Lockheed Martin: Global Conflict Escalation Presents An Oppurtunity

A) Introduction

With the news of Boko Haram and ISIS joining forces on Friday and the increasing calls for more US troops on the ground in Iraq, it is clear that the war in the Middle East is escalating. In this report, we'll be outlining why we maintain an "Outperform" rating on Lockheed Martin (NYSE:LMT), the defense contractor. Besides being a clear beneficiary from the escalation in the Middle East and Ukraine conflicts, we believe Lockheed Martin has a very strong growth profile at a value that isn't yet too expensive. Lockheed has also been demolishing analyst estimates recently, which is a trend that we believe will continue.

We will begin by breaking down the company's relative value, then we'll analyze its growth profile, how it has performed versus analyst expectations, and conclude with a qualitative discussion of potential catalysts and risks. We should note that we base our quantitative analysis purely off of academic research, thus restricting our analysis to metrics that have been empirically shown to predict stock returns. For a detailed breakdown of prominent academics and the insights revealed from their research, click here.

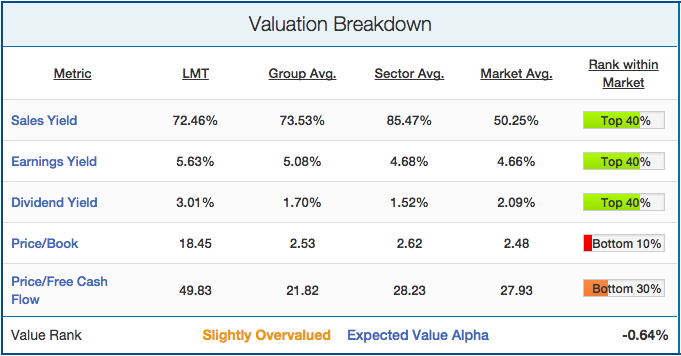

B) Valuation Breakdown

We start with a breakdown of relative valuation, as valuation metrics have been repeatedly shown to be some of the best predictive indicators. There is a reason that most of the best investors tend to be value investors. Over the long-term, cheap stocks beat expensive stocks. The following breakdown shows Lockheed Martin's valuation profile, looking at five traditional value metrics that have strong predictive ability:

Source: QuantifiedAlpha.com/stockData/LMT#value

Lockheed falls roughly in line with the Aerospace and Defense industry group averages, except for on a book value basis. Lockheed is currently trading at 18.5 times book value, which is wildly higher than the industry group (2.53), industrial sector (2.62), and overall market (2.48) averages. Our algorithms take into account each metric, so the company's extremely high price-book ratio hurts its value rank. With that being said, it should be noted that Lockheed Martin has a history of trading at an extremely high price/book ratio. This ratio is significantly down from it's high of 790x book in January 2013, which has been trending downwards ever since. From a revenue and earnings basis, Lockheed looks attractively priced with both its sales yield (72.5%) and earnings yield (5.6%) being higher than the overall market averages (50.3% & 4.7%). Lockheed also offers a solid dividend yield (3%), which is double the industrial sector average (1.5%). Overall, we rate Lockheed as "Slightly Overvalued" but don't expect it to materially hurt the stock's performance versus the S&P 500 over the next twelve months.

C) Growth Breakdown

There are a variety of different growth metrics that have been shown to predict stock returns. Most important among them is price momentum. Winning stocks keep winning (based on six-month price performance), and losing stocks keep losing. Lockheed Martin's growth breakdown is shown below:

Source: QuantifiedAlpha.com/stockData/LMT#growth

As we said at the start of the report, Lockheed Martin should be bought because of its growth not its value. Over the last six and twelve months, Lockheed has vastly outperformed its industry group, sector, and the overall market. Lockheed grew EPS (+24%) at more than double the rate of its industry group (11%), which is especially impressive given its immense size (>$62 billion market cap). Lockheed's management has clearly been doing their job well, as evidenced by their extremely strong return on equity (85%). This is a very positive sign, and shows that management has been able to convert its EPS growth into tangible value for its shareholders. Overall, Lockheed Martin is a "Strong Growth" company, and we expect its growth profile to contribute to significant outperformance over the next year.

D) Earnings Breakdown

Next, we'll see how Lockheed has been performing relative to analyst expectations recently. We've found through historical back testing that stocks that have a history of beating analyst expectations are much more likely to beat estimates in the future. This is key as stocks that beat analyst estimates often see big jumps in price, and vice versa for earnings misses. Lockheed's earnings estimate breakdown is shown below:

Source: QuantifiedAlpha.com/stockData/LMT#earnings

Lockheed beat consensus EPS estimates by 7% last quarter, extending its streak of consecutive EPS beats to eight. It also beat on consensus revenue numbers (by 5.5%), though it had missed the quarter before. Still, the stock has now beaten EPS estimates nine times out of the last ten quarters and beat revenue estimates eight times. Our earnings model is projecting a very high probability of beating EPS estimates next quarter (75-100% probability) with the expected beat to be about the same size as last quarter. The model is less optimistic on revenue numbers, though it still expects a small beat. Analysts are calling for $2.48 in EPS and $10.22 billion in sales when the company releases (projected to be in 51 days, or early April).

