Saturday, August 28, 2021 4:00 AM EDT

Friday's payrolls number will have a strong bearing on whether the Federal Reserve announces tapering in September.

Source: Shutterstock

US: Payrolls to determine whether tapering is announced in September or November

Next week’s highlight will be the August US jobs report. The Federal Reserve is on course to announce and start a tapering of its QE asset purchases and should we get a strong figure (say 650k or more) for non-farm payrolls it may help swing momentum towards the idea of a September 22nd announcement and an October implementation. If it is soft (say 450k or less) it may mean officials will want to see another month of figures before opting for a November 3rd announcement with a December implementation. Either way a taper is looking highly probable this year with Fed officials suggesting that the US has a resilient economy and will be able to withstand the latest wave of Covid cases. More officials are also warning about inflation persisting for longer and the financial stability risks associated with elevated asset prices.

We are forecasts a payrolls figure of 675k versus the consensus 750k prediction after posting two 900k+ figures for June and July. The resurgence of the Delta variant of Covid has seemingly impacted travel and hospitality given a certain degree of wariness creeping into consumer psychology and this may have led to a slight loss of momentum. Nonetheless, underlying economic demand is strong and businesses continue to worry over the lack of suitable workers so that provides a strong underpinning. We expect the unemployment rate to fall to 5.1% with wages picking up further to 4.1%YoY given the competition for staff with the required skill sets.

Other numbers include the ISM series, which are set to soften given the declines seen in the regional indicators. This is still largely a function of supply chain issues and production bottlenecks with supply not able to keep pace with demand. This should mean inflation readings remain elevated.

Canada: Focus on GDP data

In Canada, the focus will be 2Q GDP.

New Covid-19 containment measures early in the quarter will obviously have weighed on growth, but with conditions having improved through subsequent months given a highly successful vaccine rollout program, we expect to see much stronger growth in the second half of the year.

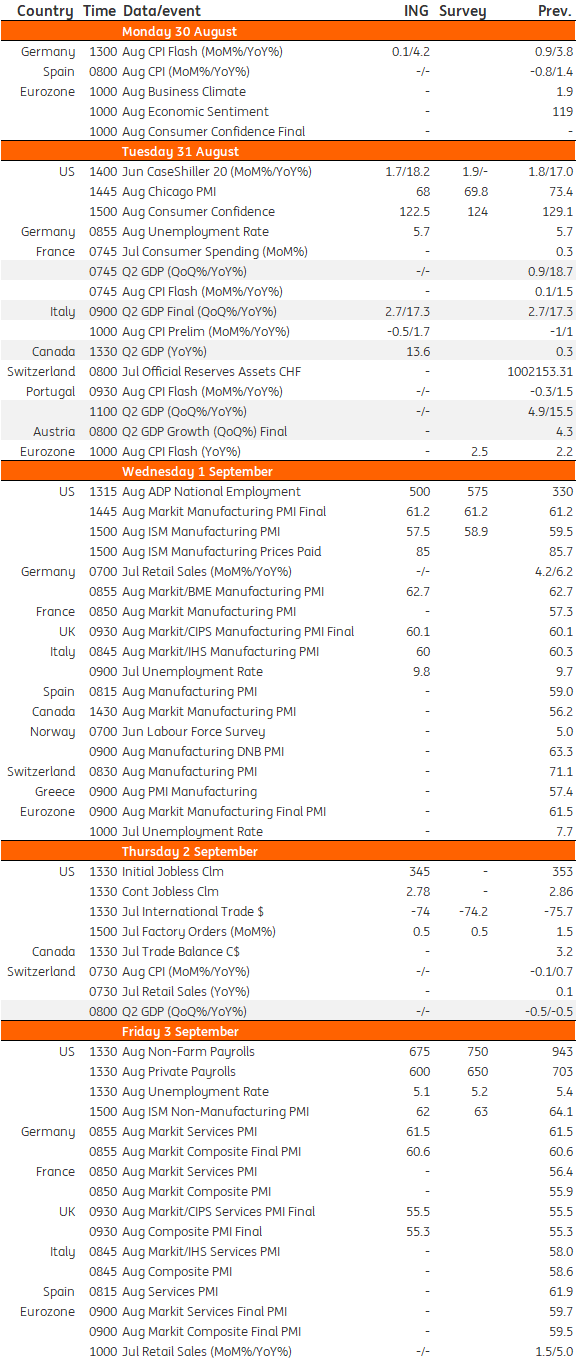

Key events in developed markets next week

Refinitiv, ING

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.