Let's Call It Constructive

The fact that stocks pulled back a bit last week shouldn't have come as a surprise to anyone. The S&P 500 had enjoyed an historic joyride to the upside in a very short period of time. As in +19.2% in just 10 weeks.

Along the way, stocks became overbought and sentiment got a little too optimistic. Everybody could recite the bull narrative... The Fed is now on hold (and perhaps even thinking about returning to an accommodative stance later this year) and the Trump trade deal will fix the global #GrowthSlowing woes.

So, with key resistance overhead and some disappointment on the news front, it wasn't exactly a shock to see a break in the action.

Speaking of the news, there were five headlines that caught my eye last week and, at least in my opinion, might have contributed to the red bars on the charts.

But first, we need to set the stage. Coming into last week, it was clear that momentum had slowed. The S&P had spent the prior week moving sideways and flirting with a breakout of the key resistance zone in the 2815 area. And since the bulls had been able to break on through to the other side of the all-important 200-day moving average the week before that, it seemed it was only a matter of time until the bulls would be testing the old highs again.

At the beginning of last week, there was an awful lot of talk about a "Goldilocks economy" here in the good 'ol USofA. As in the economy wasn't too hot (to cause inflation and the Fed to get back to work), wasn't too cold (to cause a recession) but was "just right" (for corporate profits to grow at a strong enough rate for stocks to continue to rise at 8-10% per year). Party on, Wayne!

But a funny thing happened on the way to the run for the border. That's right; it didn't happen. Nope. Instead, the #GrowthSlowing theme may have gained some traction.

First, there was the ECB "pivot." This time it was Mario Draghi's turn to surprise investors as the ECB acknowledged the slowdown in economic activity by cutting the central bank's forecast for growth in the Eurozone in 2019 from 1.7% to 1.1% and by offering up a new cheap loan program designed to encourage lending.

Next, there was talk of "peak employment." Mark Zandi, Chief Economist at Moody's Analytics, provided us with this sound bite, which reminded everyone that the economic cycle is clearly getting a little long in the tooth.

We also heard from the Fed's Lael Brainard, who acknowledged that slowing growth has caused a major change in her outlook.

And when it came time to revel in the economy's robust jobs market, the bulls bonked. While analysts had expected the monthly report on Nonfarm Payrolls to show a gain of 180,000, the Bureau of Labor said the economy created just 20,000 jobs last month. Ouch.

Sure, there were lots of "yea, buts" to go along with the jobs report and my guess is that the numbers will likely be revised higher. But the bottom line is that 20K vs. 180K was a pretty big miss and effectively put a spotlight on the idea that growth might indeed be slowing - even here in the U.S.

Oh, and as for the imminent trade deal, you know, the deal that is expected to return the world's economies to growth and prosperity, that didn't happen either.

So, stocks did what one might have expected them to do. They pulled back a bit. And so far at least, the decline in the stock indices has been orderly as a fair amount of intraday dip-buying was on display last week. Friday was a perfect example of said action as the S&P closed almost 1% off the low of the day.

From my seat, the action thus far has been "constructive" and is more indicative of a pause than the start of a meaningful decline. My guess is this is the dip that many had been praying for a few weeks ago. As such, it will be interesting to see if the bears have anything left in the tank next week or if the underinvested souls that have missed out on the best start to a new year in ages continue to #BTD.

Weekly Market Model Review

Now let's turn to the weekly review of my favorite indicators and market models...

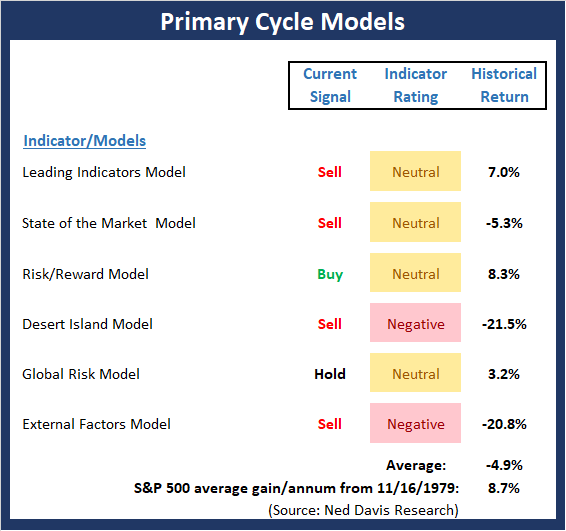

The State of the Big-Picture Market Models

I like to start each week with a review of the state of my favorite big-picture market models, which are designed to help me determine which team is in control of the primary trend.

View My Favorite Market Models Online

The Bottom Line:

- The good news is there was some modest improvement in the "Primary Cycle" board again this week. However, as I've been saying, the overall "state" of the board suggests that everything may not be as rosy as the recent joyride to the upside (to the tune of 20% from the Xmas Eve low) might suggest. And given the fact that #GrowthSlowing was recognized by the ECB this week, the market may be in for a "reality check."

This week's mean percentage score of my 6 favorite models improved to 47.9% from 45.4% last week (Last 2,3,& 4 weeks: 40.3%, 44.2%, 48.9%) while the median upticked again to 50.0% from 46.3% last week (Last 2,3,& 4 weeks: 42.5%, 40%,46.7%).

