Market Briefing For Friday, August 28

|

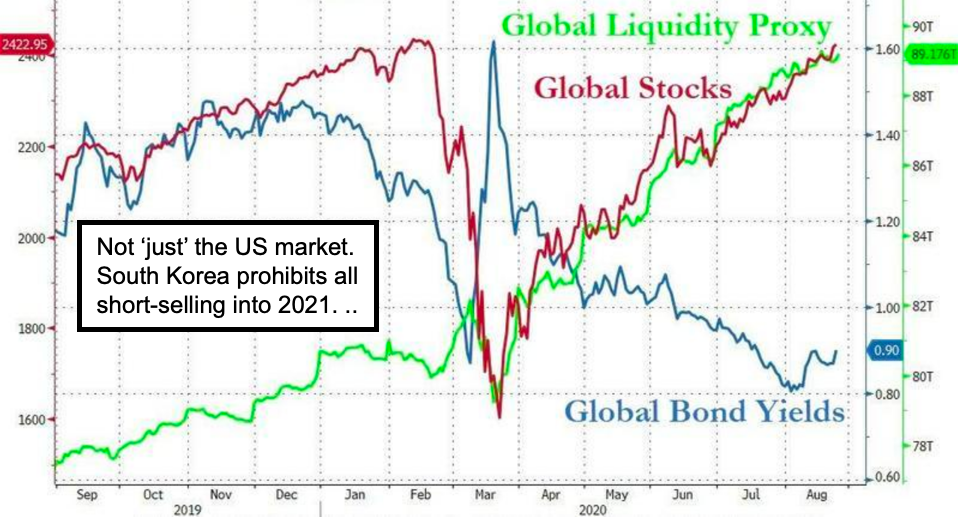

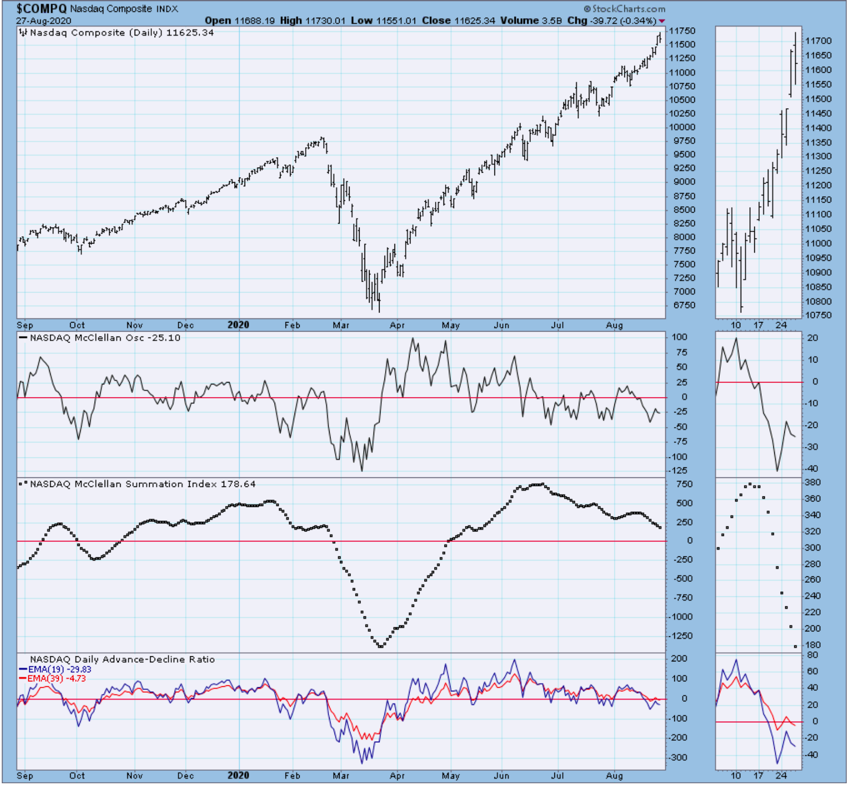

An overvalued market has now prevailed for some time, just via a cursory glance at S&P, or certainly the tech-heavy Nasdaq and NDX in-particular. Growth trends are slow, though they look better 'relative' to where the economy has recently been. And it's not just the U.S., given dovish monetary policies globally, and rising stocks overseas too. Will others start barring short-selling (which ultimately contributes to a series of rebounds, though isn't generally view thusly these days, given how it's used for reasons other than originally viewed .. but frankly if not for the shorts on Tesla (TSLA) or Apple (AAPL) from time-to-time, it would have been harder to arrest fast shakeouts).

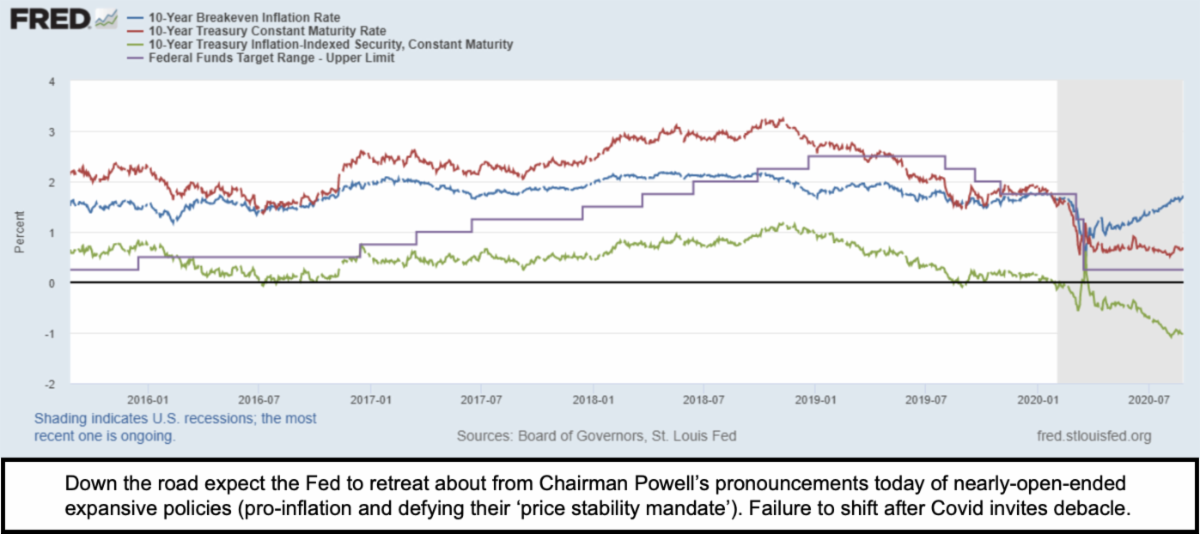

That's part of why both the Fed and a majority of corporate CEO's are concerned (and the latter via a survey) about prospects ahead. Of course a rapid emergence from Covid-19 conditions would change everything, and put 'valuation' in a different perspective, but we're not there yet. And that makes it tough when saying the Fed's policy is 'favorable'. So I think the Fed would back-off if they see real ebullience.

Executive summary:

In-sum: the circus continues under a 'big top', but it doesn't have to be a lasting one. And that is the rub as there's a rush toward optimism, which is hardly justified when one looks at the minimized reasons for testing, and then proclamations of new tests that aren't particularly comfortable (nasal) nor advised unless one has symptoms. (I noted the major networks are having trouble trying to assess the CDC's revision. It's nuts, smells of political influences, and as for the 'backlog' of tests, sure, moving to a color-coded easy system helps, but that's not a reason to question testing wisdom.) Of course that latter aspect will be thrown-out for the moment, as Abbott's is being hailed as a game-changer. Yes it's a plus, yes it's inclined to yield false negatives, and the limitations on this particular test or the reduced testing regiment itself, seems to be a recipe for community spread of Covid. You need pre-symptomatic testing.

