Like A Lion

Welcome to March, where markets like the weather, are greeted with the intensity of a fading trend be that winter or a bull market in risk or harsh economic data. The US GDP 4Q and better Chicago PMI led the selling of bonds yesterday and that supported the USD but it didn’t hurt risk moods. Overnight the China Caixin PMI was better even as Korea trade data was worse as exports fell sharply again. Japan saw better 4Q Capex, worse unemployment and weaker PMI. The focus in Europe was lower core HICP at 1% and as expected weak PMI reports. German jobs were stronger and retail sales robust. This data all matters but seems less of the driver for risk-on everywhere as its still all about US/China trade talks leading to a deal. The fear of a no-deal Brexit is also significantly lower and so that helps markets in Europe and the UK. Data becomes important when geopolitical fears are lower and that describes the start of March – the lion is more a symbol of strength than of volatility as the first 2 months of 2019 have been kind to passive investors chasing momentum and looking for carry. Whether this can change in March will rest on the data dependency of central bankers and their reaction functions. Markets are set up for another test of 2800 in S&P500, which is the upper boundary of many value players. Without better data, the run up in global risk will seem more hope than fact. For those looking for a barometer – watch the AUD/JPY – its back in play with carry, US/China trade hopes, the rush up copper prices and the seemingly eternal easy money of the BOJ. The AUD will be waiting for the RBA and GDP next week and some confirmation of the easing expectations priced into the market. Until we break 80.75 the lion of the 2019 recovery may still just be a lamb in the making.

Question for the Day: Are we near the growth bottom? The better US Chicago PMI yesterday, the stronger Caixin China PMI today (almost at flat 49.9), better Japan 4Q Capex and hopes for a US/China trade deal mixed with FOMC patience and other central banks easy money – all put many analysts into the “green shoots” camp for global growth. Of course, the markets appear to have already priced this theme.

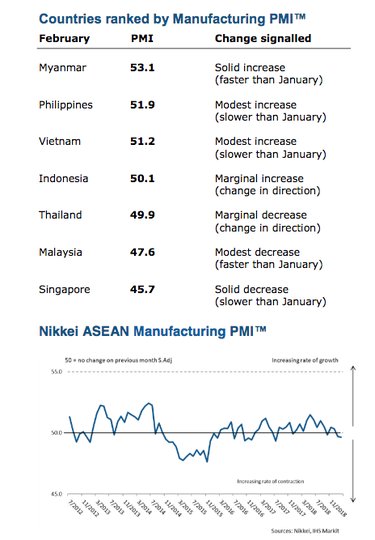

However, there are other stories that conflict with this like the ASEAN February Manufacturing PMI at 49.6 from 49.7 – this is the first back-to-back loss in 2-years as new orders continue to drop as foreign sales contract for the 7th month. This isn’t a bottom but a continuation of trouble that holds from 4Q. The hope for growth needs facts to prove the point and make it real. Today’s US ISM will be watched accordingly. There is one silver lining in the divergence of the region and in that Indonesia and Vietnam maybe the key places to watch to confirm a bottoming out for the region.

What Happened?

- Korea February trade surplus $3.1bn from $1.34bn – more than $1.5bn expected. Exports fell by 11.1% y/y to $39.56bn after a -5.8% y/y drop – worse than -7% y/y expected – 3rd month of declines, worst since July 2016 driven by weak semiconductor demand. DRAM chip prices are off 36.8% and NAND off 25.2%. Car shipments rose for 3rd month with India notable destination, while steel rose for 2nd month with US and Japan orders. Imports fell at 12.6% to $36.47bn.

