January 2019 Empire State Manufacturing Index Declined And At Lowest Level In Over One Year

The Empire State Manufacturing Survey index significantly declined and remains barely in expansion. The key internals declined with unfilled orders in contraction.

Analyst Opinion of Empire State Manufacturing Survey

With both the main index and key indices declining, this was a much worse report than last month...

Econintersect reminds you that this is a survey (a quantification of opinion). Please see caveats at the end of this post. However, sometimes it is better not to look too deeply into the details of a noisy survey as just the overview is all you need to know

- Expectations from Econoday were for a reading between 10.9 to 13.0 (consensus 12.0) versus the3.9 reported. Any value above zero shows expansion for the New York area manufacturers.

- New orders sub-index of the Empire State Manufacturing declined but remains barely in expansion, whilst the unfilled orders sub-index declining and slipping deeper in contraction

- This noisy index has moved from 17.7 (January 2018), 13.1 (February), 22.5 (March), 15.8 (April), 20.1 (May), 25.0 (June), 22.6 (July), 25.6 (August), 19.0 (September), 21.1 (October), 23.2 (November), 10.9 (December) - and now 3.9

From the report:

Business activity grew slightly in New York State, according to firms responding to the January 2019 Empire State Manufacturing Survey. The headline general business conditions index fell eight points to 3.9, its lowest level in well over a year. New orders increased at a slower pace than in recent months, while shipments continued to climb significantly. Delivery times were slightly shorter, and inventories declined. Labor market indicators pointed to a modest increase in employment and hours worked. The prices paid index moved lower for a second consecutive month, indicating some slowing in input price increases, and the prices received index held steady. Looking ahead, firms were less optimistic about the six-month outlook than they were last month.

The above graphic shows that when the index is in negative territory that it is not a signal of a recession - of 10 times in negative territory (since the Great Recession) - no recession occurred. Conversely, a positive number is likely to be indicating economic expansion. Historically, when it does make a correct negative prediction it can be timely - this index was only two months late in going negative after what was eventually determined to be the start of the 2007 recession.

This survey has a lot of extra bells and whistles which take attention away from the core questions: (1) are orders and (2) are unfilled orders (backlog) improving? - and the answer is that the key internals declined with unfilled orders in contraction.

Unfilled order contraction can be a signal for a recession.

Summary of all Federal Reserve Districts Manufacturing:

Richmond Fed (hyperlink to reports):

Kansas Fed (hyperlink to reports):

Dallas Fed (hyperlink to reports):

Philly Fed (hyperlink to reports):

New York Fed (hyperlink to reports):

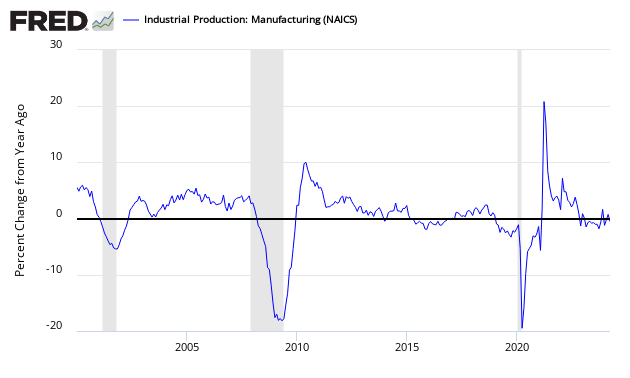

Federal Reserve Industrial Production - Actual Data (hyperlink to report):

Holding this and other survey's Econintersect follows accountable for their predictions, the following graph compares the hard data from Industrial Products manufacturing subindex (dark blue bar) and US Census manufacturing shipments (lighter blue bar) to the Dallas Fed survey (light blue bar).

In the above graphic, hard data is the long bars, and surveys are the short bars. The arrows on the left side are the key to growth or contraction.

Caveats on the use of Empire State Manufacturing Survey:

This is a survey, a quantification of opinion - not facts and data. Surveys lead hard data by weeks to months and can provide early insight into changing conditions. Econintersect finds they do not necessarily end up being consistent compared to hard economic data that comes later, and can miss economic turning points.

According to Econoday:

The New York Fed conducts this monthly survey of manufacturers in New York State. Participants from across the state represent a variety of industries. On the first of each month, the same pool of roughly 175 manufacturing executives (usually the CEO or the president) is sent a questionnaire to report the change in an assortment of indicators from the previous month. Respondents also give their views about the likely direction of these same indicators six months ahead.

This Empire State Survey is very noisy - and has shown recessionary conditions throughout the second half of 2011 - and no recession resulted. Overall, since the end of the 2007 recession - this index has indicated two false recession warnings.

No survey is accurate in projecting employment - and the Empire State Manufacturing Survey is no exception. Although there are some general correlation in trends, month-to-month movements have not correlated with the BLS Service Sector Employment data.

Over time, there is a general correlation with real manufacturing data - but month-to-month conflicts are frequent.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more