Long-Term Bonds Surge As Investors Pile Into Safe Havens

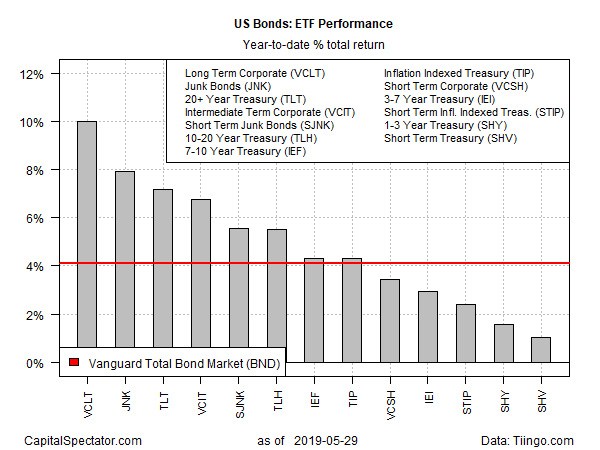

The revival of a risk-off bias in global markets this month has been a boon to long-term bonds. Although every corner of the US fixed-income market has been rallying this year, the latest surge in long-term maturities stands out, based on a set of exchange-traded funds.

Long-term corporates, in particular, are now the top year-to-date performer in 2019 by a substantial margin through yesterday’s close (May 29). Vanguard Long-Term Corporate Bond (VCLT) is up 10.0% so far this year. That’s comfortably ahead of the second-best performance so far in 2019 for US fixed income: junk bonds. SPDR Bloomberg Barclays High Yield Bond (JNK) is up 7.9%.

Another difference between this year’s performance leader and its runner-up: VCLT has been on a tear in recent days while JNK has stumbled. Indeed, Vanguard Long-Term Corporate Bond (VCLT) has posted gains in each of the past six trading sessions, lifting the ETF to a record high (on a total-return basis).

JNK’s modest decline of late still leaves it near its all-time high (after factoring in distributions). But in the current risk-off climate, along with rising worries about US economic weakness and relatively low yield spreads, the possibility of further declines for JNK isn’t easily dismissed.

Note, too, that iShares 20+ Year Treasury Bond (TLT) — the third-strongest year-to-date performer — has also rallied sharply this month.

The catalyst for the renewed appetite for safety is the escalating US-China trade conflict, which is expected to be a significant headwind for the global economy.

“A trade war is now everyone’s base case,” says Peter Tchir, head of macro strategy at Academy Securities. “The reality of a trade war is finally sinking in. Little or no progress seems to be occurring. If anything, both sides seem to be digging in their heels.”

The latest news: China is reportedly taking the battle up a notch on the soybeans front. According to Bloomberg: “China, the world’s largest soybean buyer, has put purchases of American supplies on hold after the trade war between Washington and Beijing escalated, according to people familiar with the matter.”

The risk-off trade could unwind quickly and perhaps dramatically once the trade war ends, but for the moment there are few signs that the conflict will fade in the near term. On the plus side, the US economy continues to enjoy a healthy growth rate, based on data published to date. But signs that the macro trend is weakening are getting harder to ignore, including downgraded expectations for second-quarter GDP growth.

It doesn’t help that the US-Europe trade front is looking increasingly shaky as well.

The bottom line: the longer the trade battles rage, the greater the economic risk for the US and the global economy and the stronger the appetite for safe investment havens.

Disclosure: None.