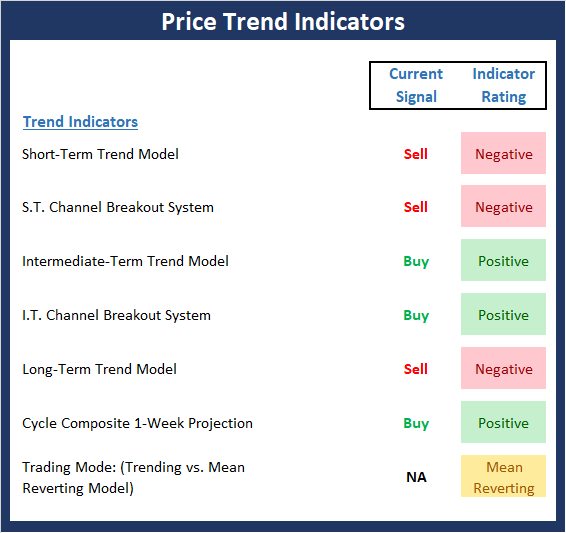

The State of the Trend

Once I've reviewed the big picture, I then turn to the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

View Trend Indicator Board Online

The Bottom Line:

- Given the recent overbought condition, it was not surprising to see the indices pull back a bit last week. Many might even label the move as being "long overdue." So far at least, the move has been orderly. And despite the S&P's break below its 200-day, the type of extreme volatility we saw in December has not been evident.

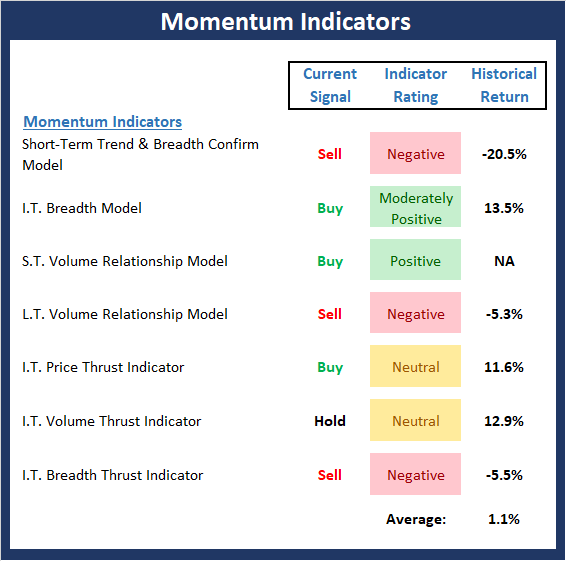

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

View Momentum Indicator Board Online

The Bottom Line:

- The Momentum board definitely took a hit this week as 3 new sell signals flashed this week. As such, we need to recognize that the recent strong momentum has clearly waned. But this is to be expected during pullbacks. And as we've been saying, the extremely strong readings seen in the momentum arena suggest that this remains a buy-the-dip environment.

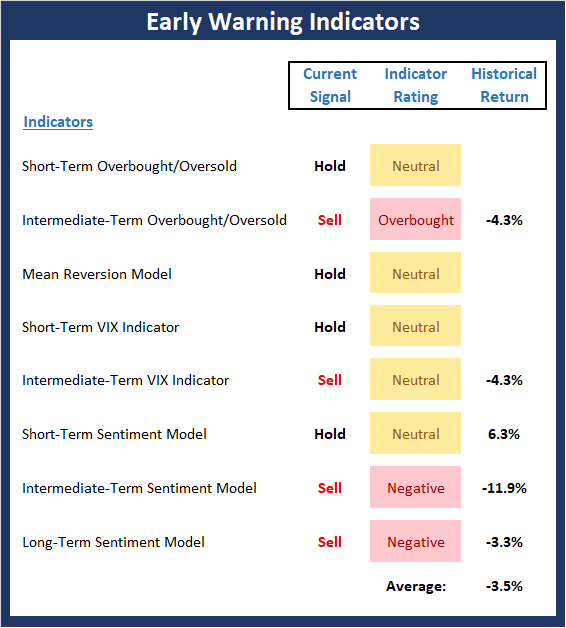

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

View Early Warning Indicator Board Online

The Bottom Line:

- The Early Warning board did a nice job warning us that the table had been set for the bears. As such last week's pullback should not have come as a surprise. And as we've been saying, the fact that the trend and momentum boards had been so strong recently, the argument can be made that any near-term downside should be short and shallow.

The State of the Macro Picture

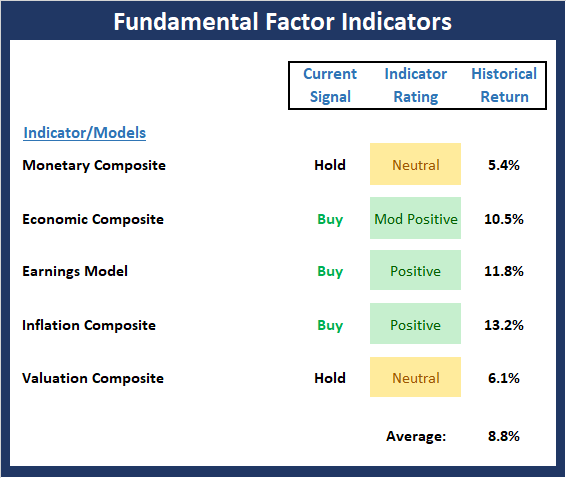

Now let's move on to the market's fundamental factors - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

View Fundamental Indicator Board Online

The Bottom Line:

- What I wrote last week bears repeating here:

"While the Fundamental Factors board suggests the backdrop for equities remains constructive, it is worth noting that some of our economic models have slipped recently. For example our model designed to predict economic growth fell into the "moderate growth" mode and our model using the index of Coincident Economic Indicators produced a sell signal. So, while the bulls should be given the benefit of any doubt from near-term perspective, we need to recognize that the #GrowthSlowing theme is real."

The bottom line is that from my seat, other than a trade deal crumbling, #GrowthSlowing presents the biggest risk to the bull case going forward. P.S. No trade deal would put more pressure - perhaps a lot more pressure - on the growth outlook for global growth and in turn, earnings.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more