Jobless Claims Fall 13,000 Despite Government Shutdown

Jobless Claims Fall To 199,000

The jobless claims report is a leading indicator for the economy and helps us understand how the monthly BLS report will look.

Lately, it has been an extremely important metric that has been followed closely because it was strong during the stock market decline in December and remains strong now as some investors wonder if economic growth is still slowing.

No indicator should be the sole reason for your positioning. Bears are trying to discredit this metric now because it is being leaned on by the bulls as a clear representation that economic growth isn’t slowing.

Soft survey data has been weak, but the hard data has been strong. The hard data is also sparse because of the government shutdown. Labor reports have been supporting the strong jobless claims readings which suggest it hasn’t gone rogue.

Jobless claims for the week of January 19th that were just released showed they fell from 212,000 to 199,000. That’s a new cycle low.

It’s the lowest amount since November 1969. It beat the consensus for 218,000. The prior week was revised from 213,000. The 4-week moving average fell from a revised level of 220,500 to 215,000. The 4-week moving average is slightly above the cycle low. The cycle low was hit in September at 206,000.

Jobless Claims - Government Shutdown Pushes Claims Higher, But They Are Still At A Historic Low

Heading into this report I was very interested to see how the government shutdown would impact claims.

Amazingly, even though the overall number dropped, Federal claims were up almost 15,000 this week to 25,400. That’s much higher than 1,650 last year.

It has been shocking to see how low claims have gotten this year. If there was no shutdown and claims were at 175,250 that would be even more of a shock. It’s quite something that this shutdown caused a 15,000 impact and claims still fell by 13,000.

As you can see from the chart below, the percent ratio of initial claims to the total labor market is by far lower than it has been at previous troughs. The labor market was much smaller in 1969 when claims were previously this low.

(Click on image to enlarge)

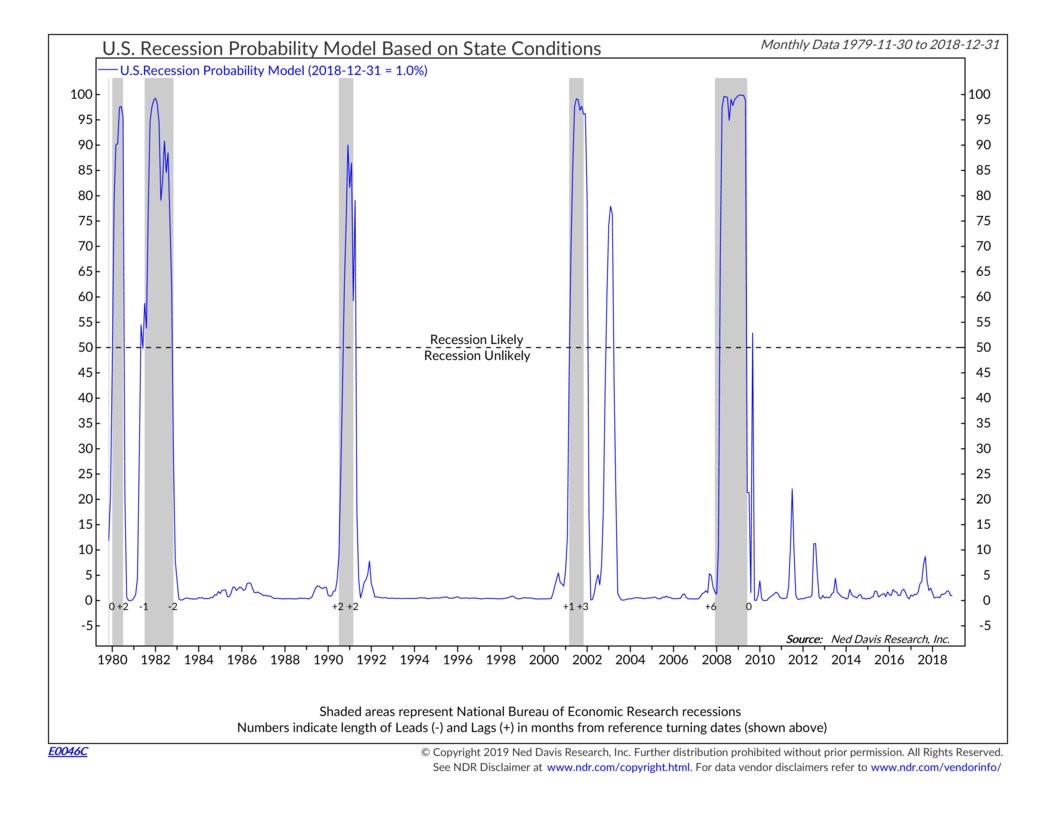

Jobless Claims - Signal A 1% Chance Of A Recession

Usually, claims rise 75,000 before recessions. The key marker investors usually look to is 300,000. Once they get over that level, it’s considered a problem.

