Large Cap Best & Worst Report - April 19, 2016

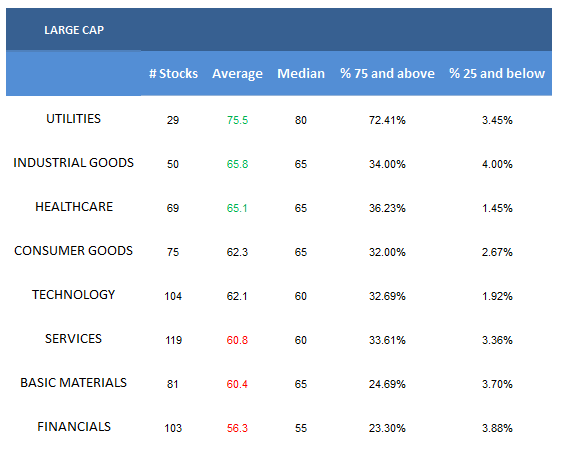

- The best large cap sectors are utilities, industrial goods, and healthcare.

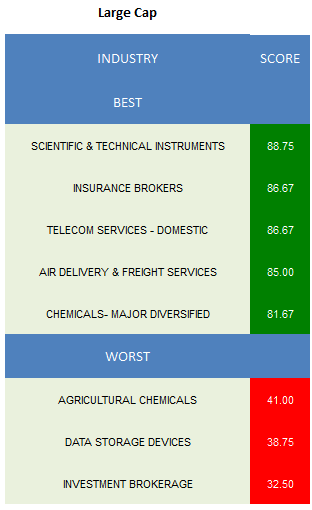

- The highest scoring large cap industry is scientific & technical instruments.

The average large cap score is 62.03 and that's above the four week average score of 60.70. Across our large cap universe, the average stock is trading -18.11% below its 52 week high, 4.51% above its 200 dma, has 4.54 days to cover held short, and is expected to grow EPS by 14.27% in the coming year.

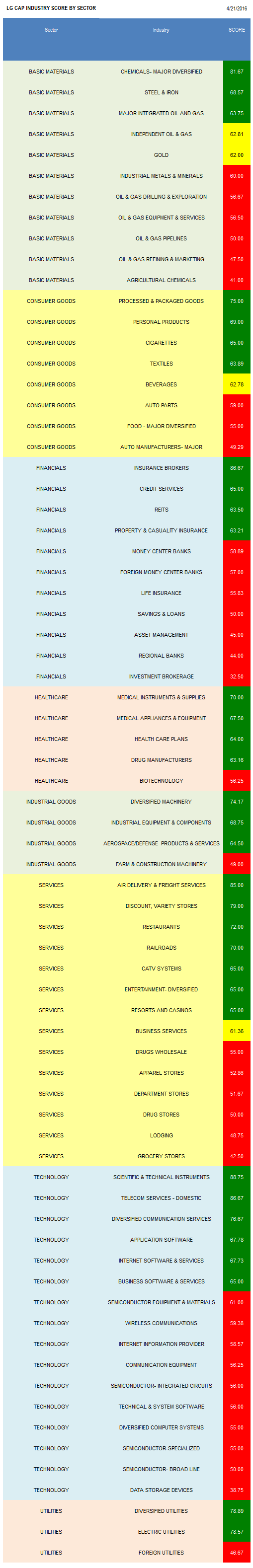

Utilities, industrial goods, and healthcare are the strongest scoring sectors in large cap. Consumer goods and technology score in line with the average universe score. Services, basics, and financials score below average.

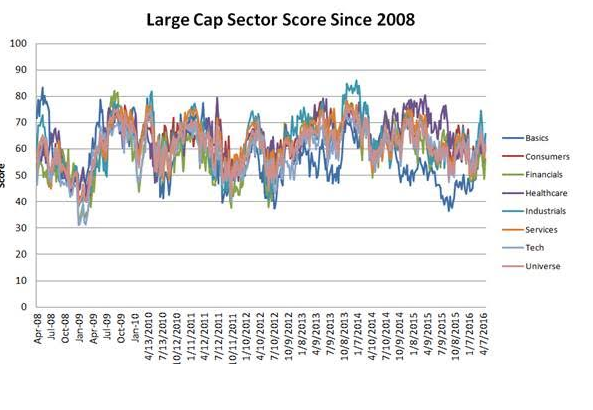

The following chart shows historical large cap sector scores since 2008.

