Large Cap Best And Worst Report - September 16, 2014

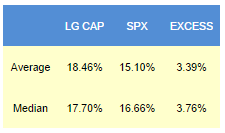

Since 2010, the top scoring stocks in our weekly large cap report have returned an average 339 bps of excess to the SPX in the following year. The best performers from our list one year ago are RCL, up 71%, LEA up 45%, CLR up 44%, and YHOO up 43%.

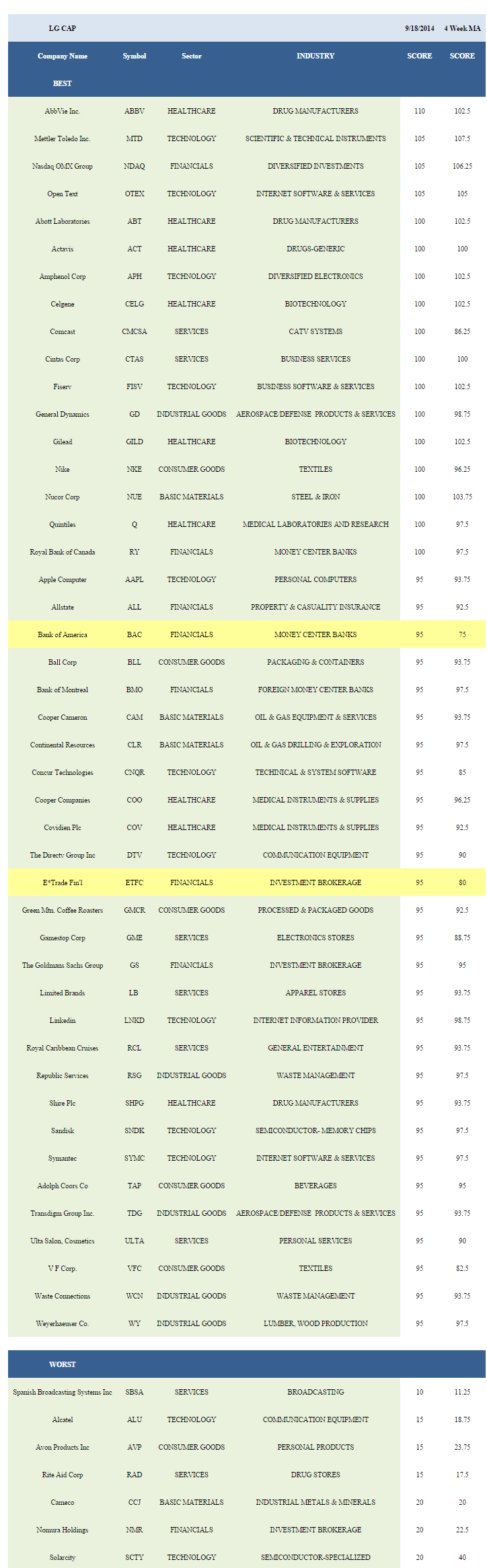

- Healthcare is the top scoring large cap sector.