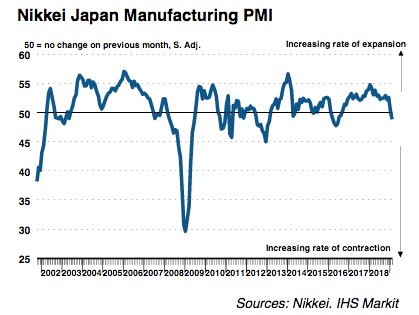

- Japan February Nikkei final manufacturing PMI 48.9 from 50.3 – better than 48.5 flash– but still lowest in 32-months. Business outlook off for 9th month, production off for second monthly decline, New orders at 2 ½ year lows.

- Japan February Tokyo CPI core up 0.2% m/m, 1.1% y/y after 1.1% y/y in January – higher than 0.9% y/y expected. The all-items CPI was 0% m/m, 0.6% y/y while the core-core rose 0.1% m/m, 0.7% y/y.

- Japan January unemployment rate rises to 2.5% from 2.4% - worse than 2.4% expected – first rise in 2-months. Job-to-applicant ratio held at 1.63. A total of 750,000 people chose to leave jobs during the reporting month, up 10,000 from the year before. In contrast, 390,000 people were laid off, up 20,000. Joblessness among men was steady at 2.5% while among women, it rose 0.3% to 2.5%. The seasonally-adjusted number of unemployed stood at 1.72 million, up 80,000 from the previous month.

- Japan 4Q Capex Spending jumps 5.7% y/y after 4.5% y/y – better than 2.2% y/y expected. This was the 9th quarter of increases with manufacturing surging to 10.9% from 5.1%, led by machinery and oil refining while food fell.

- Japan February consumer confidence dips to 41.5 from 41.9 – worse than 41.6 expected – lowest since Nov 2016. By category – overall livelihood fell 1.1 to 39, willingness to buy fell 0.8 to 40.9, income growth fell 0.1 to 41.3 but employment outlook rose 0.5 to 44.8.

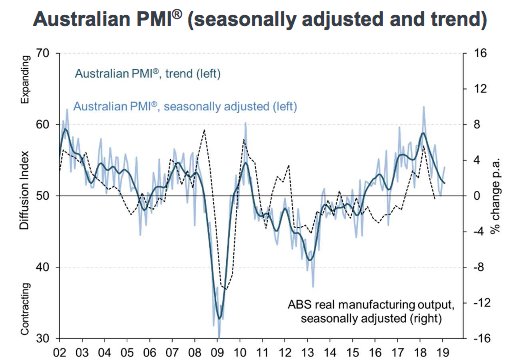

- Australia February AIG manufacturing PMI 54 from 52.5 – better than 52 expected. Trend PMI fell 0.2 to 51.8 with drops in food -0.5 to 54.7, machinery -0.3 to 50.7, paper -0.5 to 51.8, building materials -2.9 to 48 – into contraction – along with metals down 1.6 to 46.5 while chemicals rose 1 to 54.2.

- China February Caixin manufacturing PMI 49.9 from 48.3 – better than 48.7 expected – best in 3-months. New business picked up and output increased – driven by domestic demand as export orders fell. Inventories and purchasing decreased for second month. Business confidence rose but slower than the January 8-month highs.

- India February manufacturing PMI 54.3 from 53.9 – better than 52.5 expected– 14-month highs. Both output and employment accelerate.

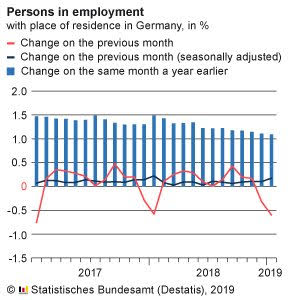

- German January unemployment rate dips to 3.2% from 3.3% - better than 3.3% expected. January employment rose 483,000 y/y up 1.1% to 44.7mn but down 0.6% m/m. February unemployment fell 21,000 after -4,000 – also better than -5,000 expected.

- German January retail sales jump 3.2% m/m, 2.6% y/y after-3.1% m/m, -1.6% y/y revised (prel -4.3% m/m, -2.1% y/y) – better than 2.5% m/m, -0.8% y/y expected.