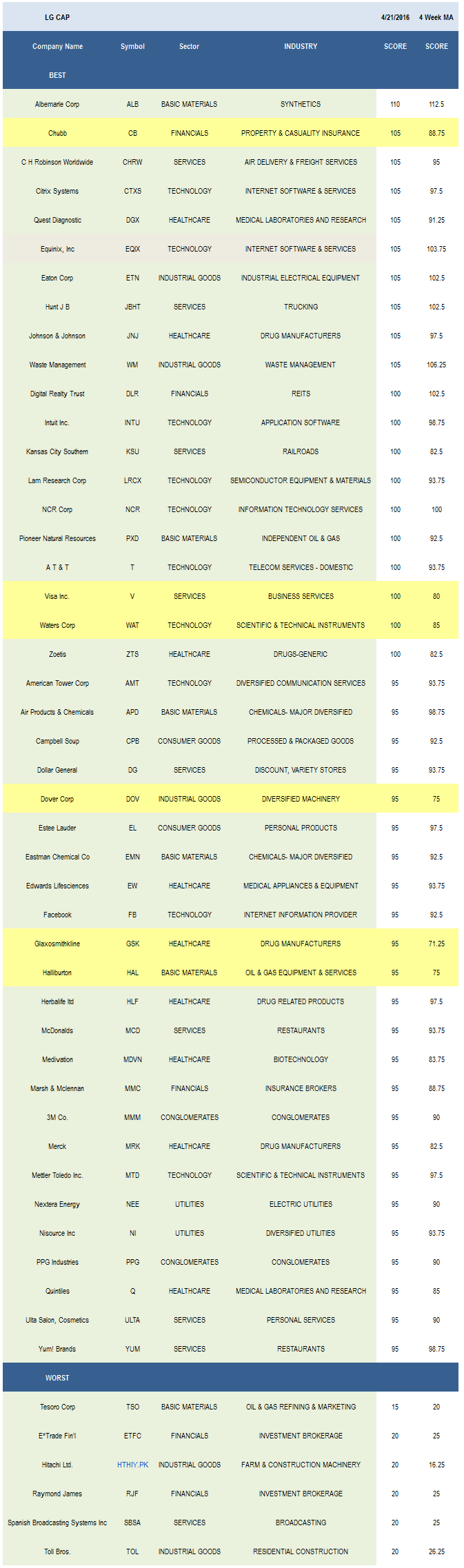

The best large cap industry is scientific & technical instruments (WAT, MTD, A). Insurance brokers (MMC, AJG), domestic telecom (T,CTL, VZ), air delivery & freight (CHRW, UPS, FDX), and major chemicals (EMN, APD, ASH, SHW) are also top scoring.

In basics, buy major chemicals, steel & iron (TX, SID, PKX, NUE), and major oil & gas (XOM). Processed & packaged goods (CPB, K, MKC, MJN), personal products (EL, KMB), and cigarettes (PM, RAI) score best in consumer goods. Insurers, credits services (SLM, EFX, DFS), and REITs (DLR, HCN, VTR, SPG, PSA, BXP) are best in financials. The strongest scoring healthcare baskets are medical instruments (BCR, SYK, BSX, BDX), medical appliances (EW, ISRG, ZBH, VAR), and healthcare plans (UNH, AET). Diversified machinery (DOV, IR, ITW), industrial equipment (PH), and aerospace/defense (BA, NOC, HON, BEAV) are best in industrials. Air delivery, discount stores (DG, DLTR, WMT, TGT), and restaurants (YUM, MCD) offer upside in services. Scientific & technical instruments, domestic telecom, and diversified communication services (AMT) are top scoring in technology. Diversified (NI, SCG, PEG, PCG, EXC) and electric utilities (NEE, EIX, DTE, ETR, PPL, FE, CPN, AES, AEP) can also be owned in portfolios.

Disclosure: None.