Long And Short Of Short Interest - Thursday, Feb. 28

Here is a brief review of period-over-period change in short interest in the February 1-15 period in 10 S&P 500 sectors.

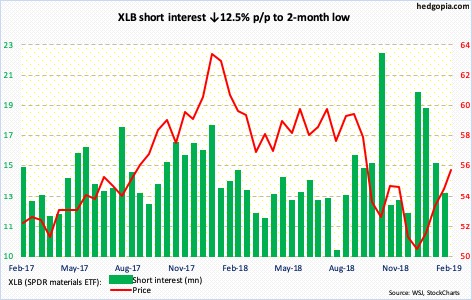

XLB (SPDR materials ETF)

Shorts continued to cut back. From the Boxing Day bottom through the high Monday, XLB (55.73) shot up just under 20 percent. Now that most of the recent buildup in short interest has been squeezed, the ETF is itching to go lower. The daily in particular is extremely overbought, even as bulls unsuccessfully tried to take out the 200-day moving average the past six sessions. Resistance at 56 goes back more than two years.

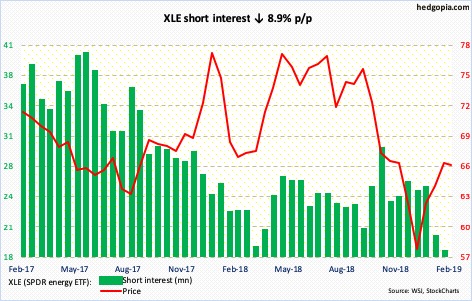

XLE (SPDR energy ETF)

Versus several other sector ETFs, XLE’s (65.91) rally the past couple of months was subdued but was enough to force short squeeze. The ETF currently sits right between the 50- and 200-day. In the past, bulls and bears locked horns at 65-66. This is occurring again. Odds likely favor the latter – if nothing else just to unwind extended conditions.

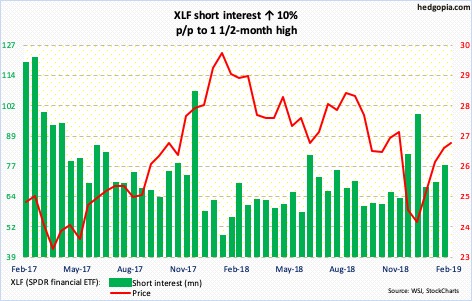

XLF (SPDR financial ETF)

Shorts slightly added in the past month. Last December, XLF (26.59) bulls lost major support just north of 25, which they recaptured in January, followed by a successful retest early this month. However, continued rally attempts were strongly rejected at the 200-day Monday. The 50-day (25.15) lines up with the support in question.

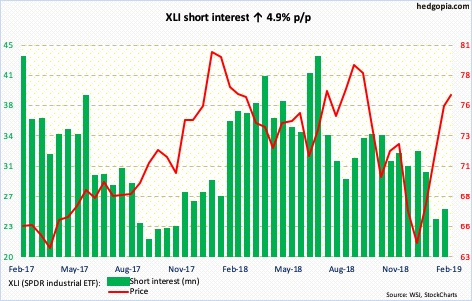

XLI (SPDR industrial ETF)

After bottoming late December, XLI (76.60) put up a strong show, recapturing both 50- and 200-day. The ETF is grossly extended, but bulls continue to carry the momentum. Wednesday, buyers showed up at the 10-day. In the event weakness develops near term – likely – the 200-day lies at 73.25.

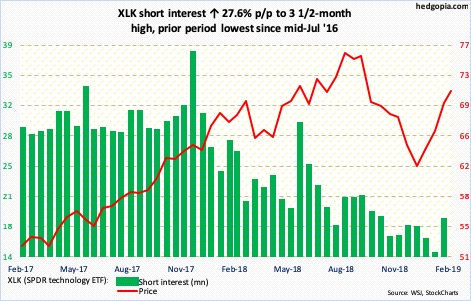

XLK (SPDR technology ETF)

XLK (71.06) shorts have been burned. In the latter half of January, short interest fell to lowest since mid-July 2016. In the reporting period, it rose to a three-and-a-half-month high. For these shorts to fare well going forward, they need to first push the ETF under the 200-day (69.67). The advantage they have is that there is resistance just north of 71.

