|

No market-related story has grabbed the headlines in early 2021 like the attempt by a group of unsophisticated retail traders/investors to execute a short squeeze on Gamestop (GME). The attempt, to no surprise to the readers of our weekly comments, ended in tears. The stock soared and then quickly crashed, leaving many small investors who purchased shares on margin with losses they could ill afford. This type of activity, thought to have ended with the demise of “bucket shops,” has reared its head again with the use of social media platforms such as Reddit to manipulate the passions of the naïve.

As investors, we should be ready to take lessons wherever they are offered, and I believe that GameStop offers a few.

To me, the most conspicuous reminder offered by GameStop is the danger in allowing ourselves to be emotionally swept up by the prospect of “quick money.” Associated with this is the danger of being influenced by “group think” such as is found on sites like Reddit and in many quarters of the internet and media. It is critical for us to monitor our emotional state when trading/investing so that we can be aware when we’re feeling over-confident, fearful, greedy, etc. It is at those times of heightened emotions that we should step back and defer trading until we can resume investing dispassionately.

Along with allowing themselves to make financial decisions in a highly emotional state, the GameStop crowd was also operating with a lack of knowledge. They have been referred to as “low information” investors, which is a charitable description! They had little or no knowledge of GameStop as a business, short-selling, or the basics of investing. While the GameStop people are an extreme example, they should serve as a reminder of the importance of knowledge. Successful investing is very difficult. There is such a thing as “beginners’ luck,” but the process of generating strong returns, and moderating risk, requires experience and a practice of constant learning. I have written before that I believe reading widely is the first attribute of a successful investor.

These reminders of what not to do provided by the admittedly extreme GameStop example will make, and save, all of us a considerable amount of money in the years ahead provided we keep them in mind.

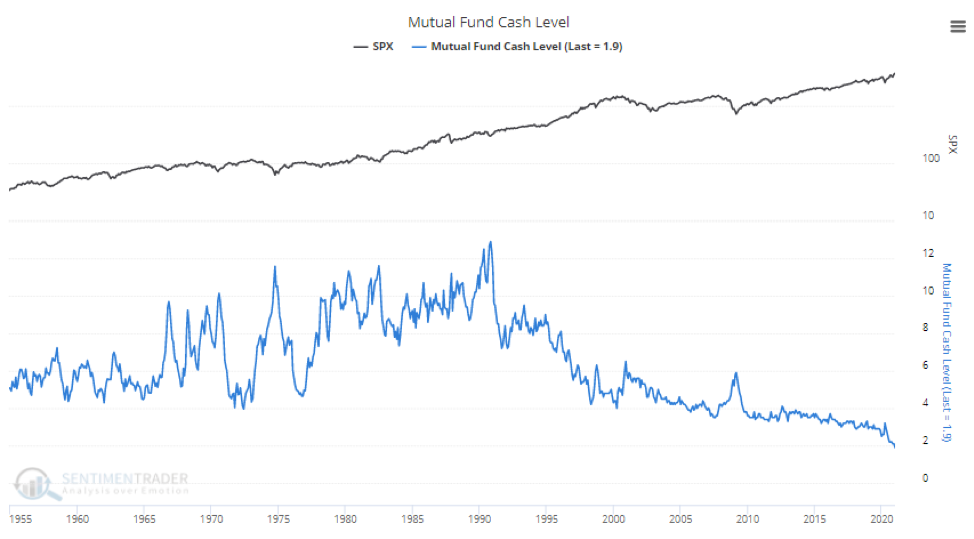

This week we leave you with another chart that depicts the extreme bullish sentiment that pervades global markets.

|