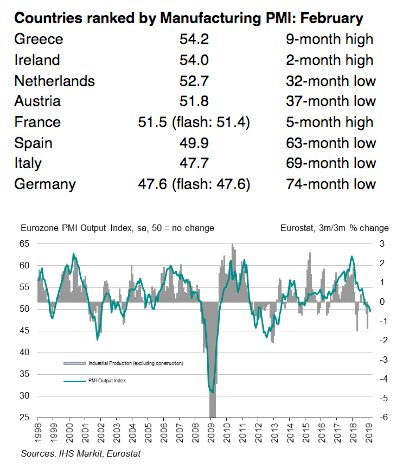

- Eurozone February final manufacturing PMI 49.3 from 50.5 – better than 49.2 flash – still first contraction since June 2013. Both output and new orders fell. Orders are falling at the fastest rate in 7-years and even with output lower, capacity rose. Business confidence dips from January 4-month highs back towards 6-year lows.

- Spanish manufacturing PMI 49.9 from 52.4 – worse than 51.5 expected– first fall in new orders since July 2016, investment goods focus.

- Italian manufacturing PMI 47.7 from 47.8 – better than 47.4 expected– new orders drop at worst rate in 6-years but business confidence at 5-month highs.

- French final manufacturing PMI 51.5 from 51.2 – better than 51.4 flash– first rise in production since Sep 2018, new orders fractionally higher.

- German final manufacturing PMI 47.6 from 49.7 – same as flash– worst in 74 months, output first drop in 6 years.

- UK February manufacturing PMI 52 from revised 52.6 (prel 52.8) as expected. Inventories rise again sharply and job losses jump to 6-year highs as confidence sinks. Brexit uncertainty blamed.

- UK January mortgage approvals jump to 66,770 from 64,470 – better than 63,500 expected. Mortgage lending slowed to GBP 3.66bn from 3.95bn – less than 3.9bn expected. However, the overall consumer credit rose to GBP 1.095bn from 0.683bn – more than the 0.8bn expected.

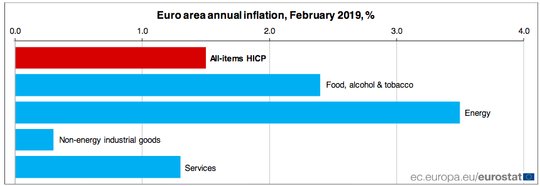

- Eurozone February flash HICP rose to 1.5% y/y from 1.4% y/y – as expected. The core slowed to 1% from 1.1% - less than expected. Energy rose 3.5% from 2.7% y/y, food/alcohol rose 2.4% from 1.8%, services 1.3% from 1.6% and industrial goods were 0.3% y/y unchanged.

- Italy 2018 GDP rose 0.9% y/y after 1.6% y/y (revised from 1.5% y/y) – weaker than 1% government forecast- putting the government budget deficit to GDP at 2.1% from 2.4% - better than 2.6% expected - well below the 3% EU ceiling but worse than the 1.9% government target. Total public debt now 132.1% to GDP from 131.3% – second only to Greece in the EU.

Market Recap:

Equities: The US S&P500 futures are up 0.6% after losing 0.28% yesterday. The Stoxx Europe 600 is up 0.6% after gaining 4.2% in February with focus on trade talks, WPP. The MSCI Asia Pacific rallied 1% with focus on US/China trade hopes.

- Japan Nikkei up 1.02% to 21,602.69

- Korea Kospi closed for holiday.

- Hong Kong Hang Seng up 0.63% to 28,812.17

- China Shanghai Composite up 1.80% to 2,994.01

- Australia ASX up up 0.34% to 6,273.80

- India NSE50 off up 0.66% to 10,863.50.