Actually Chairman Powell himself alluded to the idea of being trapped in a monetary policy that's extraordinarily dovish for too long as they push for rising inflation (just a personal take on it), and my view that promoting inflation allows repaying debt with a depreciated currency, but also plays havoc on Americans living on fixed incomes for sure (and he must know that), and sets-up a potential major debacle for markets. (In the long-run it will increase the prospect for a credit bear market, and equity crash in the future, but that's ahead not immediately to be reckoned with.) The Fed's mandate is 'price stability'. Reversing policy as Chairman Powell stated, is an emergency approach because of the debt we've built. So you intentionally risk an overshoot of dovish policies, while assuring the public that you're on-guard for rising inflation to the point of building risk. Anyway that's how he presented it. I'm not sure I concur with that, although it may continue to assist markets for awhile. I compare it to players in the 'super-cap' stocks, some of which spiked this week, and had at least temporary selling squalls today after the brief rallies on Powell's talk. It's akin to 'dancing to the music, thinking you can get off the dance floor quickly when the music stops, before the crowd decides to exit the dance floor'. The presumption is that most of the crowd thinks it's a pause before more music, and not last dance, even if this circus is taking place in the center ring under what may be a 'big top'. I actually don't think today was last dance, though valuation-wise it should have been for some of the most overpriced stocks. PE's are high, but somewhat influenced by a dearth of earnings in so many run-of-the-mine stocks, so it's not a serious measure, in the overall S&P, while it sure is if you narrow that down to the leading super-caps. |

A CEO will probably NEVER do anything except spout sunshine. That is good for share prices no matter what, nor how big the lie is.

The ban on short selling is a good start, A rule that futures can not be leveraged or bought on credit would be a good second step.

And certainly it is possible, even likely, that some mistakes will cause a non-recoverable situation in the near future, if not already. Some fatal poisons are quite slow acting.

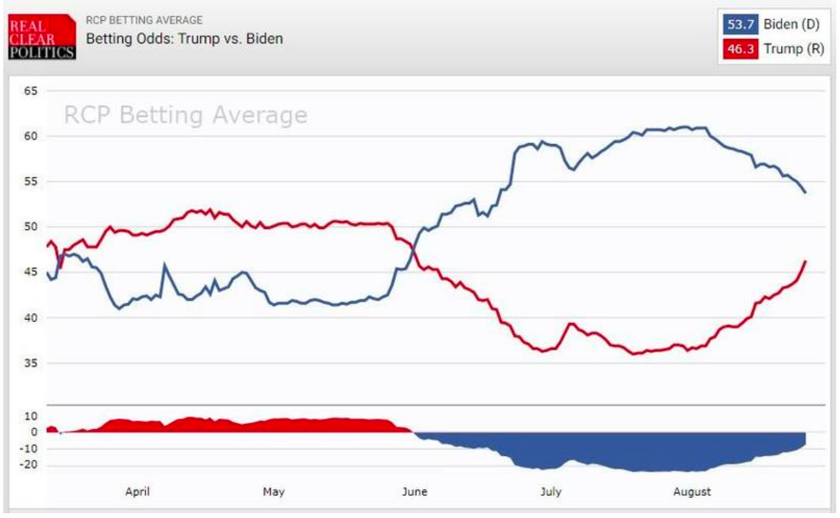

And the implications of the Trump/Biden betting are not perfectly clear, at least not to me. Like the famous quote, now referencing the election: "It's Not Over Till It's Over." Raring some huge upset, the results are a guess right now.

I think looking for stocks on the cusp of going into profitability in these times are great value plays. Also companies with lots of positive cash flow as well, although I'm not sure how rapidly they can grow from here like ISRG and GOOG. There are clearer breakout points on undervalued companies going profitable in the next 12 months. Let me know of others.

talkmarkets.com/.../there-is-beta-in-protalix-stock-due-to-prx-102