Manufacturing Recession And Gold

September marked the worst month for the U.S. manufacturing since the Great Recession. But is manufacturing still as important for the American economy in the 21st century as it used to be? Will the downturn in the industrial sector spill over to the overall economy, making gold shine?

In September, the Institute for Supply Management's PMI manufacturing index dropped to 47.8 from 49.1 in August, marking the second month in a row below 50, which indicates that - despite Trump's promises of a manufacturing renaissance - the industrial sector is contracting.

Some people disregard this data, pointing out that the manufacturing sector forms now only about 11 percent of U.S. GDP, compared to 28.1 percent in 1953, while the whole industrial production, which includes also mining, utilities and construction, amounts to mere 18.5 percent of GDP. For comparison, services generate 69 percent of GDP (or 81 percent with government services included). So, it should be clear that manufacturing is irrelevant in the modern economy, right?

Not so fast! You see, there are three kinds of lies: lies, damned lies, and statistics. The decline in manufacturing's contribution to the added value produced is justified by the economy's advancement into the post-industrial society. However, in part it is just a statistical mirage.

There are two reasons why the above numbers exaggerate manufacturing's decline and underestimate its role in the economy. First, nominal GDP has outgrown the manufacturing output largely because the overall price level has increased faster than the manufacturing price level. In other words, the share of manufacturing declined because the prices of manufactured products declined faster than other prices. It means that the statistical demise of manufacturing sector results from its... high productivity. What a tragedy! When we adjust for the price effects and calculate the manufacturing's share of real GDP, we see that this ratio has been fairly constant since the 1940s.

Second, outsourcing makes the service economy look larger in national accounts, although nothing changes in economic reality. Let's imagine a factory which produces widgets. In the good old days, all activities related to the production and sale of widgets were conducted by one or another department of one big company. But now, a lot of services are outsourced. For example, the security and cleaning services are commonly provided by external companies. The same applies to accounting, advertising, retailing, logistics, business services, etc. Instead of one giant company responsible for everything, we have now one small industrial firm, which only manufactures widgets, and several service companies around it.

This is why manufacturing is still a very important sector in the economy. According to the National Association of Manufacturers, every dollar spent in manufacturing adds $1.89 in business growth in other supporting sectors. Moreover, manufacturers perform 64 percent of all private-sector R&D in the U.S., being the main driver of innovation, which is the ultimate engine of economic growth.

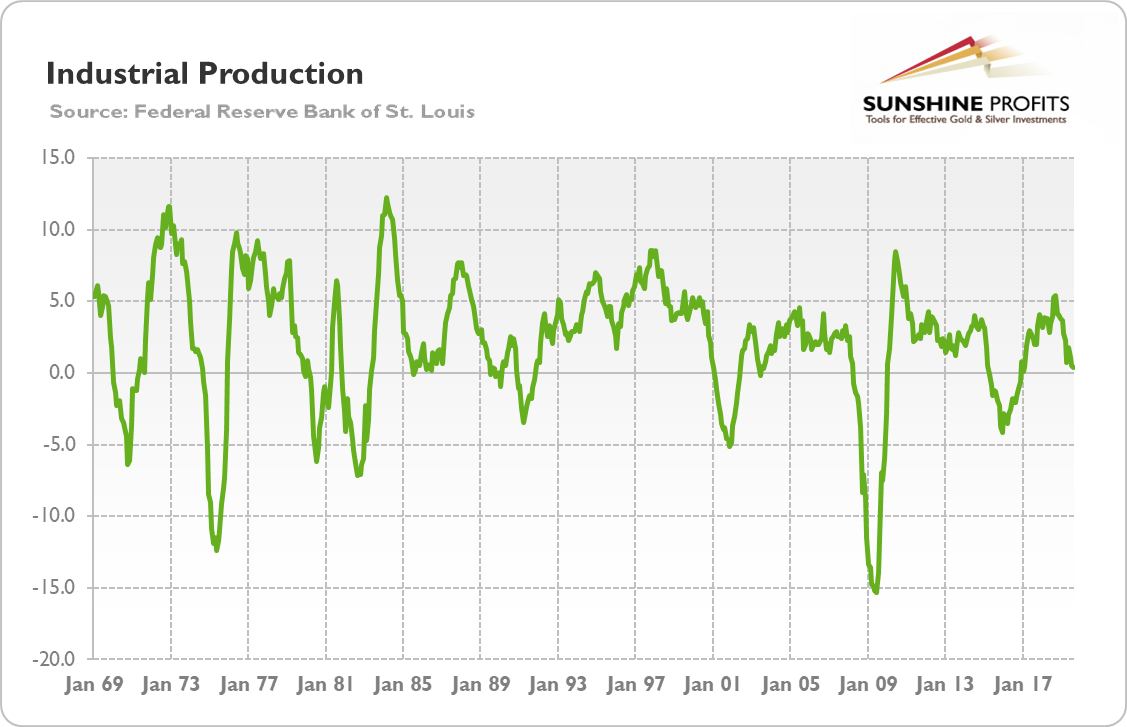

For all these reasons, we should not ignore the manufacturing slump. After all, the industrial production is one of a few recessionary indicators used by the NBER to determine the busts. And, indeed, all recessions in the last 50 years were accompanied by contraction in the industrial production, as one can see in the chart below.

Chart 1: Industrial production as a percentage change from year ago from January 1969 to August 2019.

Hence, the current slowdown in the industrial production, if prolonged and transformed into a contraction, could be a harbinger the recession in the overall economy. However, it does not have to. As the chart above shows, industrial production sometimes sends false signals. The best example is 2015-2016, when a correction in energy exploration contributed to declines in industrial production. The overall economy slowed down, but it did not enter a recession. This time, the downturn in industrial production is broader, but it partially results not from cyclical factors, but from the U.S. - China trade war and increased tariffs that are raising costs and disrupting supply chains.

What does it all mean for the gold price? First of all, the precious metals investors shouldn't dismiss the recessionary developments in manufacturing. Yes, statistically, it is a small part of the whole economy, but its economic significance is much greater. Having said that, the downturn in manufacturing does not have to cause, or be followed by, overall recession, as tariffs hit mainly industrial sector. It adds to worries, that's for sure, which could strengthen the safe-haven demand for gold, but other major indicators (except the yield curve) have not flashed recession so far. So it seems that gold bulls should not celebrate just yet.

If you enjoyed the above analysis and would you like to know more about the most important macroeconomic factors influencing the U.S. dollar value and the price of gold, we invite you to read the ...

more