- UK FTSE so far off up 0.65% to 7,122

- German DAX so far up 1.15% to 11,648

- French CAC40 so far up 0.7% to 5,276

- Italian FTSE so far up 0.5% to 20,765

Fixed Income: The better US data and mixed overnight stories support the softer global bond mood but given equity bid, fixed income is tame – German 10Y Bund yields are flat at 0.19%, French OATs flat at 0.58%, UK Gilts flat at 1.30%. The periphery is mixed with Italy off 1bps to 2.75%, Spain up 2bps to 1.20%, Portugal flat at 1.48% and Greece off 1bps to 3.65%.

- US Bonds are lower with eye on ISM next – 2Y up 1bps to 2.52%, 5Y up 2bps to 2.53%, 10Y up 2bps to 2.73%, 30Y up 1bps to 3.10%

- Japan JGBs lower with equities, but curve kinks – 2Y up 1bps to -0.14%, 5Y up 1bps to -0.15%, 10Y up 1bps to -0.01%, 30Y up 3bps to 0.63%.

- Australian bonds sold in global catch-up trade – 3Y up 5bps to 1.69%, 10Y up 7bps to 2.17%.

- China bonds curve flatten with eye on policy – 2Y up 2bps to 2.75%, 5Y up 2bps to 3.05%, 10Y off 1bps to 3.20%.

Foreign Exchange: The US dollar index rose 0.05% to 96.20 so far. The emerging markets are mostly USD bid as well – EMEA:RUB up 0.25% to 65.792, ZAR off 0.15% to 14.101, TRY off 0.3% to 5.351; ASIA: INR off 0.1% to 70.889, KRW off 0.1% to 1125.40.

- EUR: 1.1385 up 0.15%. Range 1.1353-1.1388 with USD bid holding from yesterday but 1.1350-1.1450 consolidation remains.

- JPY: 111.85 up 0.4%. Range 111.32-111.98 with EUR/JPY 127.30 up 0.5%. Testing 112 resistance with 112.40 behind it – all about risk-on.

- GBP: 1.3140 off 0.15%. Range 1.3219-1.3267 with EUR/GBP .8595 up 0.25%. Brexit hopes vs. economic reality – all about 1.3050-1.3350 consolidation.

- AUD: .7115 up 0.3% Range .7084-.7120 with NZD .6835 up 0.4% - better overnight with commodities – still watching .7050 and .6920.

- CAD: 1.3135 off 0.25%. Range 1.3130-1.3176 – watching 1.3050 and waiting for data.

- CHF: .9980 flat. Range .9970-1.0009 with EUR/CHF 1.1360 up 0.15%. Risk-on and safe-haven’s off with 1.00 pivot for 1.0080 next.

- CNY: 6.7040 up 0.2%. Range 6.6910-6.7090 with USD bid on catch up from data.

Commodities: Oil up, Gold down, Copper up 0.65% to $2.9695.

- Oil: $57.39 up 0.3%. Range $57.15-$57.88 with $58 key on day – bid to equities and global growth hopes driving. Brent up 0.2% to $66.43.

- Gold: $1310 off 0.45%. Range $1307.30-$1316.50 – revenge of USD but $1305 holding with focus on $1298 behind that. Silver off 0.35% to $15.58. Platinum off 0.8% to $868.20 and Palladium off 0.8% to $1489.70.

Economic Calendar:

- 0830 am Canada 4Q GDP (q/q) 0.5%p 0.4%e (y/y) 2%p 1.3%e

- 0830 am US Dec personal income (m/m) 0.2%p 0.3%e / spending 0.4%p -0.2%e / core PCE 1.9%p 1.9%e

- 0930 am Canada Feb manufacturing PMI 53p 52e

- 0945 am US Feb final manufacturing PMI 54.9p 53.7e

- 1000 am US Feb ISM manufacturing 56.6p 55.9e

- 1000 am US Feb final Michigan consumer sentiment 91.2p 95.6e

- 1250 pm Atlanta Fed Bostic speech

- 0300 pm US Feb total vehicle sales 16.7m p 16.8m e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.