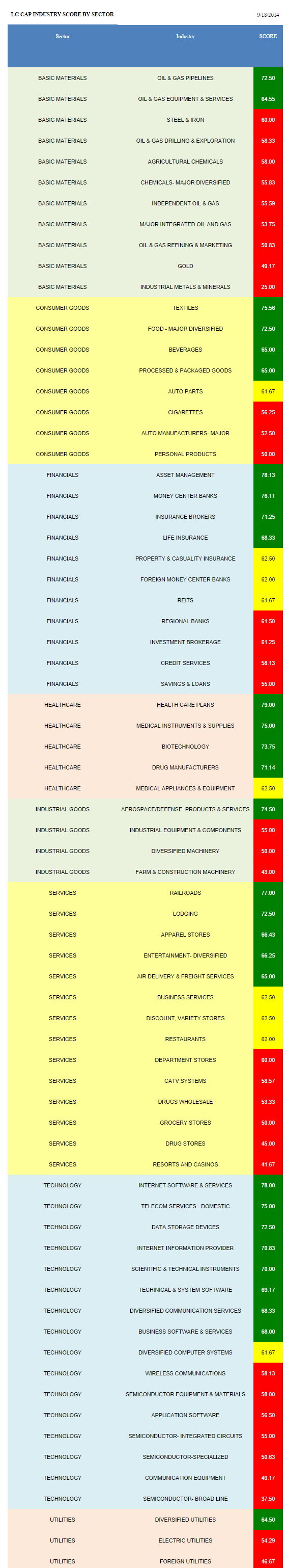

- The best industry is healthcare plans.

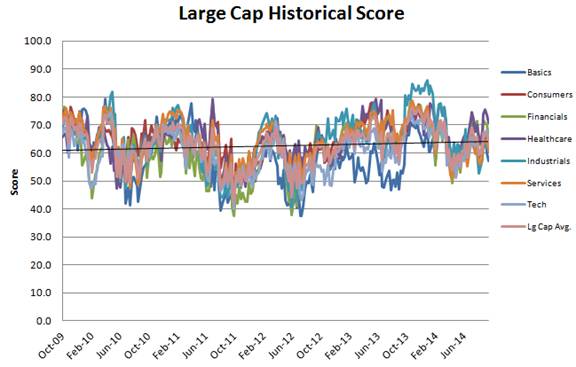

The average large cap score is 62.53 this week, below the four week moving average score of 65.85. The average large cap stock is trading -9.85% below its 52 week high, 2.33% above its 200 dma, has 4.49 days to cover held short, and is expected to post EPS growth of 13.36% next year.

Healthcare is the best scoring large cap sector. Financials also score above average. Technology and consumer goods score in line. Services, industrial goods, utilities, and basic materials score below average.

sdaa.png)

.png)

Healthcare plans (HUM, AET, UNH) are the best scoring large cap industry this week. Medicaid expansion continues to offer upside. Price adjustments and improving member mix support results following the second open enrollment, which begins in November. Asset manager (PFG, IVZ, BLK, AMP) fee revenue growth is being driven by allocations away from fixed income to higher fee risk products and by rising AUM tied to market returns. Internet software (OTEX, SYMC, VRSN, FFIV, RAX) benefits from increased demand for security software post heartbleed and ongoing demand for business intelligence solutions. Rail (CSX, CP, NSC) volume growth continues to support carload rates with railcar volume up 3.5% last week and up 4.5% year-to-date versus last year. As expected, we're seeing improving scores for banking (RY, BAC, BK, WFC), which we expect will continue -- on balance -- for the remainder of the year. Loan growth continues to trump net interest margin worries.

In large cap basics, buy oil & gas pipelines (WMB) on capacity growth and oil & gas equipment & services (CAM, WFT, NOV) on rig activity upside. In consumer goods, textiles (NKE, VFC, UA) benefit ahead of holiday shopping season. Major food (MDLZ) and beverages (TAP, DPS, STZ) also score highly. Asset managers, money center banks, and insurance brokers (MMC, AON) score best across financials. Insurance demand for niche life, health, and accident policies is rebounding alongside economic growth. The best healthcare industries are healthcare plans, medical instruments (COV, COO, CFN), and biotechnology (GILD, CELG, AMGN, REGN, MDVN, JAZZ). Biotech offers solid seasonality through the end of the year, suggesting that market weakness should be viewed as a buy opportunity. Only aerospace/defense (GD, TDG, NOC, LMT) score above average in industrial goods as unrest supports DoD budgets and available financing supports commercial airline order and production growth. The best services groups are rails, lodging (H, MAR), and apparel stores (LB, URBN). Retailers typically see headwinds ease from here and offer opportunity through the Q4 EPS reporting season. The top technology industries are Internet software, domestic telecom (CTL, T, VZ), and data storage (EMC, NTAP, WDC).

Disclosure: None.