Market Briefing For Friday, Feb. 9

Risky business of washing out and rebounding from a 'flash crash' I'd forecast for early February, quickly brought out not just sober reflections by some pundits and analysts; but brazenly risque assumptions cajoling investors to 'buy that dip'; what an opportunity. Hardly; it was textbook. It is now going to lower lows; a bounce will fail; and this is clearly not over.

In fact it was so textbook perfect (the drop to the 200-day MAL and rally to the 50-day MAL) troubled me. Because it was too formulaic but also it was occurring as 10-year rates were firming again to levels preceding a concern that preceded the market's drive down in the first place. Now of course a new angle-of-attack trendline exists to the downside, with very solidly-defined A-B-C technical aspects to the S&P's ongoing slide.

For sure the option-writing 'short-vol' backdrop was a catalyst; but so too were interest rates; and too many presumed that NY Fed's Bill Dudley in a sense emboldened the Bulls. My view was the opposite; that he surely calmed markets by virtue of saying there was nothing systemic requiring Fed intervention; but that also meant 'let the hunt for value' continue; it's normal market behavior. I agree; hence the call for more decline.

Thursday's ideal down-up-down pattern ideal was definitely contingent it seemed on another Treasury Auction, which if it went poorly would tend to frustrate the Bulls too. Our view was that the market's rebound had a period of testing ahead almost regardless; but that higher rates certainly would speed up the process; in what remains fast market conditions.

In simple parlance, we foresaw all of this particularly clearly, as there was in our opinion along the way, a protracted forecast Trump rally over a year long overall, which (while requiring tax reform to be passed) was all along 'anticipating and thus discounting' the actual economic revival.

Plus: I forewarned that the longer we went without a 'real' correction, the deeper and more sustained the S&P decline which in my view inevitably would follow. So: hence, we got more than we needed on the upside as we became more concerned about 'rotational' trading masking the smart money activities (well not entirely as many were doing option writing and smugly believing they were protected; and we also pointed out their day of reckoning was coming).

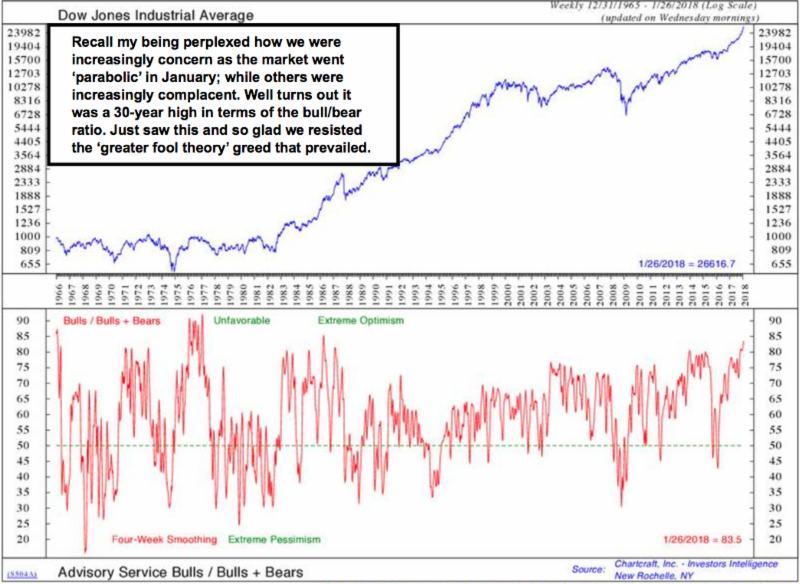

Once we got the 'above trend blow-off' (noted on charts almost daily as a rising bottoms above the previous rising tops; which was a very heavy warning of a 'blow-off' and a dragging-in of money money into high risk), because such phases are usually the final euphoric gasps, we pleaded that investors understand they were being bombarded by 'marketing' of financial products, 'not' market analysis; because this was classic stuff.

Now, realizing the duration of the move was so extended; and not at all missing the firmer tone of interest rates above inflection points others as well had said would be of concern (then oddly ignored it when occurring) I tried to measure 'roughly' when this had to end; since it didn't pause in early January for long; so we knew they were dragging everything in as fast as they could (the foreign money seeking better returns in the USA helped too). Hence I suggested ideally February's first half; maybe just around the Florida Money Show.

