Major Asset Classes - October 2015: Performance Review

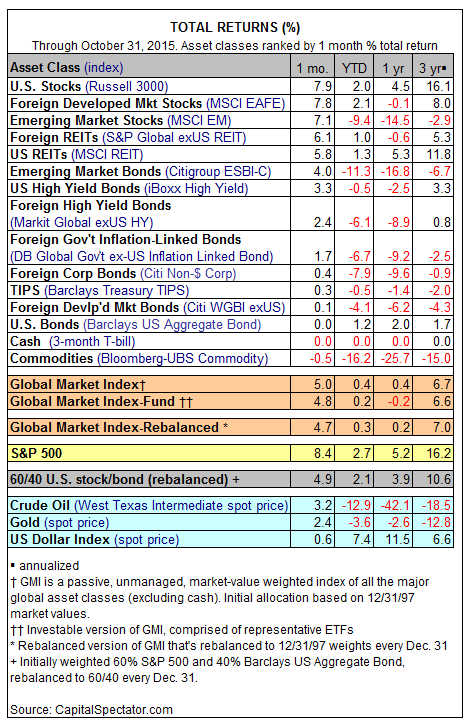

Global markets posted sharp gains in October, clawing back most of September’s hefty losses. The revival was headed by equities, with US stocks leading the charge higher with a strong 7.9% total return via the Russell 3000 Index last month. Despite the broad-based gains at the kick-off to the fourth quarter, losses still dominate the year-to-date comparisons, along with a few instances of mild gains.

While there was a bullish wind blowing in October, there was a familiar exception. Broadly defined commodities once again dipped lower, albeit mildly so this time. Although the price for crude oil revived in October, the Bloomberg Commodity Index continued to slip, retreating by a comparatively modest 0.5% last month.

The broad gains overall lifted the Global Market Index (GMI) in October. This unmanaged benchmark that holds all the major asset classes in market-value weights rose 5.0% last month, its best monthly gain in five years. The bounce returned GMI to the positive column for the year-to-date return, but just barely. GMI is ahead by a weak 0.4% for 2015 through October’s close.

The latest bounce strengthened GMI’s trailing 3-year total return too. The benchmark is higher by a respectable 6.7% annualized total return through last month, which is well above the long-term forecast for GMI, based on last month’s risk premia forecast.

Disclosure: None.