It's Time To Learn More About FelCor

My favorite real estate asset class is Lodging. I'm sure that passion can be traced back to my grandfather, who, in the early 1960s, relocated to Myrtle Beach, SC to become a motel baron. His first investment was called T&C Court, and the 50-room motel was the first to include televisions for guests.

Later, my grandfather upgraded his real estate holdings to a property called Oceans Pines Motor Court. The post card advertises the Kings Highway holding as a luxurious getaway just "670 miles south of New York and 735 miles north of Miami".

While my grandfather was known for his savvy real estate acumen, he was better acknowledged for his enterprising customer service skills. He managed to ride the wave - one of the pioneers in the hot Myrtle Beach market - and build a prosperous business that he eventually sold, being richly rewarded.

Unfortunately, I did not inherit the motels, but I did receive genetic traits - or that necessary trace of wisdom - that enabled me to become a more intelligent thinker. Accordingly, these lessons passed down over the years have equipped me to distinguish the ability to control risk, always preparing for the time in which risk meets adversity.

Becoming a Successful Hotel Landlord

As I said, I did not inherit my grandfather's hotel collection, and his legacy is now a distant memory visualized on the two post cards I just showed you. However, I can appreciate the fact that owning hotels can lead to wealth creation, and by owing great real estate and delivering sound customer service, there are outsized rewards.

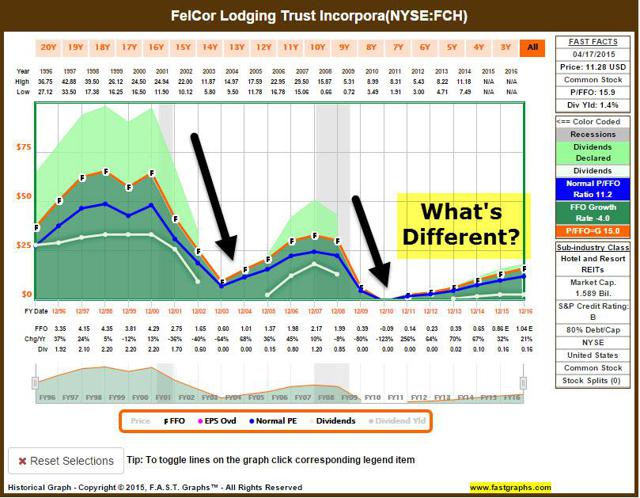

One of the reasons that I have delayed my in-depth analysis of FelCor (FCH) is because I knew that the company had a history of dividend cuts. In other words, there are some very good Lodging REITs that have formed since the Great Recession, and many of them are much better capitalized (with no legacy assets or dirty laundry). However, thanks in large part to Bret Jensen's articles, I decided that it's time to take examine the company more closely.

FelCor went public in 1994 (over 21 years ago), and the company focuses on upper-upscale and luxury hotels located in major and resort markets. The name FelCor is derived from the co-founders' last names: Hervey Feldman ("Fel") and Tom Corcoran ("Cor"). As I said, FelCor has maintained a discouraging dividend history, but I'm still plowing forward with the research:

Now you can, FelCor had two big dividend cuts (not just one). More importantly, it's my job to determine what's different about the company. I don't think anyone is happy about the past, but I'm more interested in the future.

