Joe Sixpack's Situation In 2Q2017: The Average Joe Is Better Off

The Federal Reserve data release (Z.1 Flow of Funds) - which provides insight into the finances of the average household - shows improvement in average household net worth. Our modeled "Joe Sixpack" - who owns a house and has a job, and essentially no other asset - is better off than he was last quarter (and his growth rate of improvement improved).

Analyst Opinion of the Joe Sixpack and Middle Man Indices - Z.1 Flow of Funds

One should worry about the 35% of Americans who do not own any financial asset. Z.1 Flow of Funds net worth data is not inflation adjusted. and

Food for thought [from the data in the Z-1 Flow of Funds]:

- It is interesting that consumer credit year-over-year growth was 5.9 % according to Fed data.

- The average house has appreciated around 6% but the REAL owners equity in their house is up 8.8 %.

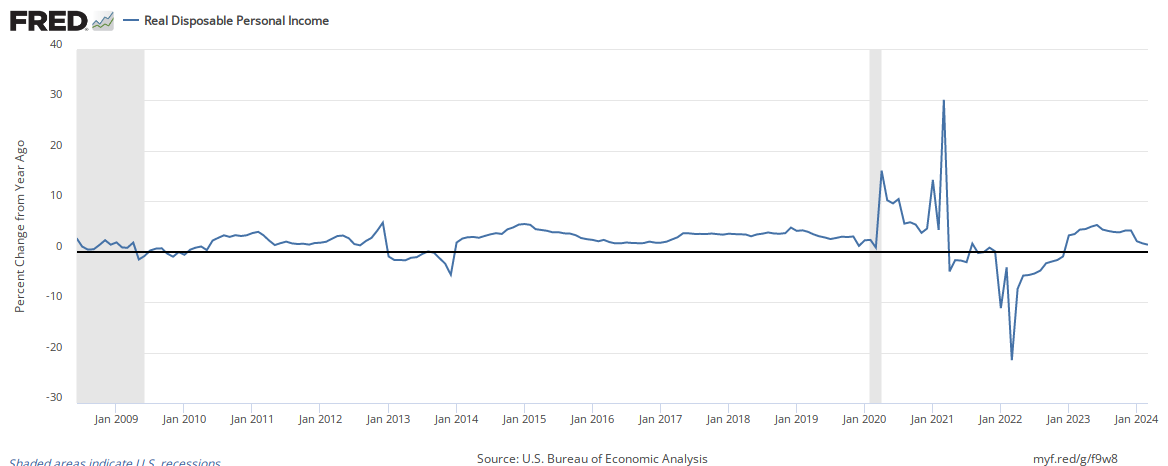

(Click on image to enlarge)

- Real disposable Personal Income year-over-year rate of growth is 1.3 % - and has been in a general down trend since the end of 2014.

(Click on image to enlarge)

- The rate of growth of financial assets is 9.1 %.

(Click on image to enlarge)

- The year-over-year growth rate of the Z.1 Flow of Funds net worth data was 9.3% [last quarter's year-over-year growth was a revised 8.4%].

(Click on image to enlarge)

- But now inflation is starting to be a factor in net worth - as the Consumer Price Index is up 1.9% year-over-year.

You may ask why this analysis is important? It looks at the financial health of the consumer - and in a consumption based economy, it measures the dynamics affecting the consumer.

35% of Americans who own no home or have any other assets are no better off (living from paycheck to paycheck) - and consumption is based simply on income. The median household's income is little better then it was 16 years ago.

First, from the Z.1 Flow of Funds report, what was shown about Household Net Worth and Growth of Domestic Nonfinancial Debt. Cumulative Household net worth grew, while cumulative household debt growth also grew.

(Click on image to enlarge)

(Click on image to enlarge)

The Joe Sixpack Index

The Joe Sixpack Index is a composite index of home prices and wage income (again - Joe owns a house with a mortgage, has a job, and no other assets). This index was designed to measure how rich Joe should feel. The theory is that the richer Joe feels, the more Joe will spend.

- The data in this index is only updated every three months, and the data was updated with the release of the Federal Reserves Z.1 Flow of Funds.

- It is inflation and population adjusted.

- Currently, Joe has a house that is increasing in value - and his income in inflation terms is growing - so the net affect is that the index improved - and now indicates Joe feels richer than he did in the last quarter. Note that the rate of increase is now improving.

