Major Asset Classes - July 2021 - Performance Review

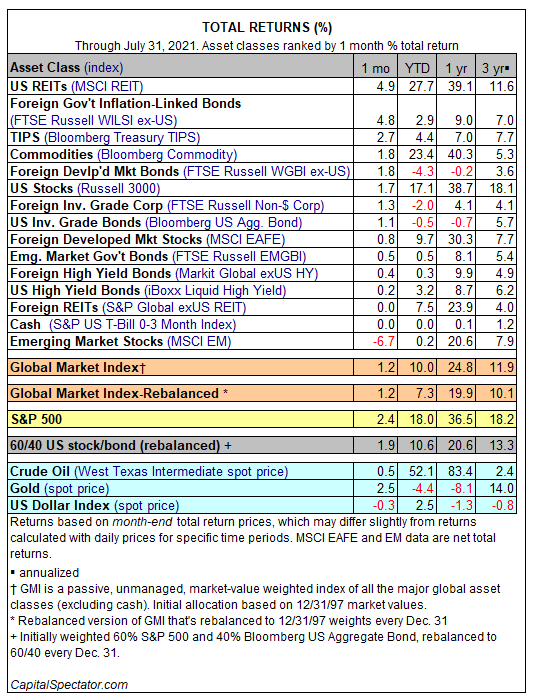

Most of the major asset classes continued to rise in July, led by US real estate investment trusts (REITs). Only stocks in emerging markets lost ground last month.

For a second straight month, MSCI US REIT Index led the gainers with a red-hot 4.9% total return. The increase – the highest since last November – marks the ninth month in a row for positive monthly performance for the asset class.

The only loser in July: emerging markets stocks. The MSCI Emerging Markets Index fell sharply, tumbling 6.7% — the biggest monthly decline in 16 months for this slice of global shares.

US equities continued trending higher. The Russell 3000 Index rose for a sixth straight month in July via a 1.7% return. US fixed-income securities also increased last month: Bloomberg Aggregate Bond Index’s recent uptrend accelerated in July, jumping 1.1% — the fourth straight monthly gain for the benchmark.

The bull run also persisted for the Global Market Index (GMI) in July. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, rose 1.2% — the sixth straight monthly increase for the benchmark. Year to date, GMI is up a strong 10.0%. Only three of 15 asset classes listed above have a higher return in 2021.

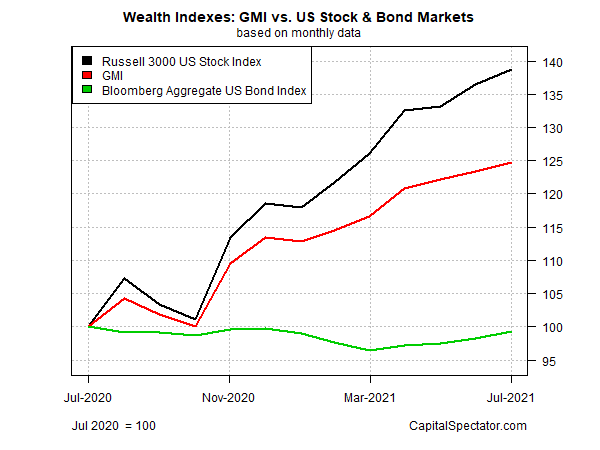

Reviewing GMI relative to US stocks and bonds continues to show a middling but still impressive performance over the trailing one-year period. The message: passively holding the world’s markets in market-value weights remains a competitive strategy. GMI earned nearly two-thirds of the gain posted by US stocks with considerably less risk over the past 12 months.

Disclosures: None.