January 2021 Real Income Grew Due To Stimulus

The data continues to be affected by the pandemic. Expenditures improved month-over-month (but is in contraction year-over-year) whilst income improved month-over-month mostly due to the stimulus payments.

Analyst Opinion of Personal Income and Expenditures

The note from the BEA says it all:

The increase in personal income in January was more than accounted for by an increase in government social benefits to persons as payments were made to individuals from federal COVID-19 pandemic response programs. The increase in "other" benefits primarily reflected economic impact payments distributed through the CRRSA Act. Unemployment insurance also increased, reflecting an increase in pandemic unemployment compensation, including supplemental weekly payments to unemployment beneficiaries re-introduced by the CRRSA Act

The $340.9 billion increase in current dollar PCE in January reflected an increase of $277.2 billion in spending for goods and a $63.7 billion increase in spending for services. Within goods, the increases were widespread across all categories, led by recreational goods and vehicles (notably, information processing equipment) as well as food and beverages, based on Census Monthly Retail Trade Survey (MRTS) data. Within services, the increase was led by spending for food services and accommodations (more than accounted for by food services), based on MRTS data. Spending for health care (led by outpatient services) also increased, reflecting data on the volume of visits as well as revenue data. Partly offsetting these increases was a decrease in housing and utilities (led by electricity and gas), reflecting data from the Energy Information Administration.

The real issue with personal income and expenditures is that it jumps around because of backward revisions - and one cannot take any single month as fixed or gospel. As an example, this month's backward revision:

Estimates have been updated for July through December 2020. For July through September, estimates for compensation, personal taxes, and contributions for government social insurance reflect the incorporation of the most recently available third-quarter wage and salary data from the Bureau of Labor Statistics' Quarterly Census of Employment and Wages program. Revised and previously published changes from the preceding month for current-dollar personal income, and for current-dollar and chained (2012) dollar DPI and PCE, are shown below.

This should be considered a better report than last month.

- The market looks at current values (not real inflation-adjusted) and was expecting (from Econoday):.

| Consensus Range | Consensus | Actual | |

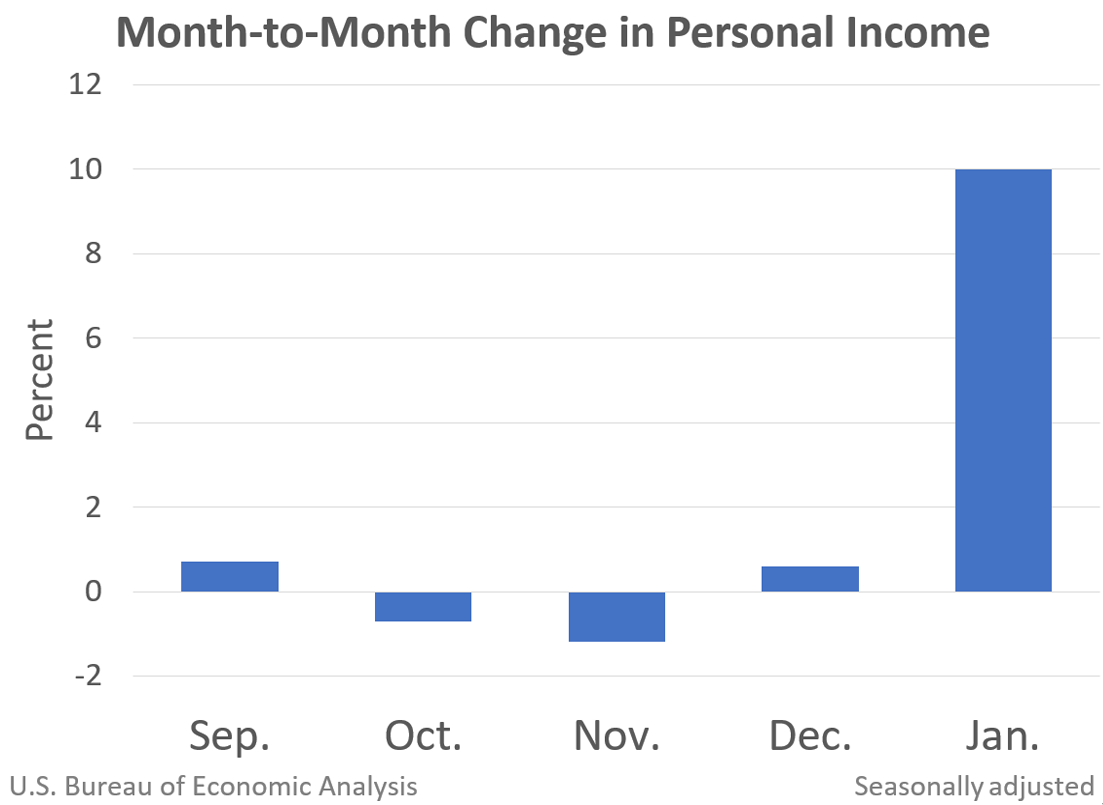

| Personal Income - M/M change | 0.2 % to 11.0 % | +9.4 % | +10.0 % |

| Consumer Spending - M/M change | 0.5 % to 3.3 % | +2.2 % | +2.4 % |

| PCE Price Index -- M/M change | 0.2 % to 0.5 % | +0.3 % | +0.3 % |

| PCE Price Index Y/Y change | 1.4 % to 1.6 % | +1.5 % | +1.5 % |

| Core PCE Price Index - M/M change | 0.1 % to 0.4 % | +0.1 % | +0.3 % |

| Core PCE price index - Yr/Yr change | 1.3 % to 1.7 % | +1.4 % | +1.5 % |

- Real Disposable Personal Income is up 13.3 % year-over-year, (accelerating 10.5 % month-over-month) and real consumption expenditures are down 1.9 % year-over-year (accelerating 1.5 % month-over-month)..

