Let’s Stop With The Lack Of Participation Argument…

There’s not a day that goes by when I don’t hear someone talking about how this market is being led, or held up, by only a handful of stocks. Normally I wouldn’t care, but the inference is usually followed by some sort of doomsday prediction. We all know that bear markets are a natural part of the investment cycle. They aren’t fun in the midst, but from time to time they are necessary for a variety of reasons.

One can continue to predict market crashes, and eventually they will be right. But this does no good for anyone. The S&P 500 was trading around 1,000 when the end of the world crash callers (due to Fed policy, Europe disaster, etc.) were out in full force. The S&P 500 is now trading at almost 3,000. Meaning a 70% crash would be needed, just to get back to those levels. You see, this is no way to invest successfully. Rather, this leads the novice investor to make bad decisions. So, I’m going to do my best to break down, and then debunk this “lack of participation” argument.

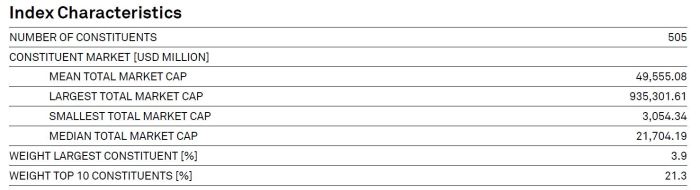

Let’s begin by understanding how the S&P 500 index works. It’s a “market cap” weighted index. So, the companies with the largest market cap are the ones that are weighted the highest in the index. Market cap is computed by multiplying shares outstanding by the price per share. As a companies stock price increases, it’s weight in the S&P 500 will also increase. Therefore the index is dynamic by nature.

So there is a “smidge” of truth in this argument. Yes, the companies with the highest market cap will account for a higher percentage of the index’s returns. This has always been the case, and will always be the case in the future, as long as the index remains market cap weighted.

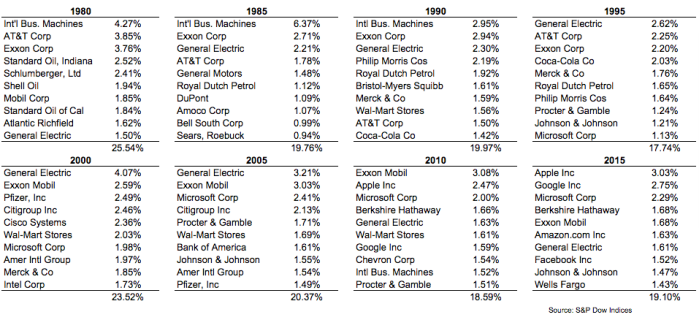

Today we find the largest companies in the S&P 500 are mostly tech companies. But that has changed numerous times in the past. And will continue in the future. Below is a list of the 10 largest companies every five years since 1980.

However, the problem arises when the argument then implies that these top companies are the ONLY stocks participating in the rally. As if the only stocks that are rising are the FANG’s (Minus FB recently) of the world. As you’ll see. This couldn’t be further from the truth.

Here is a chart of the New York Stock Exchange Advance Decline line. This exchange covers just about every investable US stock. The index has far surpassed its January highs, even though the S&P 500 has only slightly breached its January high and the Dow still trades about 2% below its. This index has no weighting scheme, every stock is as important as the other. Broad participation. If it were only a handful of stocks, this index would be going down, not up.

Here is the S&P 500 equal-weighted index. Which also weights every stock exactly the same. Here too, we see the index making new highs. If it were just a few stocks, this wouldn’t be the case.

Here is a chart of the US small cap and US mid cap stock index. Again, both index’s are well above their January highs, even outperforming the S&P 500 year to date. Broad participation.

The technology, consumer discretionary, energy, and healthcare sectors have all taken out their January highs as well.

This market is not being held up by a handful of stocks. Yes, the largest companies account for a bigger percentage of the total return. But this is an entirely different argument.

According to S&P IQ, the top 10 companies currently account for 21.3% of the S&P 500 index. All things being equal, even if the top ten companies stock prices were going down, the market could hypothetically advance, as long as most of the rest of the companies in the index were increasing.

In fact, we’ve seen numerous examples of this. Apple fell 30% twice during this bull market. Amazon has seen numerous 20-30% declines, Facebook just lost 20% in one day, Microsoft went nowhere for about a decade, the list goes on. All the while the index continued to advance higher. This argument is another example of “paralysis by over-analysis”.

So, we’ve established that the largest companies in the index will make up a larger weight in the calculation of returns. Much like if your finals make up 25% of your final grade, those finals will be the largest contributor to your final grade. But that doesn’t mean your homework and other assignments are meaningless. And it doesn’t mean you didn’t do well on those other assignments either. This should be a pretty straight-forward point. It’s amazing to me that it’s gotten this much attention.

I hope this helps clear things up a bit.

Disclosure: None.

Nothing on this article should be misconstrued as investment advice. Trading and investing is very risky, please consult your investment advisor before making any ...

more