E) Qualitative Analysis & Conclusion

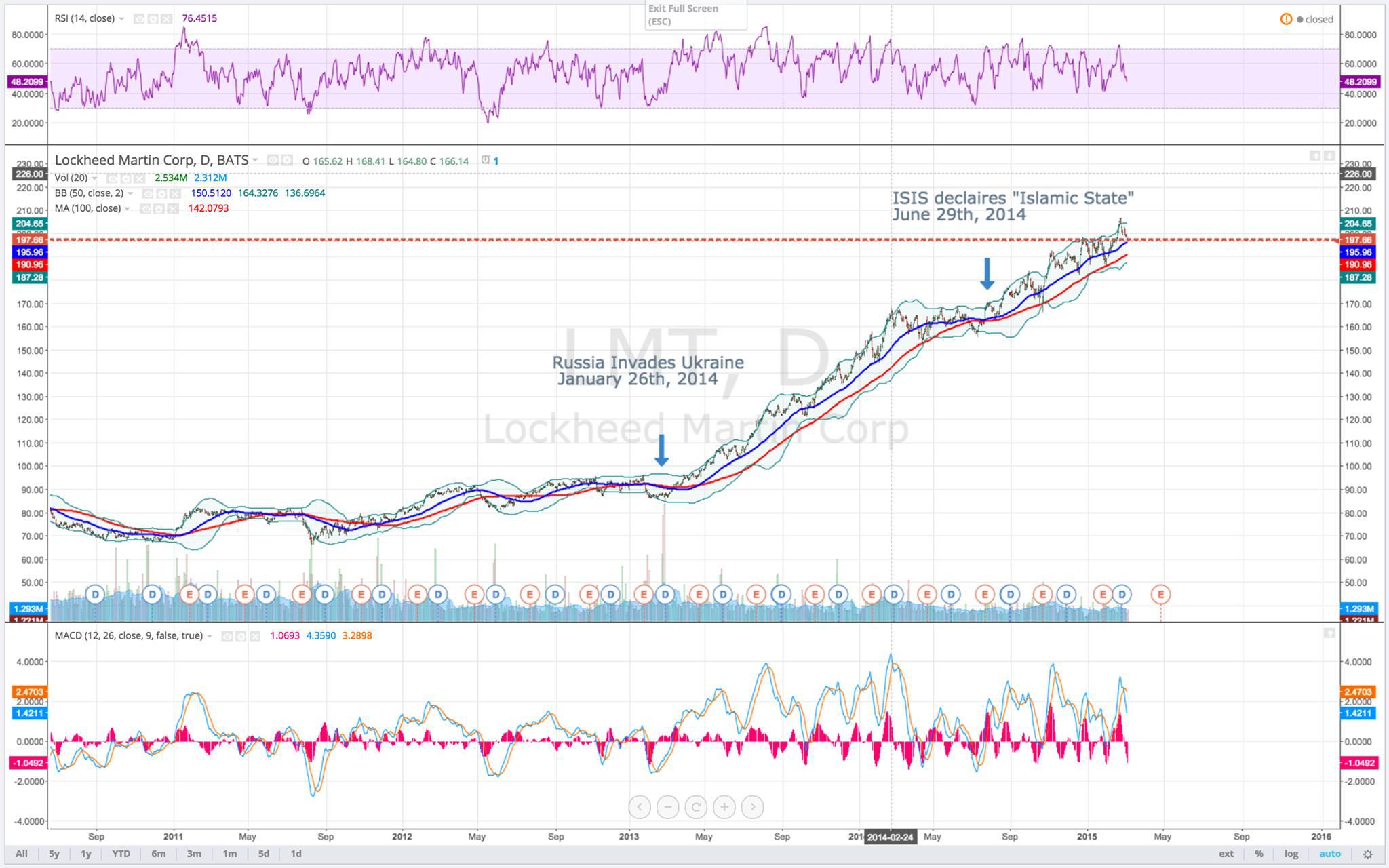

Now that we've analyzed the numbers, we'll now qualitatively discuss potential catalysts for growth. As we said at the start of the report, escalation in the Middle East and the continuing conflict in Ukraine will be industry tailwinds for Lockheed. As the chart below shows, Lockheed's stock price seems to have benefited from the conflicts:

Click on picture to enlarge

Chart courtesy of John Anastakis, Special Adviser to QuantifiedAlpha

There is no doubt that investors have been piling into defense contractors whenever conflicts have escalated. While Boko Haram's pledge of allegiance to ISIS may not change anything tangibly, it makes US intervention much easier for the US public to swallow. It does this by cementing to the public the idea that ISIS is a legitimate threat that is gaining influence and power. If the US does indeed increase their use of force into Iraq, it is likely that the US defense contractors will gain significantly. Again, this is a distant possibility given President Obama's reluctance, but we feel there is a much higher probability of further escalation versus the chance of de-escalation. One potential risk faced by many US defense contractors is the rapidly appreciating US dollar. This risk is mitigated with Lockheed Martin, as the US government accounts for the overwhelming majority of its revenue (approximately 80%).

Overall, we feel Lockheed Martin represents a very strong growth stock that has been crushing analyst estimates recently and that is still trading at a relatively fair valuation. With the potential to gain from the escalating conflict in Iraq as well as the continued conflict in Ukraine, the time is now to buy into US defense contractors. We believe Lockheed Martin is the best of the bunch, and maintain a "Moderate Outperform" on the stock over the next twelve months.

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in LMT over the next 72 hours. The author wrote this article themselves, and it expresses their ...

more