Then I backed off when I detected new fissures that were filled-over in late January; but which were unable to draw upon new money entering; so I suspected the market would do an 'el foldo' before the Money Show (I believe it was around Jan. 24 or 25, on the Royal Caribbean cruise), I concluded it was time for 'crash alert' even as they papered over small hits; and kidded about the (not so poor) retired broker seemingly trying to impress me by pouring money into the SPY while on the cruise (yes I did mention that; after arguing with him over coffee about his sanity). In fact that was the day after I first uttered the 'crash alert' expression (just recalled that I mentioned to him I had just said crash alert and he said I was wrong and you have to double down to make money...). Well back to the cabin I went; my very next comment sharing that delightful time. I don't mean to pick on him; but it all fell into place nicely; with me already clearly viewing the parabolic excess of a wonderful year-plus march.

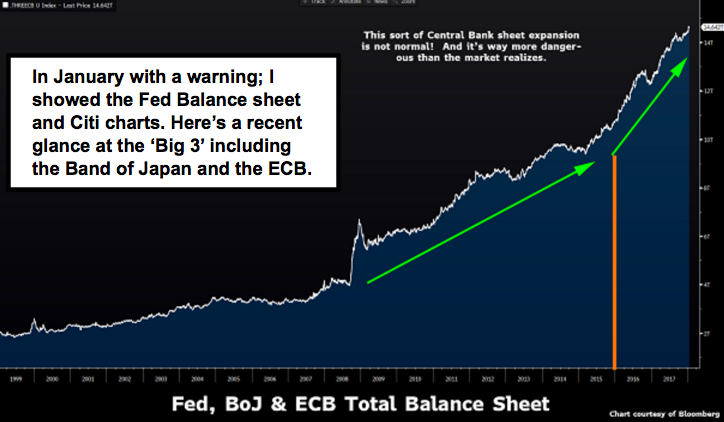

Dashed dreams . . . might be a concern here too. While it is possible to have the economy advance while the market corrects; that's not entirely likely 'if' things get seriously ugly. For instance, a clearly ballooning new Federal Budget will force the US to borrow more than $1 trillion this year and risks worsening the global picture; especially if the ECB and BoJ do ultimately respond with higher rates of their own; to slow capital flight to the USA. Hence risk of a cascading situation, that also throttles (delays) the speed of recovery, which is so essential to achieve the stated goals.

'This time is different' is a risky perspective to take. But in a way it is. It's essentially opposite what textbooks may say Congress should be doing, but because so much necessary infrastructure and other work was not done by recent Administrations (both parties), you had a shadow stealth recovery that really isn't strong; but is presented 'as if' things were really better. They're not by much (for most people); hence you really needed a shot in the arm which tax reform and more were intended to provide; but which are potentially jeopardized (the outcome) by the structure now .. meaning that deficit financed tax cuts and spending increased tend to result in more Fed tightening and higher interest rates; which are high at this point .. sufficiently to pull funds into the US, as has been occurring.

I also have questioned the 'quality' of Labor Force participation; noting a paucity of new high-paying jobs overall in the prime age for productivity by an individual (18-34). In any event; we do need 'serious growth; and this behavior while anticipated for the stock market 'can' have a way to impede the grander plans and backdrop by which so many are saying it is a correction and not a bear market.

Bottom line: the technical trend continues lower; and is not over nor by any normal measure should it be. Proximity to how much gain preceded is irrelevant; this is a decline from excess that is getting its own life. And it is now a full intermediate correction in a short period of time which has all the earmarks of becoming a Bear Market; even if everything is faster than the historical precedents. Many stocks are already in bear market territory (meaning give-or-take 20% off their historic highs or lots more).

There is NO reason for the market to make an enduring bottom as yet. Of course there can and are 'Hail Mary' rallies along the way; but given the leverage that was employed in this preceding move, there's really a paucity of 'actual cash' that should (or could) be employed to stop this.