January 2021 Producer Price Final Demand Increased

The Producer Price Index (PPI) year-over-year inflation increased from +0.8 % to +1.7 %

Analyst Opinion of Producer Prices

Year-over-year inflation pressures significantly grew this month.

Here is what the BLS said in part:

The Producer Price Index for final demand increased 1.3 percent in January, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This advance is the largest since the index began in December 2009. Final demand prices rose 0.3 percent in December and 0.1 percent in November. (See table A.) On an unadjusted basis, the index for final demand moved up 1.7 percent for the 12 months ended January 2021, the largest increase since climbing 2.0 percent for the 12 months ended January 2020. Two-thirds of the January advance in prices for final demand can be traced to a 1.3-percent rise in the index for final demand services. Prices for final demand goods increased 1.4 percent. Prices for final demand less foods, energy, and trade services moved up 1.2 percent in January, the largest advance since the index began in September 2013. For the 12 months ended in January, prices for final demand less foods, energy, and trade services rose 2.0 percent, the largest increase since a 2.1- percent advance for the 12 months ended June 2019.

The PPI represents inflation pressure (or lack thereof) that migrates into consumer price.

The market had been expecting (from Econoday):

| Consensus Range | Consensus | Actual | |

| PPI-Final Demand (PPI-FD) - M/M change | 0.3 % to 0.5 % | +0.4 % | +1.3 % |

| PPI-FD - Y/Y change | 0.8 % to 1.0 % | +0.9 % | +1.7 % |

| PPI-FD less food & energy (M/M change -core PPI) | 0.1 % to 0.3 % | +0.2 % | +1.2 % |

| PPI-FD less food & energy - Y/Y change | 1.0 % to 1.3 % | +1.2 % | +2.0 % |

| PPI-FD less food, energy & trade services - M/M change | 0.2 % to 0.3 % | +0.2 % | +1.2 % |

| PPI-FD less food, energy & trade services - Y/Y change | +2.0 % |

The producer price inflation breakdown:

| category | month-over-month change | year-over-year change |

| final demand goods | +1.4 % | |

| final demand services | +1.3 % | |

| total final demand | +1.3 % | +1.7 % |

| processed goods for intermediate demand | +1.7 % | +3.1 % |

| unprocessed goods for intermediate demand | +3.8 % | +6.6 % |

| services for intermediate demand | +1.3 % | +2.8 % |

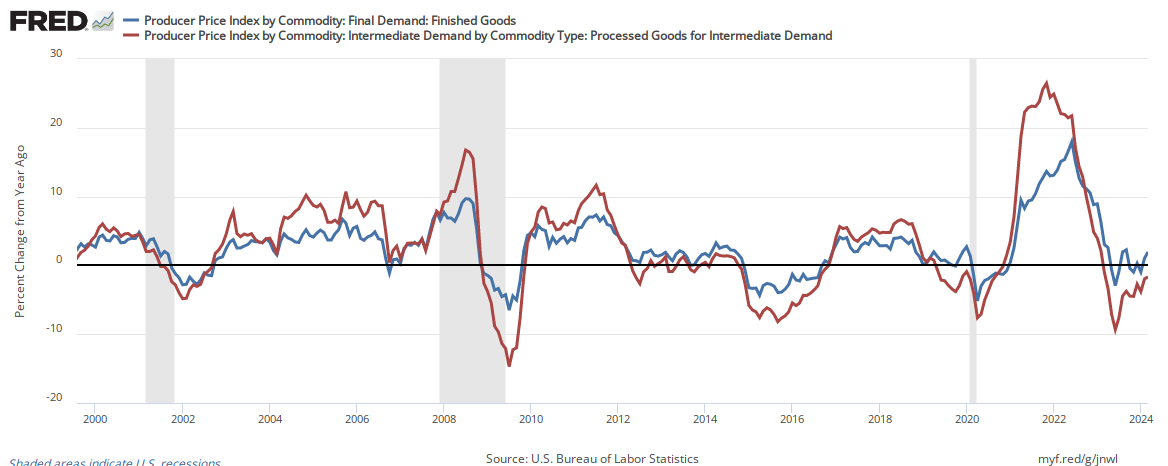

In the following graph, one can see the relationship between the year-over-year change in the intermediate goods index and finished goods index. When the crude goods growth falls under finish goods - it usually drags finished goods lower.

Percent Change Year-over-Year - Comparing PPI Finished Goods (blue line) to PPI Intermediate Goods (red line)

Econintersect has shown how pricing change moves from the PPI to the Consumer Price Index (CPI).

Comparing Year-over-Year Change Between the PPI Finished Goods Index (blue line) and the CPI-U (red line)

The price moderation of the PPI began in September 2011 when the year-over-year inflation was 7.0%.

Caveats on the Use of Producer Price Index

Econintersect has performed several tests on this series and finds it fairly representative of price changes (inflation). However, the headline rate is an average - and for an individual good or commodity, this series provides many sub-indices for a specific application.

A very good primer on the Producer Price Index nuances can be found here.

Because of the nuances in determining the month-over-month index values, the year-over-year or annual change in the PPI index is preferred for comparisons.

There is a moderate correlation between crude goods and finished goods. Higher crude material prices push the prices of the finished goods up.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more