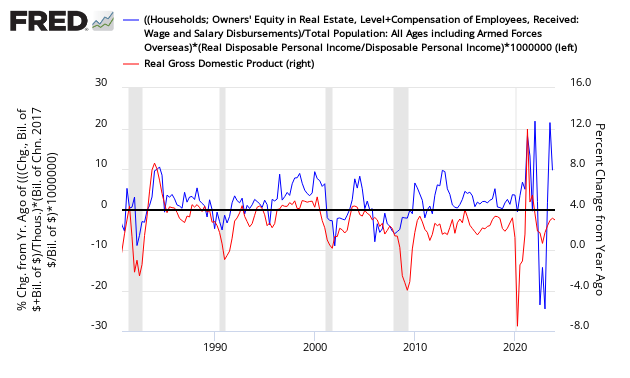

Joe Sixpack Index (blue line, left axis) shown against GDP (red line, right axis)

(Click on image to enlarge)

The Middle Man Index

The middle class household with financial assets and real estate assets is Middle Man. A Federal Reserve Publication shows the percentage of households owning various financial assets. Other than real estate, Middle Man holds transaction accounts (checking - 1% of all financial assets) and retirement accounts (roughly estimated by Econintersect at 25% of household financial assets).

(Click on image to enlarge)

Unfortunately, retirement accounts are not separately detailed in the Z.1 reporting - but the graph below uses 25% of the change in Total Household Assets as a proxy for change in retirement accounts.

Total Household Assets (blue bars) vs Savings (red bars)

(Click on image to enlarge)

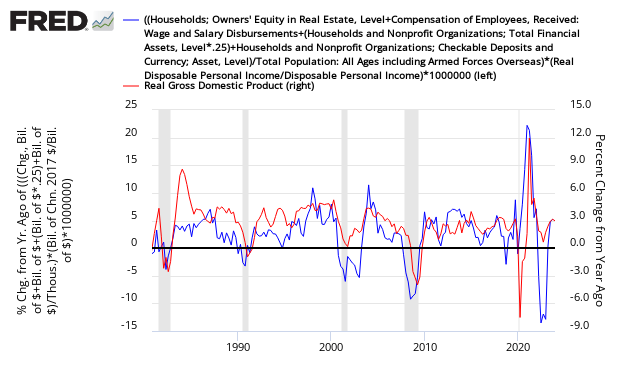

Adding the financial assets of Middle Man to the housing and compensation data used in the Joe Sixpack index, we see that Middle Man is better off than last quarter with his situation - but the rate of improvement declined. It is the growth in value of real estate and other assets that is the governing factor for Middle Man (not wages).

Middle Man Index (blue line, left axis)

(Click on image to enlarge)

Takeaway

My takeaway is:

- On whole, American households with no assets and only income from wages or safety nets has a modest improvement in their lot in life.

- This is a lagging view of the average American's situation. Having said this, Joe and Middle Man's consumption is somewhat affected by how rich they feel - and it takes some time for the wealth effect to sink in.

- The majority of Americans are more like Joe Sixpack than Middle Man.

Caveats on this Post:

Most of the data in this post comes from "Flow of Funds Accounts of the United States" (Z.1) data release from the Federal Reserve which is released quarterly. Although Econintersect can validate the data in general using other sources, micro movements are difficult to validate. Importantly, the Z.1 data is a treasure chest of aggregated data across all sectors of the economy - and an invaluable tool in evaluating historical relationships.

The Joe's Index was introduced by Econintersect in a 07 July 2012 post. This index is documented at the bottom of the July 2012 economic forecast.

To begin, one needs to define Joe Sixpack. Urban dictionary defines Joe:

Average American moron, IQ 60, drinking beer, watching baseball and CNN, and believes everything his President says.

Too many of us think we are smarter than Joe - and are above Joe in the social order. But many of us are Joe. Per Wikipedia:

John Q. Public (and several similar names; see the Variations section below) is a generic name in the United States to denote a hypothetical member of society deemed a "common man." He is presumed to represent the randomly selected "man on the street." Similar terms include John Q. Citizen and John Q. Taxpayer, or Jane Q. Public, Jane Q. Citizen, and Jane Q. Taxpayer for a woman. The name John Doe is used in a similar manner. For multiple people, Tom, Dick and Harry is often used. Roughly equivalent are the names Joe Six-pack, Joe Blow, the nowadays less popular Joe Doakes and Joe Shmoe ….

Almost all Americans who MUST work to survive are Joes. Americans who are relying on some level of earned income during retirement are Joes. I believe many who see themselves as middle class (educated or not - professional or blue collar) is a Joe. Joe is somewhere around average American:

- Joe's median family unit spends or makes about $57K per year

- Joe's median net worth was $120K in 2007

We specify by definition that over 50% of Americans are Joes.

Note: The Z.1 data is based on averages not medians. In other words, the rich are getting richer - and this influences the averages.

Disclosure: None.

Good article. I would tend to agree, however, getting to this is tough given the skew from the non Joe's. The sad fact is there are more non Joe's today on the low end than before and there are less Joe's on the high end although they are much wealthier which is probably a more important change than the lack of change from the average Joes.

Absolutely - the lower end is just surviving from hand-to-mouth and this group is growing