Market Briefing For Friday, June 18

Markets dislike uncertainty, historically. However current confusion or even rancor (towards the Chairman) over what the Fed will do or when they will do it, dominates discussion without grasping an understanding of how variable the conditions over the next year or so will be. You only get one re-opening or revival thrust; then it becomes more micro-management; and unless we really to suffer another huge wave of Covid (Heaven forbid); it won't repeat.

So that means that the CPI was unduly impacted by sudden thrusts of returns by certain industries; like tourism, hotels, airlines and restaurants and regular (brick & mortar) stores too. That kind of impact is non-recurring; but can sort of become steady growth if things stay on-course. Similarly costs of housing materials (like lumber) soared and are coming off their highs; so to a degree it is correct that some aspects will be 'transitory'. But wage pressure won't abate so I think the Fed recognizes there are some aspects that become ingrained.

If anything, Fed Chairman Powell did a stellar job of threading the needle on a slew of alternatives; and the willingness of the Fed to employ their tools 'if and as needed'. General uncertainty has been with us for the entirety of these 15 months of Covid and recovery; and that didn't prevent a plunge early last year or the comeback from 'The Inger Bottom' of March 23rd 2020.

The point being that the psychology of the market prefers a Fed that isn't too rigid; that's open-minded and willing to adjust. And that's what you have with a Chairman Powell at the helm. At the same time it was necessary to inject the huge liquidity last year; and makes no sense (listen to me Janet Yellen) to call for trillions more being thrown at the economy; outside of just infrastructure.

The 10-year has been going lower in part because traders think the Fed must be on hold; and in a sense the Fed also (just listen to the range of topics Fed Chair Powell broached, which was unusual and definitely not in 'Fed-speak') it seems is uncertain about 2022 and 2023, and they should be.

Underlying this is the pressure to somehow allocate spending to retire some of the outrageous (even if necessary) levels of debt, over time. They want to do it with depreciated Dollars; hence the desire for inflation. But not too much I suspect, as the Chairman knows history and what happens when a nation's central bank decides to do everything they can by constantly printing money.

Shame on politicians who don't learn from (or even know perhaps) history of such profligate spending regimes; as too many are punch-drunk from being able to fund pet projects not just the needs of the average struggling citizen in the past couple years. Yes the punch-bowl has to be taken away; gradually in our view (and it seems Powell's view); as this Fed knows what happens when you end the 'spending party' on a dime (ask former Chair Bernanke about it).

As to Covid: acting like the pandemic is over when it’s not -especially globally- will tend to prolong it. Doesn’t mean to worry like before but to act responsibly. I think that also played into the Fed Chairman's remarks. I've noted that much of the world is 'almost as severe as the worst times' of Covid; and most media trivializes risks now; and actually encourages what in any country (or state) so far not at 70% vaccinated (or empowered with natural immunity from having a bout of Covid earlier) could be viewed as reckless.

Is an 'Enforcement Action' widely discussed as possible from the SEC likely. If there is such an action with manipulative aspects, it's unclear if Government's really able to pick-and-chose which metrics to apply. Trying to apply analysis to such moves (like whether AMC fundamentals justify a long or short) opens a can of worms that the SEC may not really want to address. Congress gave it a shot and got nowhere fast; however that's not to say there's not a need to review the entire spectrum of security regulations as relate to short-selling of course; but also to order-flow and so on. And both bull & bear positions? That last part is unlikely as bulls can always contend they have no pressure like the short-sellers due; and can be patience. Time works against bears 'typically'.

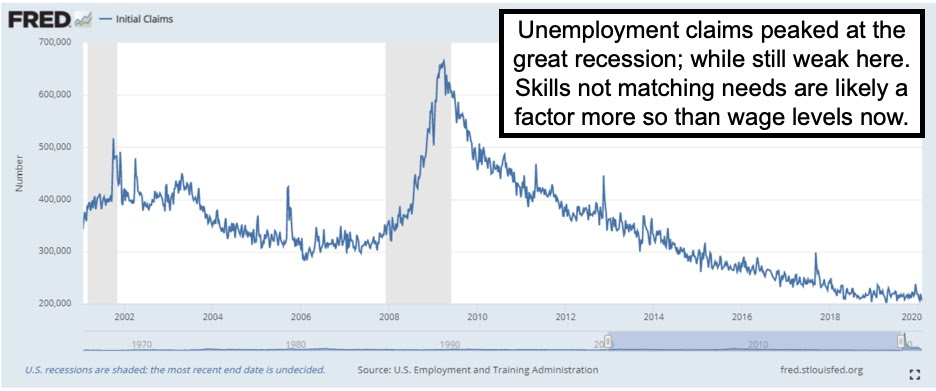

Shakeouts were limited; and indecisive almost across the Board. Commodity moves as well. Perhaps the Unemployment Claims rise sustains the idea that we do have a form of Stagflation threatening; ie: limited qualified workers for the core competency jobs; while much of the country is impacted by inflation.

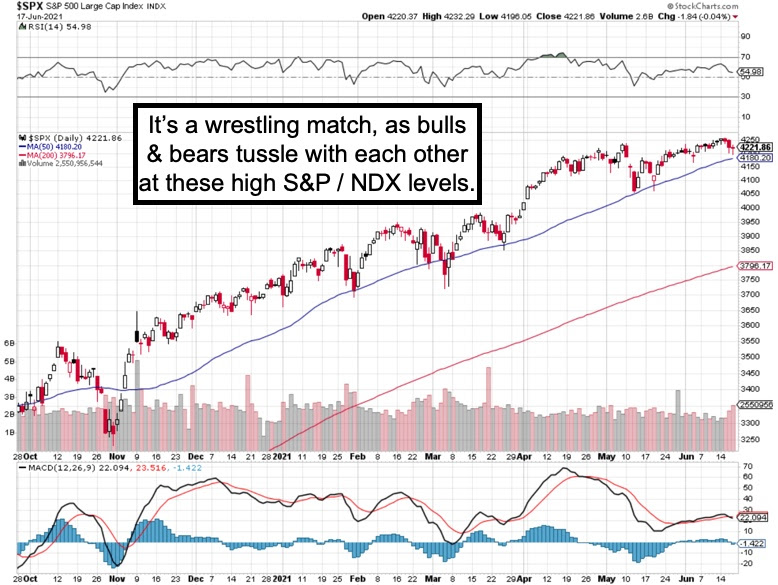

Yet this isn't clear beyond what we all know; which is a consumer (those for sure with funds) eager to live and travel; and stocks that discounted that with the preceding rallies that we projected from late March 2020 forward. We also allow for a correction now; after nominal record S&P highs (achieved the first, with a correction yet to unfold in the Indexes; ongoing rotationally in stocks).

Tapering is not bearish for business coming from the levels; though markets it seems will be confused by whatever the Fed does. So that's uncertainty over the near-term; probably favorable for the longer-term, providing we get decent corrections on a rotating basis, especially this Summer coming right up.

Remember this is Quadruple (Quarterly) June Expiration; so distortions due to particularly high 'open interest' (of in the money Calls) may have an effect not so much Friday, but perhaps early in the new trading week.

This is an excerpt from Gene Inger's Daily Briefing, which is distributed nightly and typically includes one or two videos as well as charts and analysis. You can subscribe more

Probably "the market" is almost as confused about what the Fed will do next as "the fed" itself is confused.