Mall Vacancy Rate Hits 8-Year High Amid Record Number Of Store Closures

While the investing public's attention is transfixed by the slow motion train wreck that is the WeWork collapse - which is set to become a case study of how to go from a $47 billion valuation to bankruptcy in just a few months - US commercial real estate is happily cratering on its own, thank you, without Adam Neumann's help.

As RetailDive writes, landlords across the US are rushing to fill vacant retail space and will have to scramble all the more as Forever 21 this week said it would add 178 stores to a closure count that has already surpassed last year's grim total. And while the retail vacancy rate in the third quarter declined to 10.1%, from the 10.2% of both last quarter and the third quarter last year, the average mall vacancy rate has reached an eight-year high, inching up 0.1% from last quarter to 9.4%, according to real estate research firm Reis.

Both supply and demand for retail space decelerated in the quarter, "as fewer developers build traditional neighborhood and community shopping center space," wrote Reis Senior Economist Barbara Byrne Denham. "Still, tenants are leasing stores in what is getting built as shoppers prefer the new over the old in any market."

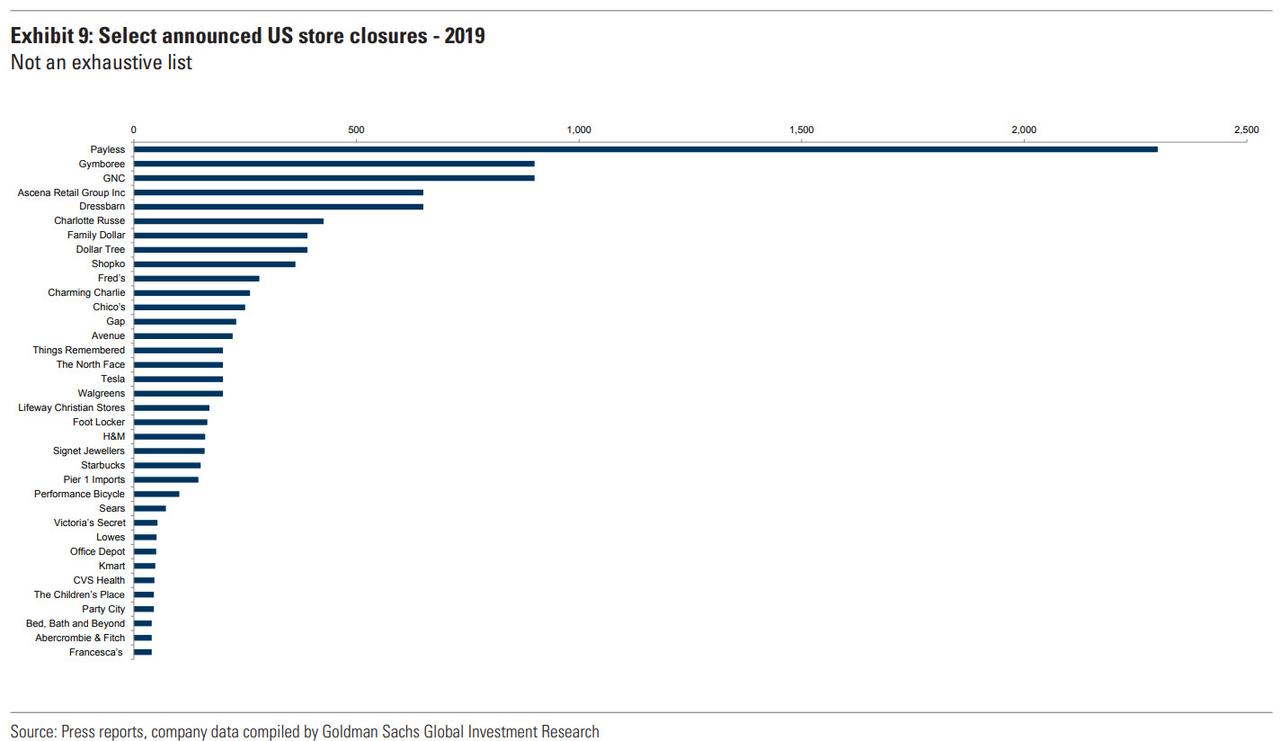

Yet as market participants jostle for positioning, one thing is clear: vacancy rates are only going higher. As Goldman notes in a recent research report, retailers so far in 2019 have announced or completed a record 11,000+ store closures, already exceeding the annual numbers of the past few years with CoreSight Research projecting the figure to touch an all time high 12,000 by 2019 end.

Curiously, Reis' Denham downplayed that latest wave of closures and said the market can withstand it: "The retail sector has withstood numerous store closings, this latest one should not deliver a big blow," she said of the fast-fashion retailer's announcement. "Retail spending remains healthy as consumer spending keeps climbing in step with job growth. In short, the retail sector is poised to continue to grow at the current slow but steady rate."

Still, the report underscored that regional malls are doing worse compared to strip-style centers. Such malls have traditionally been anchored by department stores, which have been falling like dominoes. Sears, J.C. Penney and Macy's have also exited malls as they shuttered hundreds of locations in the past few years.

Their departures have fed a vicious cycle, where the resulting traffic decline hurts other mall tenants, which in turn close or open their hands to re-negotiate rents. "Many malls now have only one, maybe two anchors, where they once had three or more," Keith Jelinek, Managing Director at Berkeley Research Group, told Retail Dive in an interview. Traditional malls are less convenient to shop than community strip centers, at a time when consumers are pressed for time and anxious for convenience, he also said.

That has prompted the likes of GNC and even Gap to consider those strip-style locations, where traffic is fairly low but conversion often higher.

Still, many landlords are finding new tenants, though not always retailers. Movie theaters, doctor's offices and municipal motor vehicle departments are increasingly found in malls, Jelinek said. In some areas, churches have also started taking over anchor locations or even entire malls.

While how much that helps retail remains an open question, it could be helping support rent in some areas. "Although retail store closures and bankruptcies still dominate the news, the overall retail property statistics have held steady as new users fill vacated space of large department stores," according to the Reis report.

They may have "held steady", but one look at the chart below shows that the deluge is relentless...

... as is the onslaught of bankruptcies.

Since June 2015, retail chains have accumulated more than $45 billion in aggregate chapter 11 liabilities in connection with over 80 bankruptcy filings: pic.twitter.com/Q1XO9pSWij

— Reorg First Day (@ReorgFirstDay) August 20, 2019

As a result, the tipping point for US commercial real estate is approaching fast, begging the question whether WeWork's upcoming bankruptcy will be the straw that finally breaks the camel's back. For some additional discussion of that, see "A Dive Into WeWork's $3.3 Billion In CMBS Exposure"

Copyright ©2009-2015 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you engage ...

more