Market Briefing For Friday, April 12

Suppressed behavior continues to characterize soporific S&P market action, while beneath the superficial neutrality just shy of a 2900 level challenge, there is quite a bit of potentially disruptive chatter. So far it is mostly just that; while the ramifications could have grander impact.

Issues range from trying to revive IPO fervor (it really isn't that hot and more investors understand how it's often wise to stand aside until after 'lockup expiration' for most if not all IPO's; then make a decision as to whether putting money in a given company is worth the risk); to newer arguments about streaming media victors or vanquished; to a slew of political discussions ranging from (the most pertinent) Brexit delays as the EU encourages the UK not to delay a resolution internally for long; to of course pondering whether President Trump was 'really' cleared in the Mueller Report (details of which we should know any day now); at the same time there is revived talk of indictments of former staff from the Obama era (we've already had indictments on the Trump side too of course). Basically the market's numbed by most of this, for now.

Today Goldman 'finally' referenced the 'absence of buybacks' perhaps as a contributor holding back the market. Well it's about time; since it's a topic often noted here; and I suspect part of why some major firms in recent weeks have become more cautious (some missed the run from last December) about the market's ability to hold up. Since 'buybacks' are a feature primarily of 'big-cap' (momentum most often) stocks, I'm thinking this is a contributor to the dips in FANG or similar areas.

Overall market action has been so exciting (cynically said) that media is reduced to talking about 'whether dog owners are happier than cat owners' (no kidding; that was a long discussion on CNBC today). It's a sign perhaps that they can't readily find guest analysts willing to really wax enthusiastically about stocks; while they are perhaps reluctant to call for declines (and that's possibly as so many have for months).

Perhaps financial journalists should focus a bit more on low liquidity or 'why' (despite missing the move) many institutions may avoid talking a lot about the 'monetary base'; even though the President likely nailed it, without identifying the specifics.

Presently, the Treasury market, by establishing rate inversion, implies the Fed's present interest rate policy is nearly 50 basis points too high and getting wider. A quick reversal, perhaps helped by a 'trade deal' of course with China, could reverse the slide in economic growth; at least help the animal spirits out there; but there can be a lag from news to a measurable result. That's why our longer view (optimistically) looks at this year as a 'transition', with prospects brighter later and next year.

In sum: while the S&P is still near the recovery high for the year, as outlined; the modicum of 'correction' and 'pauses to refresh' (at least), permeate the mood out there; with a sort-of risk-aversion tendency. It is valid in some ways; not just earnings of short-term excess; but that liquidity impact of rates 'too low for too long' and a slow recovery (if we really have a recovery, which is as you know, nuanced at best, and in a semi-recessionary state at worst; dating from about a year ago).

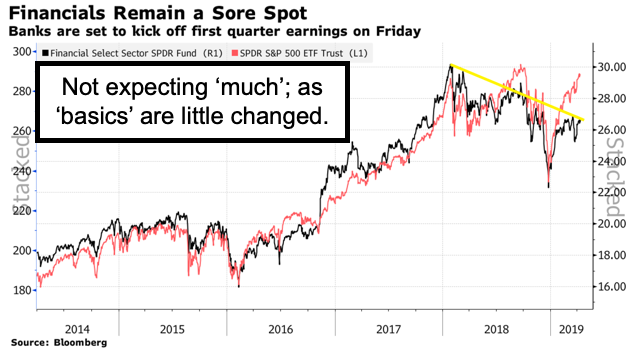

Since so many companies gave conservative or even poor guidance, at their last earnings reports / conference calls, it's not unreasonable to suggest they may have overemphasized risks, due to uncertainty in the economy, or even the unknown global trade picture ahead.

That's thus giving a possibility that (some) may exceed their defensive guidance; thus making it look like they did better than they 'expected', in their last 'calls', but not necessarily in year-over-year terms. So we will see how that unfolds, but generally - with no China deal under belt as of yet - it's still tough for guidance to estimate when things will either improve or conversely deteriorate (if there were not to be a deal).

This idea of a 'trade deal' is not an 'end-all' to market concerns either; it is just a factor that helps deter any enthusiasm to fade markets here; but doesn't mean there's euphoria either. Hence a defensive, more or less range-bound market, as we've outlined (shy or around S&P 2900) with no dramatic resolution.

Bottom line: in this 'mix', and with buybacks diminished during 'quiet periods' ahead of earnings reports, you have incremental selling that's able to repress price behavior. That's why strength (or lack) especially in Oils, plus of course the leading techs, tends to lead the shuffles. It's also why we're indicated the April-May time-frame is reasonable for a 'pause to refresh', or a series of minor corrections, to appear. And sure that can swiftly shift depending on trade or other news 'events'.