Make This Easy Trade To Get Into The Real Estate Market

When most people talk about asset allocation, they are talking about stocks and bonds. Typically, those earlier in their life want to have a higher allocation to stocks. Then, when they reach retirement age, they switch that around and have a higher allocation to the safe haven of bonds with the aim of living on this interest.

Real estate is another major asset class, however the market is extremely illiquid and investors with exposure to this class can have funds tied up for years. Accessing those fund by selling a property can also incur hefty fees.

Thankfully, these days there has been an explosion in ETF’s and investors can gain exposure to just about anything and everything via an ETF, with real estate being no exception.

The beauty of investing in a real estate ETF is that you don’t have to pay hefty sales commissions, or taxes and you don’t have to worry about colleting rent or a tenant damaging your property.

Personally, I love adding real estate ETF’s to my long-term holdings and then using options to trade around my core position. For example, if I own the IYR ETF and it has gone up significantly in value, I might either buy a put to protect some gains, or sell a call to generate more income.

I also like doing wheel trades on this ETF by selling a put and then selling calls against the shares if I get assigned.

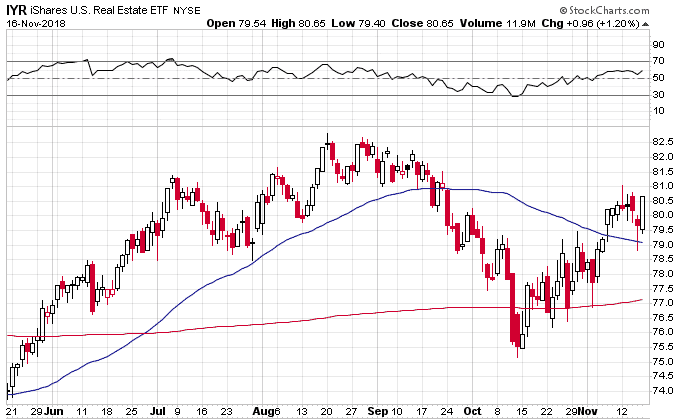

IYR pulled back around 10% in September and October this year which was a really nice time to start selling puts.

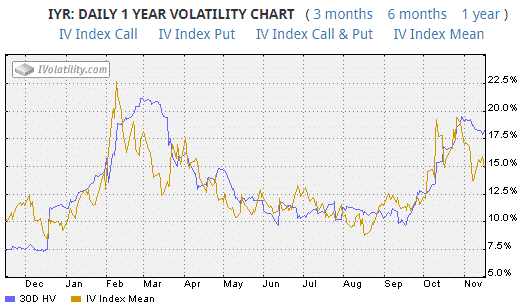

For example, in mid-October, implied volatility jumped up to nearly 20% which was near to a 12-month high. That means juicy premiums for option sellers.

At the time, traders could have sold a November $75 put for around $1.35. That put expired worthless last week for a 18.77% annualized return.

After a nice run up in IRY, I’ll be waiting for a bit of a pullback before taking any more exposure.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more