Lethal Levels Of Financial Leverage Are Highly Contagious

As I discussed last week in Ponzi Markets Unravelling Once More, global asset markets have never been more over-valued, leveraged, and interconnected in our lifetimes. This presents a massive instability risk for all of us, whether we appreciate it or not.

This is why insolvency in one major company (Evergrande) or sector (like Chinese realty) can quickly morph into a cash crunch and panic selling in global risk markets all at once.

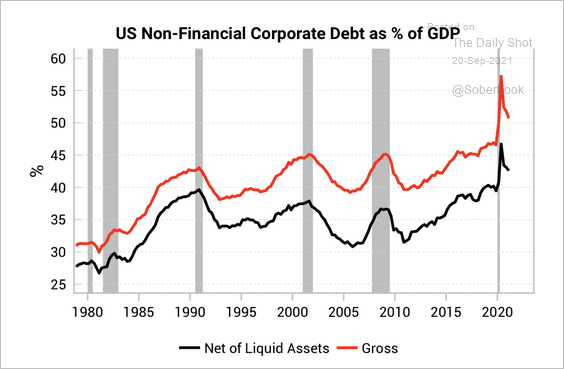

As shown below, since 1978, the corporate sector has never been more indebted (less resilient to negative shocks) as a percentage of economic output (GDP).

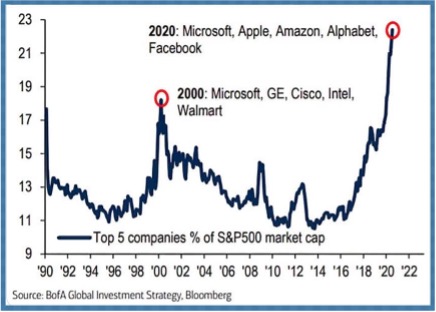

The much-chased equity indices have never been so heavily concentrated in a handful of stocks. As shown below, since 1990, the top 5 most expensive companies make up a 23% weight of the S&P 500 today versus 18% before the 2000 tech bubble top imploded.

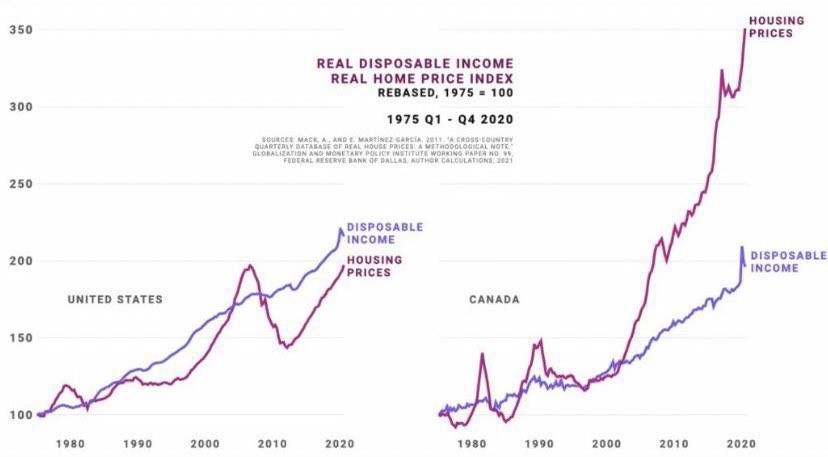

At the same time, homes have risen out of reach for many people worldwide as prices riped to record highs and affordability ratios have disintegrated. See Global Housing Market is Broken, and it’s dividing entire countries.

As shown on the lower right, the extent to which Canadian home prices have outpaced disposable income is infamous and drastically worse than before the US housing bubble collapsed in 2006.

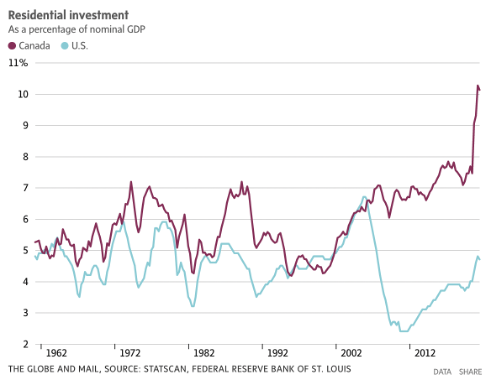

This is especially ominous since Canada’s economy has become dependent on heavily indebted, unsustainable property markets.

As shown below, since 1960, Canadian residential investment (ownership transfer costs, new construction, and renovations) account for 10% of our recent nominal GDP growth (in red)– more than double the equivalent rate in the United States.

All of this means that all those holding index-tracking funds, ETFs, and managed portfolios of corporate debt, equities, and real estate are much less diversified and stable than understood.

Years of destructive policies and behaviors have set us up for financial contagion for the history books. Central banks can make it worse, but they can’t fix this. Lower prices and debt write-downs are the solutions. Getting there will be painful.

Disclosure: None.