Just Another Merger Monday

Berkshire Hathaway is buying Precision Castparts (PCP)!

That is kind of encouraging as it's a big ($37.2Bn) bet on manufacturing but PCP manufactures aerospace parts and that is one of our only working sectors and PCP, as you can see from this chart, is 70% aerospace. BUT $32Bn is only a 20% premium to Friday's close with the stock at $193.88 so we're looking at about $233 if this deal goes through as advertised. You will hear some irresponsible journalists (let's fact it, most of them) calling this a $37Bn deal because they are adding in the assumption of debt but they don't subtract the assumption of assets and profits so this is an idiotic way to look at a merger deal aimed only at creating more excitement than there actually should be and to fool you into thinking things are better than they actually are.

Warren Buffett is no fool with his money and has owned a bit of PCP for many years and is taking advantage of the recent weakness in the sector to buy the whole company for far less than last year's highs at $275.

PCP made $1.77Bn last year and $1.5Bn this year (they year ends in Q1) and is on track to do about the same ($1.5Bn) this year so $32Bn is a p/e of 21.3. This does NOT give other investors the green light to bid other companies up to p/es of 33 or 103 – but they will because investors are idiots, so today will not be a day we chase any stocks.

We can, however, chase PCP with an arbitrage play, but we won't know which until we see the market open and get an idea of the prices. We will feature the trade idea live, over at Seeking Alpha's Premium Research Section, where our 5% Monthly Portfolio has just been launched.

The real story is that Berkshire managed to find a bargain needle in this market haystack and, since there aren't many other good deals these days – they figured they may as well buy the whole company and make it part of Berkshire Hathaway (BRK-A), which is a $350Bn company with an overall p/e of 17.41. So adding PCP at 21.3 will bring the overall p/e of BRK-A up to 17.76 over the short-term but Berkshire also owns plenty of industrial companies that can help PCP expand their sales including 2.5% of General Electric (GE), 5% of Deer (DE), 2.5% of General Motors (GM), all of NetJets (private)…

Is Buffett early calling a bottom on PCP? Possibly. We have been early calling a bottom on Cliffs Natural Resources (CLF), Transocean (RIG), Lumber Liquidators (LL) and Hovnanian (HOV) but at some point you need to pull the trigger if you want to pick up a cheap stock and, as Buffett well knows, it's a long race.

HOV is an interesting on with $285M in cash that well covers the $60M they burned through last Q for a good year to come and, income-wise, they only lose $19M, so 10 quarters at that rate yet the company is priced for imminent bankruptcy even though they projected loss for the year is 0.11 and next year they are projected to make a profit of 0.26 per what is now a $1.50 share (p/e 5.76).

Just $220M buys you the whole company at this point. Berkshire will probably pay more than that in incidental fees incurred in closing the PCP deal! I'm not saying Buffett should by Hovnanian, but I wouldn't mind taking a run at them at this price. Bargains aren't hard to find if you know where to look – you just have to be brave enough to go against the crowd and put your foot down at a certain value.

