Logical Invest Investment Outlook - July 2016

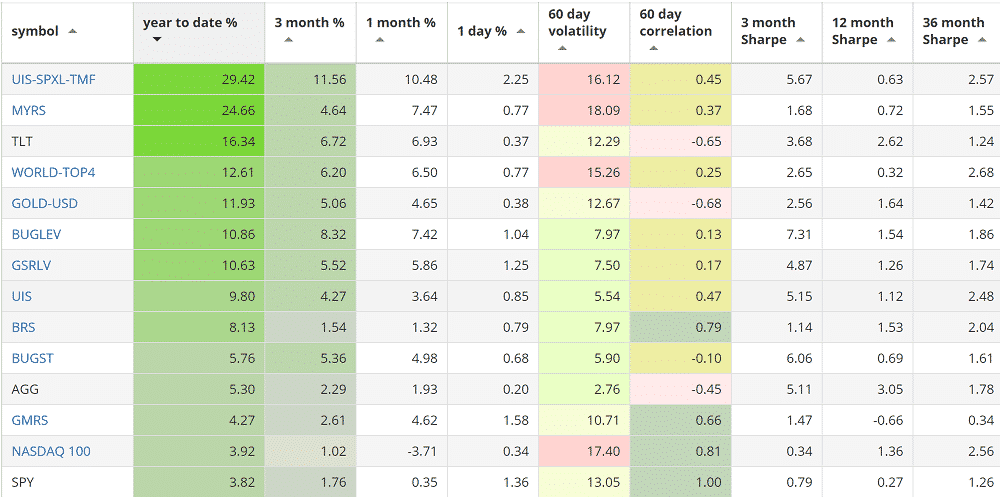

Our top year-to-date strategies:

- The Leveraged Universal strategy with 29.4% return.

- The Maximum Yield strategy with 24.6% return.

- The World Top 4 with 12.6% return.

SPY, the S&P500 ETF, returned 3.82%, year-to-date.

Market comment:

The big event for June was the British E.U. membership referendum. Contrary to widespread expectations, Britain’s vote was in favour of leaving the Eurozone. Anyone trading on the 23rd experienced unprecedented volatility as the VIX first crashed on expectations of the “remain” camp winning and subsequently spiked up as the actual results came in.

As of this writing the SP500 has almost recovered. Still, this provides an excellent opportunity to see how our strategies perform under a real and unprecedented market shock.

Our core strategy, UIS saw a drawdown of barely -1.45%. Our BUG leveraged strategy, being 200% invested, lost no money and returned +7.4%, its majority allocation being in gold, treasuries and inflation protected treasuries (TIPS). Our year-to-date top performers, the UIS 3x and MYRS strategies, returned +10.4% and +7.4%, completely ignoring the ‘black-swan’ event.

So let us take a closer look and see why our strategies remained robust in this type of risky environment. Most of our current subscribers are familiar with the fact that all our strategies are hedged using treasuries, some using gold as well. The idea is to participate in longer term growth through equity investment while hedging part of the portfolio in a leveraged treasury ETF. When a market negative event materializes, money flows to traditional safe heavens like treasuries or gold. Having a (variable) allocation to these will dampen the shock to the portfolio and sometimes even provide profit, especially if the shock to the system is temporary and the equity part recovers. Of course all this assumes that ETFs like SPY and TLT/GLD are inversely correlated, which is mostly the case.

No wonder that most our strategies had a good June return:

The two BUG strategies, being exposed to both TLT and GLD benefited, returning +4.98% and +7.4% for the month. Our World Top 4, despite its exposure to foreign markets did +6.50%, mainly due to the treasury hedge. The most interesting play was our fairly new Gold-USD strategy: It returned +4.6% benefiting from two side-effects of the Brexit vote. The strategy was long Gold and short the Euro (using an inverse ETF): Gold rose as it provided a safe heaven to panicked GBP-based investors while the Euro fell as the market priced in a possibility of a deepening E.U. crisis.

Another point to examine is how monthly (or bi-monthly for MYRS) rebalancing helps our UIS 3x and MYRS strategies do well through large market swings . Even though both strategies held fairly steady allocations for the past few months, they do need rebalancing and effectively sell positions into strength and buy positions into weakness. An example: UIS 3x was allocated 50/50 to SPXL and TMF, the 3x versions of SPY and TLT. As TMF rose significantly for June, the value of the TMF component rose beyond 50% while SPXL share fell below 50%. So assuming a new 50/50 allocation, one would have to sell part of TMF (for profit) and buy some (weaker) SPXL.

Although the markets seem to be back to normal, make no mistake: Britain’s exit is a historical decision with many long term political, social and economic consequences. But in terms of our investments it seems to have a positive effect as world central banks further delay rate hikes and pledge increasing support to the markets.

We remain close to last month’s assessment: We expect a somewhat volatile summer while we wait for a very interesting pre-election fall. For now, we still favour our more conservative strategies like UIS, the BUGs, GSRLV and BRS.

We wish you a healthy and profitable July.

Logical Invest, July 1, 2016

Strategy performance overview:

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)