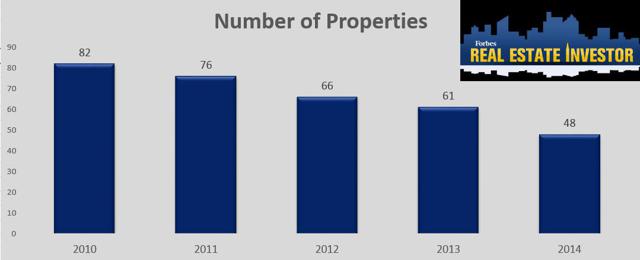

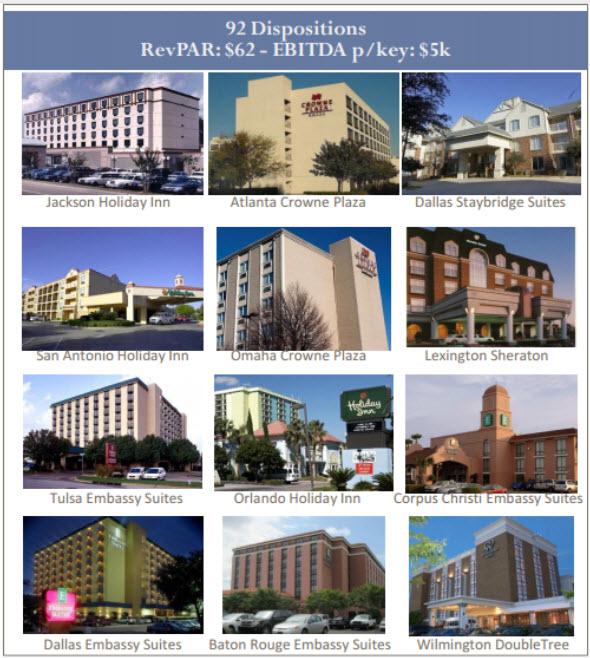

FelCor owns 48 hotels, down from 82 in 2010. As a result of the lessons learned from the latest recession, it has been repositioning its business model, focusing more on quality than quantity.

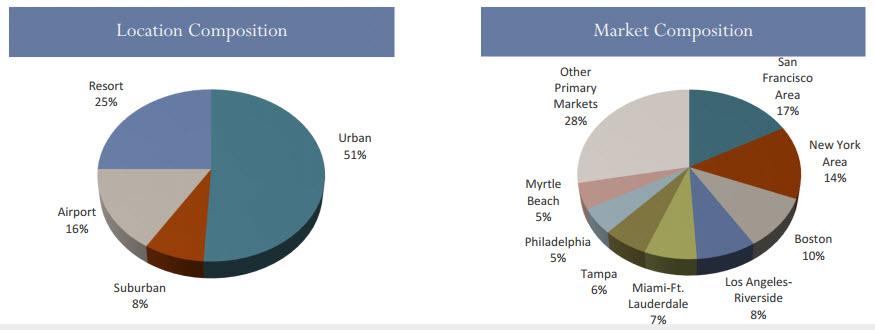

Today, FelCor focuses on markets with high barriers to entry and with dynamic demand generators. Around 90% of the portfolio is comprised of upper-upscale and luxury located primarily in urban and resort locations.

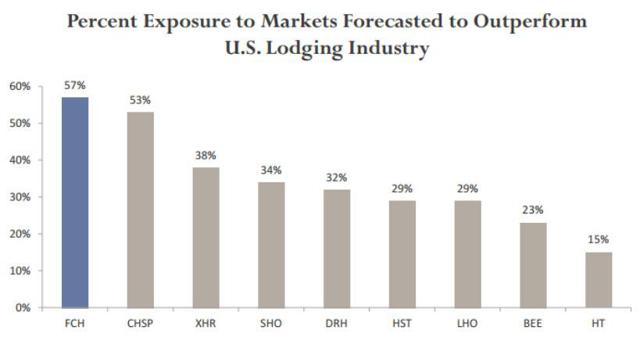

The company's portfolio is strategically located to provide better growth, with a specific strength in sub-markets with strong demand generators. PKF forecasts FelCor to have the highest exposure in these markets in 2015-2017 (Source: Investor Presentation).

By repositioning the portfolio on quality, FelCor has drastically reduced the size of the company:

However, the acquisitions have been targeted to aggressively maximize revenue management.

Continue reading this article here.

Disclosure: The author is long O, DLR, VTR, HTA, STAG, CSG, GPT, ROIC, HCN, OHI, LXP, KIM, TCO, DOC, UDF, EXR, HST, BRX, WPC, HCP, CLDT, MPW, APTS.

more