This situation might be different because it has fallen so low. A 75,000 increase from 199,000 would only be 274,000.

As you can see from the chart below, based on the current jobless claims there is a 1% chance of a recession. The numbers at the bottom show the number of months the signal flagged a recession before or after it started.

This isn’t a great recession predictor as it was 6 months late to the last one. It’s a verification mark. Its only false reading was in 2003. There never was a recession without this indicator giving a confirmation signal.

To be clear, even though the recession started in December 2007, a signal in May 2008 would have been helpful. Many investors weren’t sure if the economy was in a recession at that point.

The S&P 500 fell 47.51% from May 30th to the eventual bear market trough. Since this indicator doesn’t signal a recession, it’s fair to say with confidence that a recession didn’t start 6 months ago. We probably aren’t in one now either.

(Click on image to enlarge)

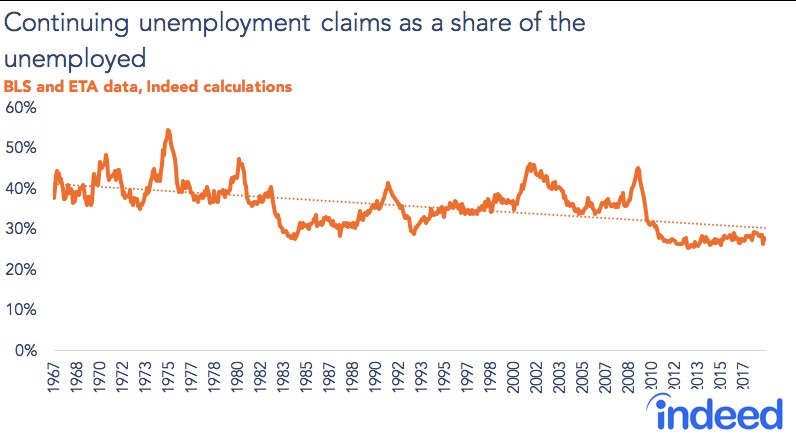

Jobless Claims - Main Flaw In The Jobless Claims Report

Because the claims as a percentage of the labor market have been at a record low for a few years, this indicator has perplexed me.

The reason being is that the prime age labor force participation rate hasn’t been at a level consistent with a full labor market. The labor market wasn’t full in 2016 and still isn’t full now. It will become full if the expansion continues for another 2 years and the prime age participation rate keeps increasing at a similar rate it has been increasing at for the past year.

The chart below supports my suspicion that the claims are showing the labor market is stronger than it is. Reality is policy changes have altered who qualifies for unemployment claims.

As the chart below shows, the percentage of continuing claims as a share of the unemployed has decreased in the past few decades.

This means it’s more difficult to file for unemployment claims. Suppressing the number doesn’t make the labor market stronger. To be clear, we can look at jobless claims in relation to this cycle, but historical comparisons are flawed.

Specifically, continuing claims fell 24,000 in the week of January 24th. The 4-week moving average increased to 1.730 million which is about 50,000 higher than mid-December. The unemployment rate for insured workers is near a historic low at 1.2%.