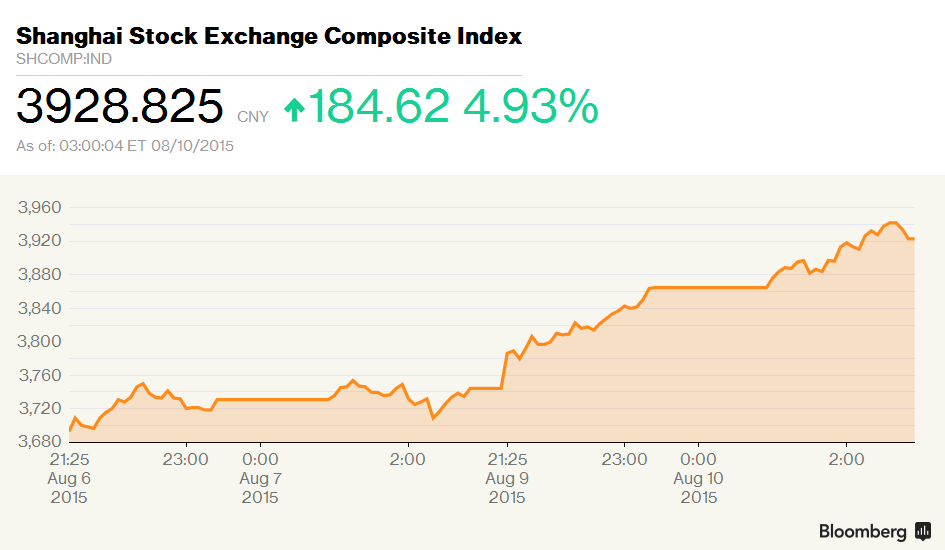

China put their foot down this morning and popped the Shanghai Composite 5% this morning but Hong Kong was not impressed with the obvious manipulation and closed 0.13% lower on the session. China has had 13 policy changes in the past 5 weeks aimed at boosting the marketand, since July 1st the market had dropped 12.5% into today's "sudden improvement".

Chinese markets are still running on that "bad news is good news" theory and the news could not have been worse this weekend as Exports were down 8.3% in July, matched by an 8.1% drop in Imports too. Meanwhile, Producer Prices fell 5.4% in China, back to the lowest levels since 2009 in the 41st CONSECUTIVE month of declines. Well, we've ignored the last 40 months so we may as well ignore this one too – why break the streak?

“Weak non-food inflation and falling producer prices reflect a combination of subdued commodity prices, industrial overcapacity and weak demand,” Bloomberg economist Fielding Chen wrote in an analysis. “The risk is a negative feedback loop where low prices push up real borrowing costs, damp corporate investment and discourage consumer spending.”

Greece is also fixed again this morning so Europe is happy and up about 0.6% along with our Futures as "THEY" work desperately to avoid the death crosses we warned about last week. We'll see how successful it is with the DAX right at 11,500 and our Dow (/YM) is at 17,450, S&P(/ES) 2,092.50, Nasdaq (/NQ) 4,550 and Russell(/TF) 1,212.50 and we are not at all impressed since last Wednesday we were shorting at these lines:

So we're done being bullish and now, expecting a Dollar bounce off 97.50 until the next statement, we're back to playing the S&P Futures (/ES) to fail at 2,100 and Nasdaq (/NQ) short at 4,600 and we'll watch the Russell (/TF) below 1,235 and the Dow (/YM) at 17,600 to confirm weakness and stay bearish and very tight stops over the lines – in case we move a bit higher than expected.

Thursday we told you MDLZ was a con at $48.50 and that company continues to sink but today we'll be looking to see if these thinly-traded Futures bounces last past the open (probably not) and we can make some more money with more Futures shorting as it's too early in the month to sustain a fake rally.

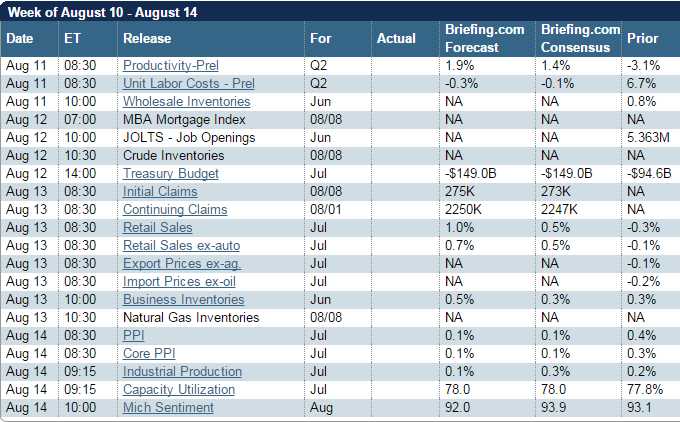

Stay tuned later for a trade idea on PCP – that's almost certain to be the trade of the day. Overall, it looks like it's going to be an exciting week:

more