Light Selling

We are not seeing a whole lot from either side of the market, just a mixed sequence of low key buying and selling which so far has edged in bulls favor, but there would be no give aways on the daily reporting - only by looking at the weekly charts would you see the benefits of this action.

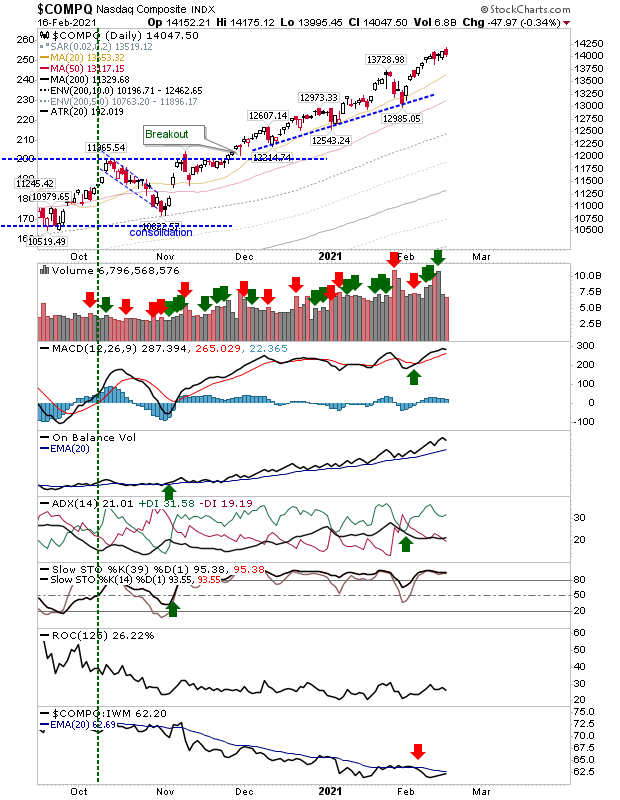

For the Nasdaq we are seeing is a general drop in trading volume after a steady build up since early November. Whether this is a sign of things to come remains to be seen. The index is slowly building towards a period of potential relative outperformance, which should help it attract buyers. Other technicals are net bullish with On-Balance-Volume going particularly well despite the recent drop in trading volume.

The S&P has been more modest in its trading volume, although there has been a steady drop off since the start of February, with volume spikes in the past week running in bears favor. However, it too it lining up for a potential outperformance relative to the Russell 2000.

The Russell 2000 has edged in favor of distribution over the last four days. Today's action played out as a bearish engulfing pattern, although rising support was not breached. Technicals are seeing a little weakness with On-Balance-Volume on the verge of a new 'sell' trigger, but otherwise the technical picture remains okay.

Indices continue to rise in what looks to be complacent buying. The lack of any meaningful consolidation since last Autumn means there are likely a number of weak hands ready to jump ship if sellers are able to mount a series of 1%+ loss days. But until then, things keep moving higher in small steps.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis ...

more