Largest Junk Bond Since 2017 Set To Price As Investors Flood Back In (With One Exception)

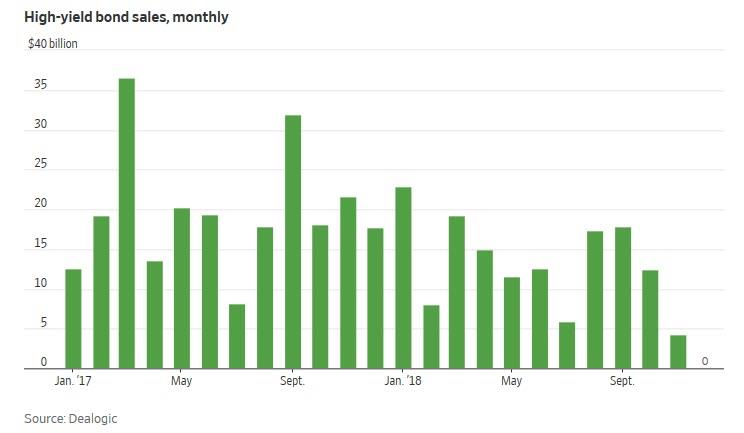

After a 40 day hiatus in December and part of January when not a single high yield bond was sold due to "market conditions", the longest such stretch since 2008...

... the junk bond market is on fire again, with CommScope Holding in the market with the largest U.S. high-yield bond sale in more than a year, the latest sign that the recent rebound in prices is enticing more issuers.

The wireless network provider, through its CommScope Finance LLC unit, is set to borrow $3 billion to help fund its acquisition of Arris International, according to a filing Monday, Bloomberg reports. The proceeds of three series of notes, which are expected to price next week, follow a $3.869 billion term loan offering last week to help back the $7.4 billion deal.

According to Bloomberg, at $3 billion, this would be the largest junk bond sale since Avantor’s $3.5 billion offering in Sept. 2017. It’s the latest example of a thawing junk-debt market, where collapsing spreads and plunging yields have led to a flood of issuance in both junk and IG, after weeks of hiatus.

As shown in the chart above, high-yield spreads have narrowed 100 basis points since the start of the year as issuance-starved investors came out in force for new supply and risk sentiment soared, thanks to the recent sharp rebound in stocks ever since Steven Mnuchin summoned the plunge protection team.

Courtesy of Bloomberg, here are some other deals in the junk-bond and leveraged-loan markets this week:

- Colfax Corp. is in the market with another large deal at $1 billion for its acquisition of DJO Global Inc. from Blackstone

- Dun & Bradstreet’s $1.35 billion sale is expected to price later this week, in what would be the first CCC rated offering since November. It’s also borrowing $2.63 billion in term loans for acquisition purposes

- Studio City is expected to price a $425 million bond offering to help fund a tender offer

- In leveraged loans, BrightSpring Health and PF Chang’s are holding lender meetings Monday

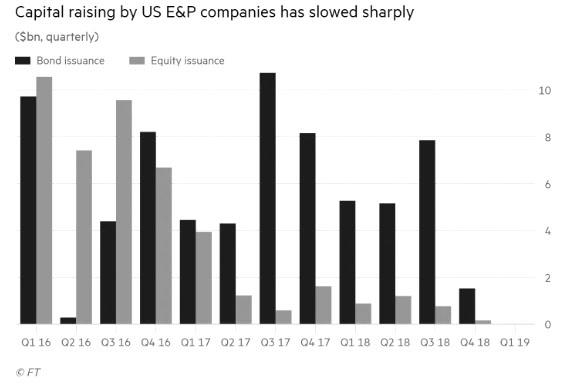

And yet, not every corner of the junk bond market is enjoying the recent renaissance. As we reported late last week, capital raising by mostly-junk rated US oil exploration and production companies remains frozen after falling sharply following the decline in crude prices that began last October, pointing to cutbacks in capital spending budgets and a continuing slowdown in activity.

As the FT reported recently, companies in the sector have not held a single bond sale since the start of November, according to Dealogic, while share sales have also slowed. The data suggest that after a record-breaking boom in US oil output in 2018, growth will be weaker this year.

Ken Monaghan, co-head of high yield at fund manager Amundi Pioneer said the rise in exploration and production companies’ debt yields had put off potential borrowers, with spreads over US Treasury bonds climbing from 3.9 to 7.5% at their peak before settling back to about 5.9% this year.

“No one wanted to issue debt unless they had to,” Mr Monaghan said. “At the peak, they would have been looking at yields of about 10.25 per cent. That’s awfully expensive."

Speaking on a panel at the World Economic Forum in Davos on Wednesday, Vicki Hollub, Occidental Petroleum’s chief executive, said US shale oil companies were being forced to react to an investor push for more spending discipline. “Not as much money is going to be pouring into the Permian basin,” she said.

Still, should the market fail to retest recent lows in the near-term, investor demand for yield of any kind will mean that such trivial considerations as deteriorating E&P fundamentals won't be able to hold back the investing horde for too long, and it's only a matter of time before investors storm back to take advantage of the surging HY spread between Energy names and the broader corporate sector.

Then again, should junk E&P names fail to regain market access, it will soon turn very ugly for the shale patch.

Speaking on a panel at the World Economic Forum in Davos last Wednesday, Vicki Hollub, Occidental Petroleum’s chief executive, said US shale oil companies were being forced to react to an investor push for more spending discipline. “Not as much money is going to be pouring into the Permian basin,” she said, suggesting that all else equal, and should oil prices fail to rise from current levels, the US oil production miracle will soon go into reverse.