(Click on image to enlarge)

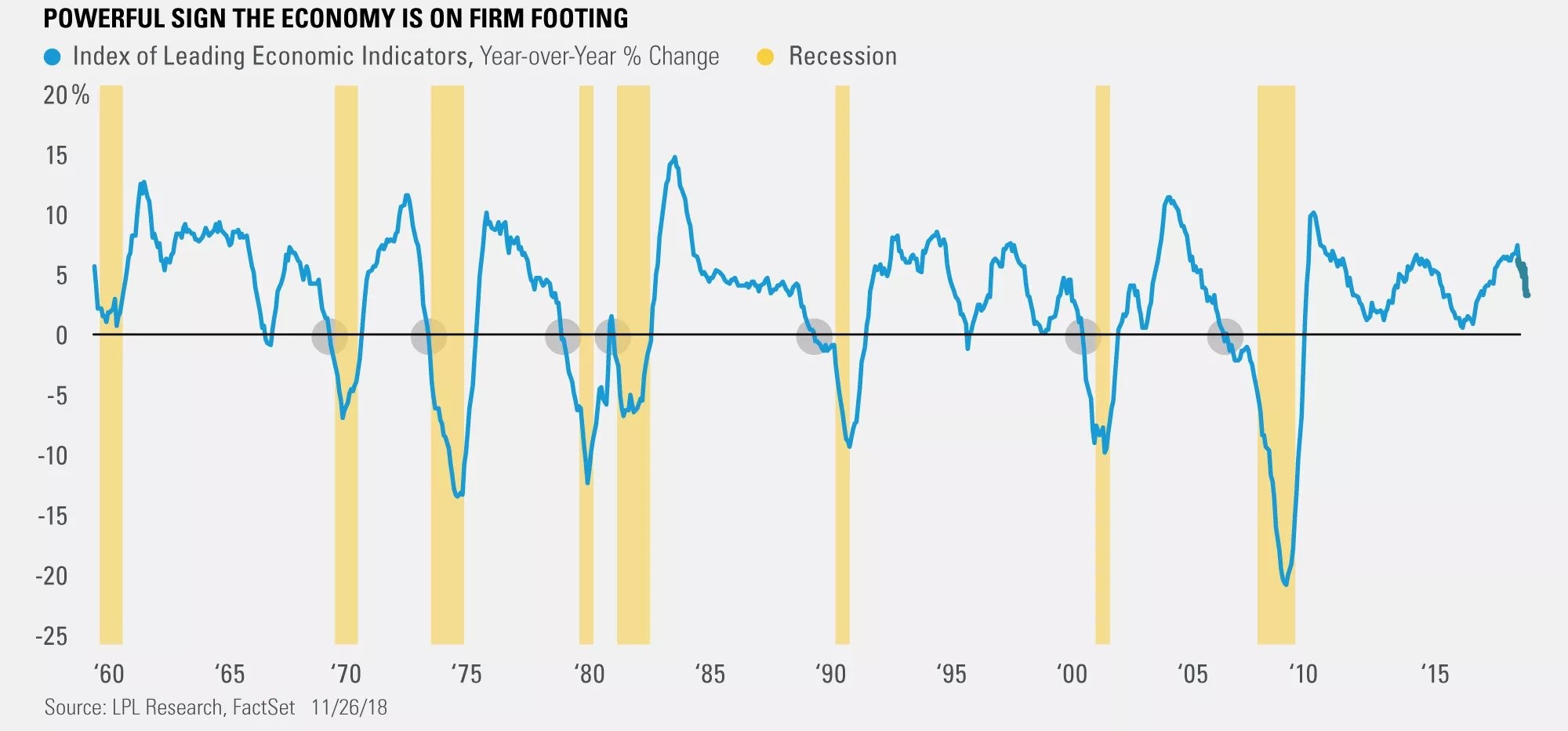

Jobless Claims - Leading Indicators Growth Slows

It’s no surprise the leading indicators were weak in December because the stock market cratered, and the manufacturing ISM report was weak.

Month over month, the leading indicators were down 0.1% after being up 0.2% in the prior month. As you can see from the chart below, the leading indicators are now only up 4.2% year over year. With the stock market’s great January, it wouldn’t be surprising to see this index regain form.

The bulls love this metric because it has gone negative on a year over year basis before recessions. In rate of change terms, this metric is weak, but it still isn’t signaling a recession.

This slowdown isn’t worse than the prior two yet.

Jobless claims indicator is another one of the 10 in this index. As I discussed in this article, claims have been low this month. That will also help in January.

The January manufacturing ISM PMI hasn’t been released yet, but I’m not optimistic about it because the Empire Fed and Richmond Fed manufacturing reports were weak. Philly Fed index was strong, and the Kansas City Fed reading was mediocre.

(Click on image to enlarge)