Market Briefing For Friday, March 15

Concerns about 'trade talk delays' are the superficial excuse for delays in the market extending recent gains beyond the expected 'nudging' above S&P 2800; although I suspect there's quite a bit more in the background.

Late Thursday Xinhua, the Chinese News Service, reports a few things: 1) that final wording is being prepared for a U.S. / China Trade Deal (that's far more than the way President Trump described ongoing progress); 2) they talked about the 'signing into Law' a measure to protect foreign investment in China (which refers to Intellectual Property; though enforcement is key of course to what it will mean in practice); 3) they report 'fines' to several major financial bankers (including HSBC and UBS) for 'bringing to market' a series of failing IPO's (implying regulators believe some companies should not have been brought to market for varying reasons); and 4) all of this follows the restraints trying to limit exposure with high leverage margin buying.

That's typical of upside blow-off phases, and likely why Chinese media is publicly warning 'against mad cows even in a bull market' or similar. (Amid all this Shanghai is actually up 30 points in early Friday trading.)

Among those, let's look at the potential 'criminal' sharing of data, which sure focuses (perhaps appropriately on the surface) on Facebook; but appears to potentially involve others complicit in such scandals. Those one may think are a year old; but in reality it's the 'offshoots' that come to mind, which may impact all kind of other platforms, that either sold or somehow risked all or a lot of their users (or customers) data.

That's a big unknown and investors may not be comfortable not just with the revelations that may directly (or indirectly) come-off this; but meaningfully be a catalyst that changes many aspects of online marketing that had prevailed for quite some years now. Besides that, the obvious issue is 'irresponsibility' in using or protecting customer or user data, as the case may be.

Accounting for user data, and the availability to third parties, matters more in many cases (not just Facebook), whether the average consumer seems to really care or not. Of course the ultimate example takes you to China, where 'social credits' grew to become an Orwellian overreaching and overarching determinant to control peoples activity online, to the point of punishing them (like travel denials, higher fees for licenses or less perks) more precisely.

Here in the United States, it's more subtle; where HR (Human Resource) or 'headhunter' agencies, have scrutinized Facebook or Twitter to ascertain a lot more about potential employees personal lives than historically would be any of their business in a free society. Authorities do that too. Perhaps that's why Zuckerburg recently pledged to make FB more private; focus more on it as a 'communications' tool; and even come up with a way of deleting photos or other content a user posted beyond a certain defined trailing time-frame.

Facebook continues to have significant risk; after the rebound and beyond in this case the charges being brought regarding data-sharing. The swiftest departure of executives I've seen there is occurring and that matters too. It's likely related to what we discussed; as well as a new trend for PRIVACY as the most-desired aspect people increasingly want focused-on.

Note that we are about to be deluged by a series of video adds from Apple emphasizing not of course the upcoming 'streaming video service'; but more efforts to distinguish their services from 'the Cloud' and the crowd. Few yet grasp that when an iPhone recalls your likely next destination based on your habits; that information is retained on your phone and not on their Servers. It is one example. And unlike most of their competitors, data isn't resold. They have had issues with some App's; but if the providers don't comply with the necessary revisions (again Apple's privacy policy); they get booted. I realize it's slightly hypocritical. For instance, Google pays a fortune TO Apple to be the default search engine on Safari. And then Google uses that information; but Apple will say the data benefits the companies that collect them (so they are nevertheless facilitating that collection). Anyway I welcome the initiative if for no other reason than to heighten users awareness of privacy.

What's obvious is that Apple has slow iPhone sales and want to differentiate Apple products 'privacy protection' issues; and that's good. Perhaps it will inspire a trend that is overdue as the US should move away from Orwellian types of social networks or services; essentially doing the opposite of China. Doing the opposite hampers sales (mentioned before) in China; but that's the cost of ethics and privacy, as the overriding requirement.

Aside this possibility; there is Brexit; actually President Trump's repeated mentions of being willing to 'not' make a deal with China unless it's a good deal for the USA; but also his added remark today about the UK and EU.

That was during meeting with the Irish Prime Minister, where the President remarked about the 'great deals the U.S. will do with the UK' if they are out of the EU (which the Irishman was not too thrilled about). That's fine; but he then added how we can do good deals with European (then he added word countries); before saying all of them. Moments later he said 'with the EU' at the same time adding: if they don't make good deals with us we'll tariff them.

Perhaps that's reminding markets of the unresolved issues with the EU; and that's especially related to the German automotive sector. Today Audi states they will have 20-30 models electrified (that can be hybrid or pure electric) on-sale within the next few years (starting with the eTron presumably), and they acknowledge a sports model that shares the same platform with a very hot (nice styling, at least I think) Porsche Taycan that's in initial production.

In sum: we're into Quadruple Quarterly Expiration now; and the June S&P is the front-month contract (March goes off the board). The bias often (not always) is higher into, and lower after, a Quarterly Expiration; but generally does not change the overall trend bias.

At the moment the trend is neutral at the high range level surround the area around and just above the S&P 2800 level; generally as we've outlined what would shuffle around, pending a resolution primarily to the trade deal(s).

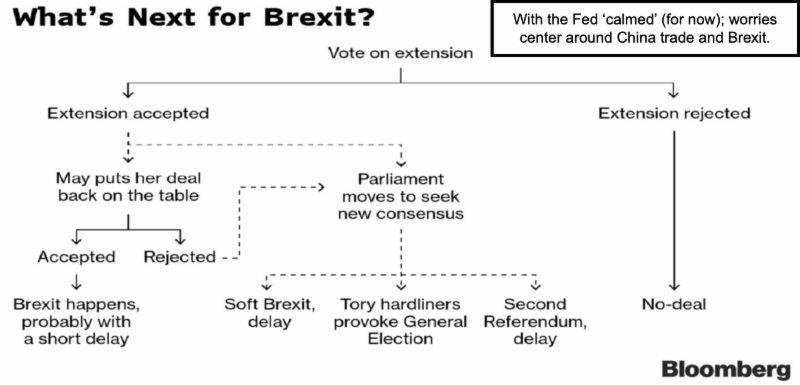

Now that we know Britain has 'ruled-out' a 2nd Referendum on Brexit, PM May has to go back to the EU and ask for a technical extension. Perhaps its embarrassing to a degree, but that's what's going on; so I suspect many UK citizens aren't thrilled to see the EU have this role in determining longevity of what is an arduous battle in Britain. It also leaves business uncertainty in planning, as I've mentioned; and not just focused on financial institutions.

Bottom-line: longer-term a 'level playing field' with China will help; but their continued sluggishness persists; and won't recover beyond a sigh-of-relief, in the very short-term. Markets realize that also limits the pace of revenue in a global sense; with the delay in simply 'getting' a deal delays grasping how long this is going to take. It's a contributing factor to hesitation and more.

Also long-dated Treasury yields are firming off-of the lower range they have been at. Perhaps some of the 'inflation realities' in sectors that really impact what people spend (we showed one chart earlier this week) come into play. Such concerns support arguments for Fed hikes later this year; contributing to questions as to whether the Fed speaks out of both sides of their mouth, when they talk about sustained stability and prosperity for 'years to come'. I think we'd all love to see that; but are aware of issues like 'Debt Service' or the Balance Sheet run-off, even if others expect no effort to address.