It’s Getting Steeper

Friday was an anniversary—of sorts. It was the first day since May that the 2–10 year Treasury yield curve steepened to three digits. The spread closed the day at 1 percent (100 basis points), up from an August bottom of 76 basis points. You did celebrate, didn’t you?

Broadly, the widening yield differential indicates expectations of quickening inflation. And in today’s market that’s actually a good thing.

It should also have been the basis for some tasty gains in the iPath US Treasury Steepener ETN (Nasdaq: STPP), a note that tracks, notionally, a long exposure in 2-year Treasury note futures together with a short position in 10-year T-note contracts. Essentially, Barclays Bank plc, the note issuer, makes Treasury futures spread trading a one-stop, no leverage proposition. As the curve steepens, 10-year rates should rise faster than 2-year yields, producing overall gains for STPP holders.

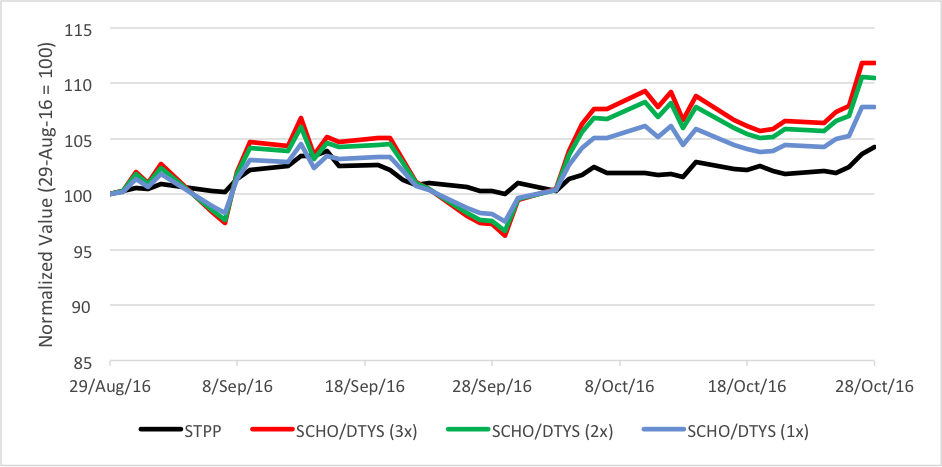

Since the end of August, the iPath note has indeed risen. But not by much. The note sells for about $31 a piece now, up just 4 percent. Still, interest in the note has increased dramatically. Average daily volume over the past six months exceeds 21,000 notes. For the previous six-month period, daily turnover was just 12,000 notes.

Some folks who might otherwise be inclined to trade STPP may have shied because of the note’s pokiness. For these investors, more bang for their buck can be had by taking two steps instead of one. Long 2-year T-note exposure can be acquired cheaply through the Schwab Short-Term US Treasury ETF (NYSE Arca: SCHO) while a short stance in the 10-year is obtainable by buying the iPath US Treasury 10-Year Bear ETN (NYSE Arca: DTYS).

If they’d done that on an equal-dollar basis at the end of August, they’d be up nearly 8 percent now, double the STPP return. The trade-off is higher volatility—much higher volatility. That volatility works to their favor as the curve steepens but can produce ugly losses in a flattening environment.

If volatility isn’t a worry, and the odds of further steepening seem strong, exposure to the 10-year note can be leverage by doubling up, dollar-wise, on DTYS. That would have produced a 10 percent gain since August. Treble the wager on DTYS and gains go up to 12 percent.

Now, there are a couple of caveats about using the iPath notes. First, they’re unsecured debt obligations of Barclays Bank—they’re just promises to pay the index return at the notes’ maturity date. So, investors have to be comfortable shouldering the counter party risk. And, second, that maturity date is coming up fast—August 2020, in fact. These notes can’t be permanent portfolio positions. They’re tactical, rather than strategic allocations.

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) ...

more