Making Sense Of Pandemic Valuations

With the pandemic induced havoc, how is that the stock market is not down more? And what effect will the economic downturn have on the valuation of startups?

In mid-April, when the Dow Industrials index was around 24,000, a friend with a predictive model for public stocks told me the market had priced-in the forthcoming bad economic news. He did not expect to see the Dow back at the 18,600 level it had hit a few weeks earlier. I had a hard time believing that, but the market hasn't validated my sense. It has remained stable as other economic indicators have worsened.

I’m not good at predicting the market—highs are higher than I think they should be, and lows are not as low as I believe they ought to be. Many people share my puzzlement.

This is the first in a trio of articles about expectations, and how uncertainty affects valuations differently in the public and private capital markets.

Classic thinking is that stock prices for established companies reflect actual performance, and that history suggests future performance. Of course, expectations that have no historic basis influence valuations too. Companies go public before they have revenue, let alone profit.

Expectations that affect valuations are being upended. Business models that were stressed before COVID-19 face potential collapse, while new ones are being viewed more soberly. For private companies with venture capital investors, an eventual exit—via IPO or acquisition—may appear more distant, and less valuable. This will cloud valuations for VC-backed private companies in the forthcoming quarters when they need to raise additional capital.

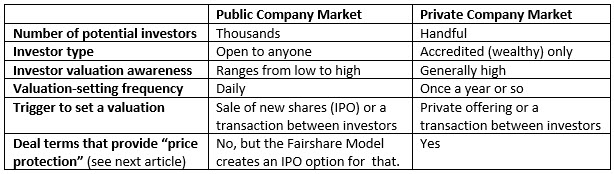

Dichotomies in valuations have always existed between the public and private markets, but current conditions may lead more people to wonder about them. Here are some thoughts that may reconcile Wall Street measures of health with reports of economic blood on Main Street.

- With interest rates so low (even negative), investors lack an appealing alternative to stocks. Absent new fear-provoking developments, investors have weak incentive to move money out of the market.

- The companies in the Dow lead their industries—they are likely to remain strong.

- Public companies have better access to capital than private ones, which enables them to be prepared when the economy opens up. Closely held small businesses lack such access, and many are suffering greatly.

- Public investors are less valuation-aware than those in the private market. Tesla (TSLA), for example, has had a higher valuation than General Motors (GM) and Ford (F), even though both dwarf Tesla in terms of vehicles produced, assets, revenue, and income. Another example is that the stock of companies often climbs after they file for bankruptcy, even though shareholders may be wiped out.

- Emotion has more impact on valuation in the public companies than private ones. Thus, rumors of a possible COVID-19 treatment or vaccine can ignite enthusiasm for public stocks. Emotion affects private capital too, but those investors demand deal terms that protect them from overpaying (more on this in the next article).

- A public company’s valuation is set daily. For a private one, it is set infrequently—when they raise equity capital. Many startups will need money in the next few quarters and a number of them have laid off employees and taken other measures to preserve cash. For those with weak performance or questionable business models, there is the prospect of a down round—a lower valuation—which will squeeze the ownership position of other shareholders and employees.

This table highlights some of the valuation dynamics.

The high-level point I leave you with is that valuation is a tale of two cities—two markets, in this case.

One is set frequently in the public one, with participation of investors who think in terms of share price. But a valuation is more than that, it is the product of the share price and shares outstanding.

In the private capital market, a valuation is set infrequently by valuation-aware investors who insist deal terms that provide price protection.

- Unfamiliar with valuation? Check out this YouTube video "Pre-Money Valuation: How To Calculate It.” The references to my 2019 book, The Fairshare Model: A Performance-Based Capital Structure for Venture-Stage Initial Public Offerings, are dated—the video was created years before it was published.

This is the first of three articles that discuss corporate valuations and capital structures.

<< Read More: The Drivers Of Valuation

Karl Sjogren is author of The Fairshare Model: A Performance-Based Capital Structure for Venture-Stage Initial Public Offerings. Its name describes its purpose: to balance and align the ...

more

Hi Karl, first of all, thank you for your article. I was wondering how you see the COVID-19 Pandemic specifically affecting private pharma/biotech companies moving forward- as they raise future rounds of money? Do you imagine the same effect on these companies compared to private companies in other sectors, or do you imagine that VC Funds will continue to pour money into these smaller private pharma/biotech companies, with the global threat of other viruses or the return of the novel corona virus?

Hi Issac! Glad to hear you enjoyed the article. Be sure to check out the other two that I posted after this one, as they relate to your line of inquiry.

As for your specific question, I think the pandemic has recast the near-term opportunities in healthcare and biotech. If a company looks like it will benefit from the new environment, its valuation will climb because more investors will have interest. That applies to the private and public sectors.

Thank you Karl, I plan on reading both of those articles and look forward to possibly discussing them too.

Regarding your response, do you see healthcare/biotech companies that are not intrinsically related to the benefits of this new environment facing tougher challenges with regard to raising funds? And if they do face challenges, do you think that you could equate the challenge of raising money for companies in this sector (healthcare/biotech) to companies in other sectors?