March 2019 CPI: Year-Over-Year Inflation Rate Rises To 1.9%

According to the BLS, the Consumer Price Index (CPI-U) year-over-year inflation rate was 1.9 % year-over-year (higher than the reported 1.5 % last month). The year-over-year core inflation (excludes energy and food) rate moderated from 2.1 % to 2.0 % and is at the target set by the Federal Reserve.

Analyst Opinion of the Consumer Price Index

Energy's increase was the main reason inflation advanced. Medical cost inflation grew to 2.3 % year-over-year.

The market expected (from Econoday):

| Consensus Range | Consensus | Actual | |

| CPI-U - month-over-month (MoM) | +0.2 % to +0.5 % | +0.2 % | +0.4 % |

| CPI-U year-over-year (YoY) | +1.7 % to +2.1 % | +1.6 % | +1.9 % |

| CPI less food & energy (MoM) | +0.2 % to +0.2 % | +0.2 % | +0.1 % |

| CPI less food & energy (YoY) | +2.0 % to +2.2 % | +2.1 % | +2.0 % |

As a generalization - inflation accelerates as the economy heats up, while the inflation rate falling could be an indicator that the economy is cooling. However, inflation does not correlate well to the economy - and cannot be used as an economic indicator.

The major influence on the CPI was energy.

The energy index increased 3.5 percent in March, accounting for about 60 percent of the seasonally adjusted all items monthly increase. The gasoline index increased sharply, and the electricity index also rose, although the natural gas index declined. The food index also increased in March, with the indexes for food at home and food away from home both continuing to rise.

Historically, the CPI-U general index tends to correlate over time with the CPI-U's food index. The current situation is putting upward pressure on the CPI.

CPI-U Index compared to the Food sub-Index of CPI-U

Notice the gap in the above graphic between the CPI and Food - historically this gap has always closed when the knock-on effect from higher food prices into other CPI components moderates.

The graphs below compare health care to the CPI-U.

Month-over-Month Change CPI-U Index (red line) compared to the Medical Care sub-Index of CPI-U (blue line)

Year-over-Year Change CPI-U Index (red line) compared to the Medical Care sub-Index of CPI-U (blue line)

The Federal Reserve has argued that energy inflation automatically slows the economy without having to intervene with its monetary policy tools. This is the primary reason the Fed wants to exclude energy from analysis of consumer price increases (the inflation rate).

In the above chart - the green boxes are significant elements moderating inflation, while the red boxed items are significant elements fueling inflation.

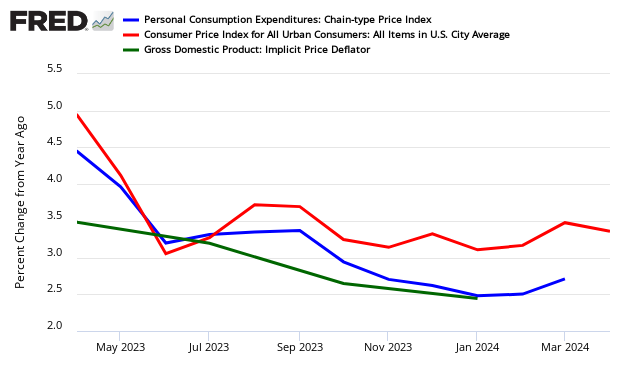

The graph below looks at the different price changes seen by the BEA in this PCE release versus the BEA's GDP and BLS' Consumer Price Index (CPI).

Year-over-Year Change - PCE's Price Index (blue line) versus CPI-U (red line) versus GDP Deflator (green line)

Caveats on the Use of the Consumer Price Index

Econintersect has performed several tests on this series and finds it fairly representative of price changes (inflation). However, the headline rate is an average - and will not correspond to the price changes seen by any specific person or on a particular subject.

Although the CPI represents the costs of some mythical person. Each of us needs to provide a multiplier to the BLS numbers to make this index representative of our individual situation. This mythical person envisioned spending pattern would be approximately:

The average Joe Sixpack budgets to spend his entire paycheck or retirement income - so even small changes have a large impact to a budget.

The Bureau of Labor Statistics (BLS) has compiled CPI data since 1913, and numbers are conveniently available from the FRED repository (here). Long-term inflation charts reach back to 1872 by adding Warren and Pearson's price index for the earlier years. The spliced series is available at Yale Professor (and Nobel laureate) Robert Shiller's website. This look further back into the past dramatically illustrates the extreme oscillation between inflation and deflation during the first 70 years of our timeline. Click here for additional perspectives on inflation and the shrinking value of the dollar.

Because of the nuances in determining the month-over-month index values, the year-over-year or annual change in the Consumer Price Index is preferred for comparisons.

Econintersect has analyzed both food and energy showing that food moves synchronously with core.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more