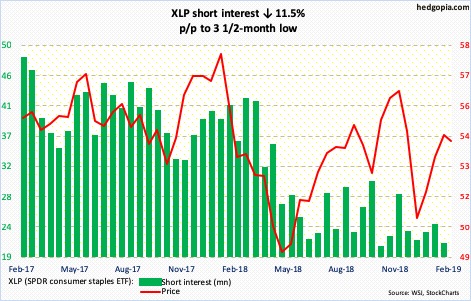

XLP (SPDR consumer staples ETF)

XLP (54.08) looks vulnerable. After rallying in seven of the prior eight weeks, last week produced a long-legged doji. Shorter-term moving averages are on the verge of rolling over. Nearest support lies at the 200-day (53.13).

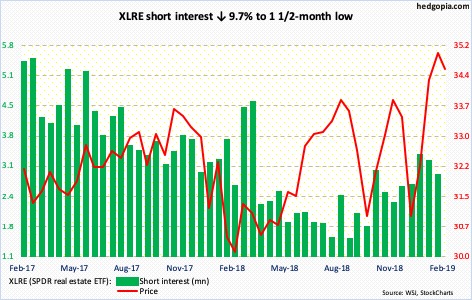

XLRE (SPDR real estate ETF)

Bulls tried but were not able to break out of just south of 35, which makes up the upper bound of a two-and-a-half-year rectangle. Shorts have not gotten too aggressive – not yet. They likely will, should XLRE (34.61) lose 34.

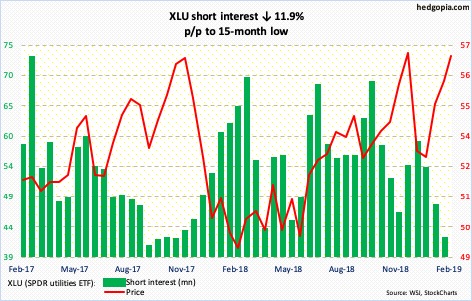

XLU (SPDR utilities ETF)

XLU (56.68) once again tested major resistance just north of 57 – unsuccessfully thus far. Shorts contributed to the rally the past couple of months, but their ranks are thinning out. Short interest is at a 15-month low. It is bulls’ ball to lose at this point.

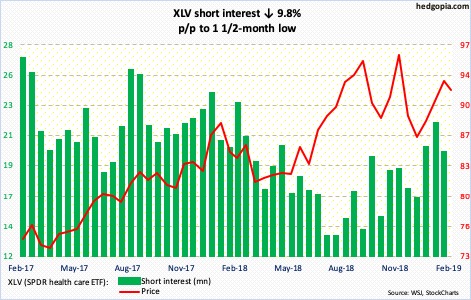

XLV (SPDR healthcare ETF)

XLV (91.92) Monday saw sellers show up at the daily upper Bollinger band. The daily MACD is on the verge of a potentially bearish cross-under. Shorts have been adding in the past few months. Odds are in their favor at least near term.

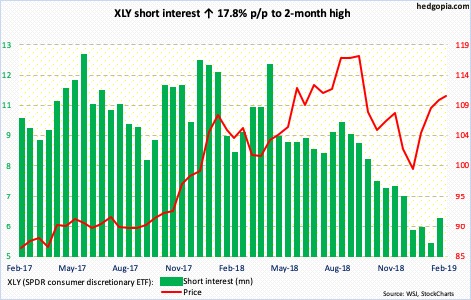

XLY (SPDR consumer discretionary ETF)

XLY (110.81) has stayed above the 200-day (108.95) the past couple of weeks, even though it has not been able to rally off of it strongly. Shorts added in the latest period but from a very suppressed level. A test of the 200-day is the path of least resistance near term.

Disclaimer: This article is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any ...

more