Looking For Action? S&P 1500 Most Volatile Stocks

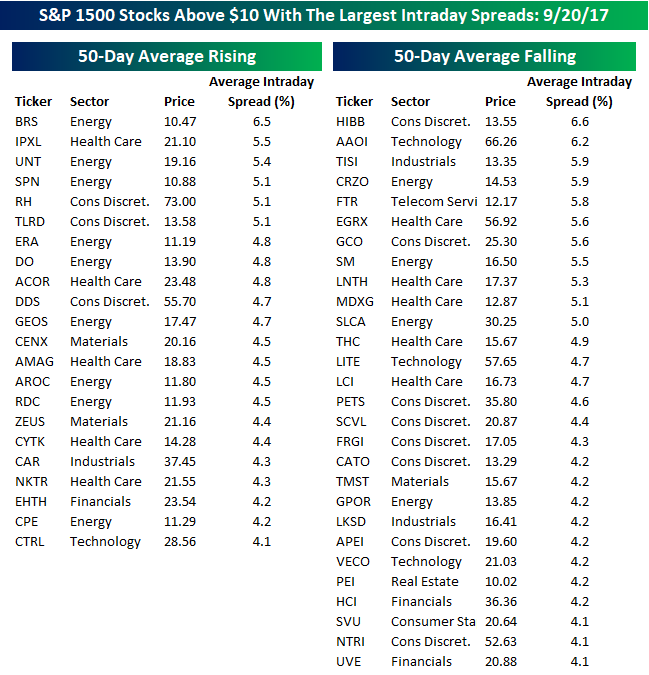

For traders with a short-term time horizon who are looking for big moves over a short period, we have updated our list of the S&P 1500 stocks trading above $10 that have the largest intraday high-low ranges (based on the average percent spread between the intraday high and low over the last 50 days). The stocks are grouped based on whether they have a rising or falling 50-day moving average (DMA).

With overall market volatility being so low that some strategists are asking whether it will ever come back to the markets (reason enough that you can bet it will), individual equity volatility has also been extremely muted. Of the 50 most volatile stocks in the S&P 1500, just 17 have had an average daily move of more than 5% over the last 50 trading days. The most volatile stock in the index has been Hibbett Sports (HIBB), which has averaged a daily move of 6.6%. For a $13 stock, 6% doesn’t amount to a whole lot in dollar terms, but it is still volatile nonetheless. In dollar terms, the stock that has had the largest average daily high-low spread has been Applied Optoelectronics (AAOI). With a $66 share price, AAOI averages a daily move of over $4. AAOI has also been volatile on a longer-term basis, as in the span of three months it has rallied from $60 to $100 and back down to $60!

In terms of sector representation on this month’s list, while names from ten out of eleven sectors made the list (Utilities is the only sector missing), three sectors dominate. With thirteen Energy sector stocks, eleven Consumer Discretionary names, and ten stocks from the Health Care sector, those three sectors account for 70% of our list.

Gain access to 1 month of any of Bespoke’s membership levels for $1!

Disclaimer: To begin receiving both our ...

more