Less-Hawkish Fed Forward Guidance To Fuel EUR/USD Appreciation

The Federal Reserve interest rate decision is likely to shake up the near-term outlook for the U.S. dollar as the central bank is widely expected to increase the benchmark interest rate to a fresh threshold of 2.25% to 2.50%.

(Click on image to enlarge)

Keep in mind, market participants may put increased emphasis on the Summary of Economic Projections (SEP) ahead of 2019 as Fed officials show a greater willingness to tolerate above-target inflation over the policy horizon, and a downward revision in the interest-rate dot-plot is likely to fuel the recent appreciation in EUR/USD as the central bank appears to be approaching the end of the hiking cycle.

However, ongoing projections for a neutral fed fund rate of 2.75% to 3.00% would indicate Chairman Jerome Powell & Co. will continue to normalize monetary policy over the coming months despite the recent remarks from the Trump Administration, and a hawkish forward-guidance may ultimately drag on EUR/USD especially as the European Central Bank (ECB) remains in no rush to move away from its zero-interest rate policy (ZIRP).

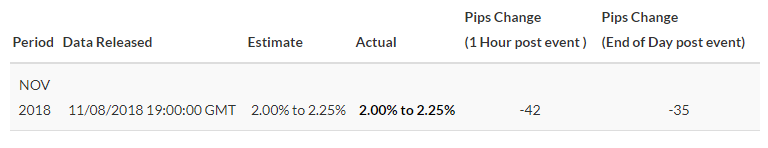

IMPACT THAT THE FOMC RATE DECISION HAS HAD ON EUR/USD DURING THE LAST MEETING

(Click on image to enlarge)

November 2018 Federal Open Market Committee (FOMC) Interest Rate Decision

EUR/USD 5-Minute Chart

(Click on image to enlarge)

As expected, the Federal Open Market Committee (FOMC) moved to the sidelines in November, with the central bank keeping the benchmark interest rate at its current threshold of 2.00% to 2.25%. Nevertheless, the policy statement suggests Chairman Powell & Co. will continue to normalize monetary policy over the coming months as ‘the Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term.’

The U.S. dollar gained ground following the hawkish forward-guidance for monetary policy, with EUR/USD struggling to hold above the 1.1400 handle as it closed the day at 1.1363.

EUR/USD DAILY CHART

(Click on image to enlarge)

- The near-term outlook for EUR/USD remains uneventful as the exchange rate continues to track the previous month’s range, with the failed attempt to test the November-high (1.1500) casting a bearish outlook especially as the Relative Strength Index (RSI) continues to track the downward trend from earlier this year.

- Need a break/close below 1.1290 (61.8% expansion) to open up the near-term support zone around 1.1220 (78.6% retracement), which coincides with the yearly-low (1.1216).

- However, the recent series of higher highs & lows raises the risk for another run at the November-high (1.1500), with the next area of interest coming in around 1.1640 (23.6% expansion) to 1.1680 (50% retracement) followed by the 1.1810 (61.8% retracement) region, which largely lines up with the September-high (1.1815).

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more