

Now we have (mostly Asia; but perhaps some from South of the Border and I'm thinking of Argentina); credit market behavior reflecting capital flight, as well as concerns of slower growth; while like technicals, doesn't exactly tell you what happens if the fundamental backdrop improves (ie: 'trade deal'). It does suggest lower, for longer, if no deal (or progress towards one) is forthcoming as we move into the late June G20 Meeting (for instance). The Trump 'tweet' about Mexico is not encouraging to lots of interests.

That doesn't mean the S&P is going to wait for the arrival of that 'gathering'; because most money managers will be reluctant to buy pending clarification of 'what's next'. Especially given tonight's news (unless they reverse course and even then it's sort of a reactive way to orchestrate policy).

Meanwhile there is a Vice Presidential forthcoming speech hitting at China's 'human rights' violations, and intolerance. It probably won't help just at this moment with regard to moving talks forward, although he'll be correct with the criticism (there are some concerns about his own tolerance views, but that's not a concern with respect to negotiating with China). Absolutely as you know, I believe this to be a valiant necessary fight with China for new balanced fair trading relationships; but sometimes it's like a couple sets of pit-bulls fighting, rather than trade negotiating teams. Finesse is missing.

In sum: my point is pretty straightforward tonight. Markets don't function in a vacuum; but an absence of concrete developments does contribute to an 'absence of bids'. That status underlies this market for two months now. On Friday you should see new lows for the overall decline barring big changes.

Technical analysis thus doesn't function in a vacuum. That's why those who simply conclude certain periods of excess resemble what we went through, of course, have a point. It's one that I've recognized frequently as well. But I do not see technicals in a vacuum; and tend to not try simplifying markets in that way (it's easier just to look at charts and not think about the backdrop).

Bottom line: Sure, we should and will work lower 'if' nothing improves and even the Oil market is showing you that. Seasonals often argue for S&P strength in June, after a particularly weak May, and in a pre-Election year; so let's see if Mexico can mollify Trump's reaction to a (serious) penetration of our Border today by illegals; which is likely what prompted his response.

But again all that is oversimplification. As I've emphasized for months now; if you get a 'deal' that's viewed equitably, though 'humpty dumpty' won't be entirely put back together (because this is a geopolitical and also strategic realignment) with China; there can be a huge relief rally 'if' the market were at lower levels. Well in a sense it is or will be in a few hours; hence 'surprise' areas of agreement in this case could indeed do more than ignite a simple sell-the-news rebound. But news tonight that Dictator Kim in North Korea had his lead negotiator for the Hanoi Summit 'killed', along with staff; does not say much about 'pal' Kim, who is acting much like the old non-pal Kim.

Conclusion: we'd rather not view technicals in a vacuum; we called for this entire Spring behavior; and we see multiple alternatives going forward, that largely depend on backdrops (including but not limited to trade outcomes), that technicals will either hint at or reflect in hindsight. Our minimum target was the S&P 2750 area, while being aware of greater risk should things go really South fundamentally (again trade and credit markets); and we have described the less-preferred (and not just by markets) bearish alternatives.

For now the market likely falters its month-end holding action at expected levels; and remains sensitive to news or tweets regarding Mexico for now.

The trend in growth is for sure shifting lower; but it has been for well over a year with nuances that I have described. This won't shift dramatically even with a China deal later; so at the same time rebound potential 'with' a deal would be greater given what's been a solid 'hit' to the market. It may remain a fluctuating market over the Summer at best; although if we get a deal, shorts will really scramble. For now we go lower. Stay tuned.