It’s (Still) Tough To Beat Mr. Market

If you keep banging your head against the wall, presumably a lesson or two will creep into your cracked skull. But if those lessons are related to investing, the crowd suffers from a recurring and long-running bout of attention deficit disorder.

This is old news, of course, but it’s also forever new, as a fresh batch of data from Dalbar, a research shop, reminds. Courtesy of The New York Times, we once again observe that the average mutual fund investor suffers from chronic, self-inflicted financial pain. As Jeff Summers reports:

Over the past year and for periods of five, 10, 20 and 30 years, the average mutual fund investor has underperformed the markets for both stocks and bonds, according to Dalbar. Bond investors have generally failed to even keep up with inflation.

In the 30 years through December 2018, for example, the average bond mutual fund investor earned 0.26 percent, annualized, compared with annual inflation of 2.49 percent, Dalbar found. Over the course of an entire generation, bond investors’ money shrank more than 2 percentage points a year in real terms.

A rational mind would study the data and conclude that behavior modification is in order. But this is finance and so while it’s possible for any given individual to change old habits, the crowd as a whole faces a different prognosis: Fuhgeddaboudit.

The “wisdom” of the masses is conspicuously lacking on the matter of tracking, much less beating, the market (and Mr. Market’s asset allocation too). For reasons that we’ll sidestep here, the mob has a perennial inability to act in its own best interest in matters of portfolio design and management. But that’s not entirely bad news, albeit for a small slice of the investment population.

The raw material for generating returns that fall into the category of encouraging (or stellar) is the tendency for most investors to make poor decisions. As Professor Bill Sharpe outlined in “The Arithmetic of Active Management,” alpha (market-beating results) is a zero-sum game. For those with the discipline and skills to earn above-average returns, you may want to send thank-you cards to the sea of investors who made those gifts possible, a.k.a. the poor souls who shoot themselves in the foot on a regular basis.

The Dalbar results impart many lessons, starting with the power of simplicity. Almost everyone ignores this advice (including institutional investors), which is why its lessons are worth revisiting from time to time. To wit, consider the following toy example.

BlackRock’s asset allocation ETFs are part of an elite group of publicly traded funds that offer impressive results in the multi-asset class investment category. Let’s just say that you could do a lot worse in the realm of managing a global portfolio of stocks and bonds. For our purposes, let’s focus on two ETFs, which proxy as aggressive and conservative asset allocation strategies:

iShares Core Aggressive Allocation (AOA)

iShares Core Conservative Allocation (AOK)

At the very least, this pair of ETFs are competitive for almost anything you can do in the long-only space for conventional portfolio design and management on a global basis. But for several reasons, the intelligent investor might want to build his own. How to begin? You could start with a dead-simple plan that holds representative ETFs in each of the main asset allocation buckets: stocks, bonds, real estate and commodities. Let’s call this our Big-4 Beta Strategy.

To pick weights, let’s take guidance from the classic 60% stocks/40% bonds benchmark and tweak ever so slightly by taking 10 percentage points from bonds and redeploying evenly to real estate investment trusts (REITs) and a broad definition of commodities. To round things out, the portfolio is rebalanced to the target weights at the end of each calendar year. The resulting mix:

60%: Vanguard Total World Stock (VT)

30%: Vanguard Total International Bond (BNDX)

5%: iShares Global REIT ETF (REET) – backfilled with RWO

5%: iShares S&P GSCI Commodity-Indexed Trust (GSG)

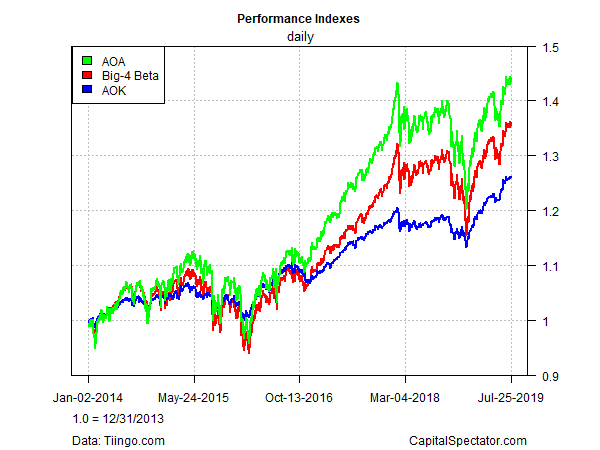

Using a Dec. 31, 2013 start date, the performance results are shown in the chart below. Note that the Big-4 Beta Strategy offers a midway result vs. BlackRock’s aggressive and conservative results. By changing the allocations, you can dial risk up or down and earn competitive results in line with the risk exposures you select.

None of this surprising, but it’s a reminder that you can easily grab the lion’s share of the world’s market betas with a simple strategy and earn respectable returns. Alpha is complicated (and tends to be elusive). Beta, by contrast, is simple and easily secured, often at rock-bottom prices.

Can you do better? Sure, but as the Dalbar numbers remind, you probably won’t—for reasons that have little to do with the markets per se and everything to do with the little gray cells between your ears.

Disclosure: None.