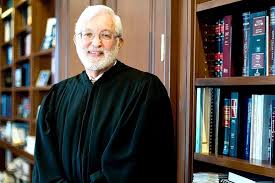

Judge Rakoff: Why Have No High Level Executives Been Prosecuted In Connection With The Financial Crisis?

It is not often that I have had the pleasure of reading and reviewing two Sense on Cents instant classics in the course of just a few days but today I am excited to bring you another absolute MUST READ.

It is not often that I have had the pleasure of reading and reviewing two Sense on Cents instant classics in the course of just a few days but today I am excited to bring you another absolute MUST READ.

None other than Judge Jed Rakoff, who has heard many of the major financial suits brought over the course of the last few years, spoke the other day to the New York City Bar Association regarding the question so many in our nation still ask, “Why have no high level executives been prosecuted in connection with the financial crisis?”

In what might have been a fabulous foreword to my upcoming book, Rakoff skillfully delivers what I believe is an incredibly excoriating indictment of those within the Department of Justice,the SEC, and elsewhere.

. . . if, by contrast, the Great Recession was in material part the product of intentional fraud, the failure to prosecute those responsible must be judged one of the more egregious failures of the criminal justice system in many years.

Indeed, it would stand in striking contrast to the increased success that federal prosecutors have had over the past 50 years or so in bringing to justice even the highest level figures who orchestrated mammoth frauds.

That’s right. Rakoff is just warming up. He proceeds by inquiring that perhaps no actual fraud was committed; however, he disarms that premise in stating,

. . . the stated opinion of those government entities asked to examine the financial crisis overall is not that no fraud was committed. Quite the contrary.

For example, the Financial Crisis Inquiry Commission, in its final report, uses variants of the word “fraud” no fewer than 157 times in describing what led to the crisis, concluding that there was a “systemic breakdown,” not just in accountability, but also in ethical behavior.

As the Commission found, the signs of fraud were everywhere to be seen, with the number of reports of suspected mortgage fraud rising 20-fold between 1998 and 2005 and then doubling again in the next four years.

As to why the Department of Justice has not upheld the rule of law by prosecuting individuals involved in perpetrating the widely known frauds, Rakoff allows us all to peer through his scope, he then . . .

Feeds . . .

Who, for example, were generating the so-called “suspicious activity” reports of mortgage fraud that, as mentioned, increased so hugely in the years leading up to the crisis? Why, the banks themselves . . . This, of course, is what is known in the law as “willful blindness” or “conscious disregard.” . . . while some federal courts have occasionally expressed qualifications about the use of the willful blindness approach to prove intent, the Supreme Court has consistently approved it.

Locks . . .

. . . the Department of Justice has sometimes argued that, because the institutions to whom mortgage-backed securities were sold were themselves sophisticated investors, it might be difficult to prove reliance . . . In actuality, in a criminal fraud case the Government is never required to prove reliance, ever. The reason, of course, is that would give a crooked seller a license to lie whenever he was dealing with a sophisticated counterparty.

Loads . . .

The third reason the Department has sometimes given for not bringing these prosecutions is that to do so would itself harm the economy. . . To a federal judge, who takes an oath to apply the law equally to rich and to poor, this excuse — sometimes labeled the “too big to jail” excuse – is disturbing, frankly, in what it says about the Department’s apparent disregard for equality under the law.

Rakoff minimizes the impact of the revolving door on the lack of prosecutions but he “. . . asks again, why haven’t we seen such prosecutions growing out of the financial crisis?” He then sizes up those who should have been protecting our interests:

READY. . .

First, the prosecutors had other priorities . . .

AIM . . .

. . . the S.E.C. was trying to deflect criticism from its failure to detect the Madoff fraud, and this led it to concentrate on other Ponzi-like schemes . . . the U.S. Attorney’s Office with the greatest expertise in these kinds of cases, the Southern District of New York, was just embarking on its prosecution of insider trading cases . . .

FIRE . . .

. . . the government, writ large, had a hand in creating the conditions that encouraged the approval of dubious mortgages . . . the government was also deeply enmeshed in the aftermath of the financial crisis . . . Please do not misunderstand me. I am not alleging that the Government knowingly participated in any of the fraudulent practices alleged by the Financial Inquiry Crisis Commission and others.

But what I am suggesting is that the Government was deeply involved, from beginning to end, in helping create the conditions that could lead to such fraud, and that this would give a prudent prosecutor pause in deciding whether to indict a C.E.O. who might, with some justice, claim that he was only doing what he fairly believed the Government wanted him to do.

In Bed with Wall Street but so much for the rule of law.

In conclusion, Rakoff unleashes one more round at the tactic of deferred prosecution agreements of the companies in question with no prosecution of the executives as “both technically and morally suspect.”

For those who care to read and review Rakoff’s 19-page Instant Classic, I welcome providing the pdf courtesy of the Financial Times.