- The latest 4Q2020 GDP estimate indicated the economy was expanding at 4.1 % (quarter-over-quarter compounded). Expenditures are counted in GDP, and income is ignored as GDP measures the spending side of the economy. However, over periods of time - consumer income and expenditure grow at the same rate.

- The savings rate is 20.5 % (up from last month's 13.4 %) - this rate is elevated because many investments have been turned into cash.

The inflation-adjusted income and consumption are "chained", and the headline GDP is inflation-adjusted. This means the impact on GDP is best understood by looking at the chained numbers. Econintersect believes year-over-year trends are very revealing in understanding economic dynamics.

Per capita, inflation-adjusted expenditure is in contraction.

Seasonally and Inflation-Adjusted Expenditure Per Capita

The graph below illustrates the relationship between income (DPI) and expenditures (PCE) - showing clearly income and expenditures grow at nearly the same rate over time.

Indexed to Jan 2000, Growth of Real Disposable Income (blue line) to Real Expenditures (red line)

The short-term trends are mixed depending on the periods selected.

Seasonally Adjusted Spending's Ratio to Income (a declining ratio means the consumer is spending less of its Income)

PCE is the spending of consumers. In the USA, the consumer is the economy. Likewise, personal income is the money consumers earn to spend. Even though most analysts concentrate on personal expenditures because GDP is based on spending, increases in personal income allow consumers the option to spend more.

There is a general correlation of PCE to GDP (PCE is a component of GDP).

Seasonally and Inflation-Adjusted Year-over-Year Change of Personal Consumption Expenditures (blue line) to GDP (red line)

Econintersect and GDP use the inflation-adjusted (chained) numbers. Disposable Personal Income (DPI) is the income after the taxes.

Seasonally & Inflation Adjusted Percent Change From the Previous Month - Personal Disposable Income (red line) and Personal Consumption Expenditures (blue line)

Yet year-over-year growth for income and expenditures is above GDP year-over-year growth.

Seasonally & Inflation Adjusted Year-over-Year Change - Personal Disposable Income (red line) and Personal Consumption Expenditures (blue line)

The savings rate has been bouncing around - but the general trend is down since the beginning of this year. In an economy driven by consumers, a higher savings rate does not bode well for increased GDP. This is one reason GDP may not be a good single metric of economic activity.

Personal Savings as a Percentage of Disposable Personal Income

And one look at the different price changes seen by the BEA in this PCE release versus the BEA's GDP and BLS's Consumer Price Index (CPI). We should note that the inflation adjustment is for PCE and Personal Income is usually lower than the ones used for GDP and CPI.

Year-over-Year Change - PCE's Price Index (blue line) versus CPI-U (red line) versus GDP Deflator (green line)

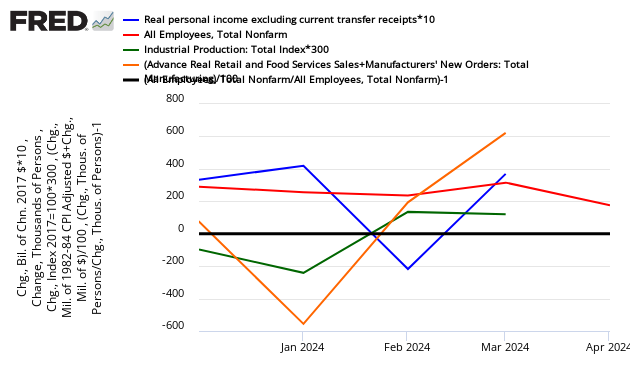

Finally for recession watchers, here is the graph below, here are the elements used to mark a recession. (1) personal income minus transfer payments, in real terms, and (2) employment. In addition, we refer to two indicators with coverage primarily of manufacturing and goods: (3) industrial production and (4) the volume of sales of the manufacturing and wholesale-retail sectors adjusted for price changes.

If a line falls below the 0 (black line) - that sector is contracting from the previous month. Personal income is the blue line. Note - the below graph uses multipliers to make movements more obvious (ignore the value of the scale, only consider whether the graph is above [good] or below [bad] the zero line).

Month-over-Month Growth Personal Income minus transfer payments (blue line), Employment (red line), Industrial Production (green line), Business Sales (orange line)

Caveats on the Use of Personal Income and Consumption Expenditure Data

PCE is a fairly noisy index and subject at times to significant backward revision. This index cannot be relied upon in real-time.

This personal income and personal consumption expenditure data by itself is not a good tool to warn of an upcoming recession. Econintersect has shown that PCE is a distraction for recession watchers, with moves over a few months having a 30% accuracy of indicating a recession start, and a 70% incidence of indicating a non-recessionary event. PCE does have prolonged declines over many months associated with recessions but these long declines are not very good in "predicting" a recession until it is already underway.

Readers are warned that this article is based on seasonally adjusted data. Monthly non-adjusted data is available with a delay of several months.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more