Leading Indicators Signal Slowdown Will Continue

The most important aspect of the economy is inflation because low inflation allowed the Fed to turn dovish which helped reverse last year’s bear market. If the Fed would have set guidance for 3 hikes in 2019, stocks may not have recovered, and the yield curve may have inverted. The great news for the economy is the Phillips curve is broken. To be clear, the Phillips curve says low unemployment drives high inflation. Low unemployment has helped wage growth, but wage growth hasn’t driven inflation. One of the biggest impacts to core inflation has been YoY comparisons of previous periods as the rate of change hasn’t been able to stay above 2% for any sustained period in this expansion.

The next big inflation report is PCE which comes out on March 1st. If inflation spikes, the Fed will need to hike rates again which might not be handled well by stocks and the economy because it is still in a slowdown. There are some green shoots in the housing market (falling interest rates & strong wage growth) which can lead to a strong spring selling season. While that could boost GDP growth, house price growth will generate more inflation. It’s a double-edged sword. While the housing slowdown hurt the economy in 2018, the modest decline in price growth helped limit inflation.

Commodity prices impact inflation. We like to see a strong demand for commodities because it means the economy is growing, but too much of a good thing increases inflation. Even though the global economy is in a slowdown, commodities have been rallying along with stocks in 2019. As you can see from the chart below, the CRB commodity index is up 8.02% year to date.

Keep an eye on rising commodity prices. It could put the #Fed back in play for a rate hike. $CRB pic.twitter.com/fRyZCjn5Va

— The Earnings Scout (@EarningsScout) February 22, 2019

It’s still down 11.13% from its 2018 high. The more it increases, the more likely the Fed is to raise rates. The Fed had an easy decision to turn dovish at the end of December because inflation was slow and growth was falling. It could have a tough decision if growth falls in the next few months, while inflation rises.

Both Leading Indicators Weaken

The Conference Board Leading Economic Index and the ECRI weekly leading index both signal the economy will keep slowing in the next few months. The Conference Board leading index was down 0.1% monthly in January which missed estimates for 0.1% growth and no growth in December. The index is 0.3% off its record. From the late 1960s until today, the range of peaks before recessions has been between 7 months and 20 months, meaning a recession is at least a few months away.

Keep in mind that the growth rate needs to fall much further to indicate a recession as the weakest recession since the late 1960s had a decline of over 6% from the top. It’s notable that this leading index was without 3 economic reports because of the government shutdown (manufacturers’ new orders for consumer goods and materials, manufacturers’ new orders for nondefense capital goods excluding aircraft, and building permits).

The Conference Board used statistical imputations to fill in the missing data. While the economy is far from a recession, it’s worth noting that the 6-month moving average of the 6-month change is only up 1.8%. Once it falls below zero, the next recession historically has been anywhere from 2 months to 15 months away, although there have been some false signals.

The chart below shows the ECRI leading index agrees as it is down -4.7% year over year after peaking at -4% two weeks ago.

ECRI U.S. Weekly Leading Index growth rate edged down to -4.7%. Read more and download ECRI WLI data for free here: https://t.co/4jdhI5tDJ2 pic.twitter.com/cvkndDFdzN

— Lakshman Achuthan (@businesscycle) February 22, 2019

That growth decline has occurred with easier comparisons. Getting below the recent low of -6.5% is near the danger zone because the period leading up to the 2001 recession only had slightly worse year over year growth. Somewhere around -10% yearly growth would be a recession warning.

Manufacturing Weakness

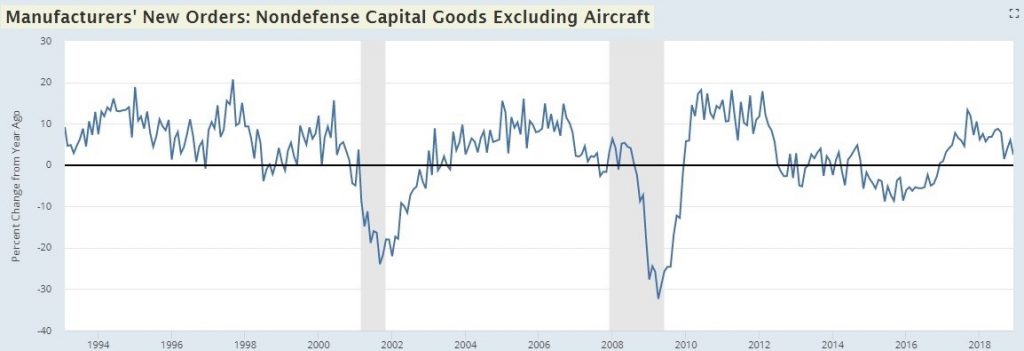

Recently we have gotten a slew of weak manufacturing reports. The durable goods orders from December had strong headline growth because of the boost in aircraft orders, but the underlying business investment was weak. Specifically, new orders were up 1.2% monthly because aircraft orders were up 50%. Vehicle orders were also strong at 2.1% growth. However, core capital goods orders were down 0.7% monthly which is a sharp decline considering they fell 1% monthly in November. There were significant declines in machinery, computers, and communications orders for the 2nd straight month. The chart below shows core capital goods orders were only up 2.5% year over year.

(Click on image to enlarge)

The flash Markit February PMI reading was great because services were strong, and manufacturing was weak. This is a reversal from the January reading. Services are much larger than manufacturing. The Composite PMI was 55.8 which was an 8th month high. It was up from 54.4. The Services index increased from 54.2 to 56.2 which was also an 8 month high. The manufacturing PMI fell from 54.9 to 53.7 which was a 17 month low. It always made sense for manufacturing to be weaker than services because manufacturing is more internationally focused, and the global economy is weak. Services should be helped by the strong labor market. This Markit PMI is consistent with 2.5% GDP growth.

The February Philly Fed manufacturing reading was a disaster. The index fell from 17 to -4.1 as you can see in the chart below.

For a city that booed Santa, this month's Philly Fed report can't be sitting well. https://t.co/896aiGnZKF pic.twitter.com/vL58xAempl

— Bespoke (@bespokeinvest) February 21, 2019

The consensus was for 14. This is the first negative reading since May 2016. The new orders index was down from 21.3 to -2.4. The shipments index fell from 11.4 to -5.3. The only good news is the 6 month expectations index was steady as the index increased from 31.2 to 31.3. Future capex increased from 31.6 to 31.7.

German Economy Strong?

Bearish investors think Germany is about to go into a recession, but in Q4 German real private fixed investment growth was 5.1% and private consumption was up 2.6%. Q4 GDP growth was 1.4%. The chart below breaks down the solid GDP report.

🇩🇪 German details of Q4 GDP growth provided interesting insights on the German economy. Notably, the temporary problems in the car industry masks solid fundamentals... pic.twitter.com/6ncmenUAan

— Nadia Gharbi (@nghrbi) February 22, 2019

Consumer expenditures, government consumption, investment, and net exports all had a sequential increase in their quarterly contribution to growth. This report was ruined by temporary problems in the car industry as the change in stocks had a big negative impact on GDP growth after having a very positive impact in Q3.

Conclusion

The bad news is inflation could increase because of the spike in commodities prices and both leading indicators signal economic growth will weaken further. We aren’t near a recession yet, but rate hikes could change that. The other bad news is the manufacturing sector is weak as core durable goods orders were weak, the manufacturing Markit PMI was weak, and the Philly Fed manufacturing reading was weak. The goods news is the services Markit PMI was strong and the German economy had strong underlying growth in Q4.

Disclaimer: Please familiarize yourself with our full disclaimer here.