It (Still) Looks Like A Bear Market For US Stocks

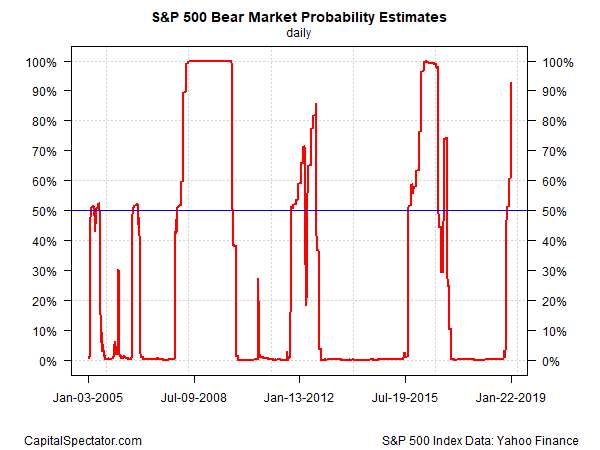

On Christmas Eve, the US stock market appeared to tip into bear-market terrain, based on econometric analysis via a Hidden Markov model (HMM). Since then, we’ve seen a strong rally in the new year. But the regime shift to the dark remains intact and in fact has strengthened.

Since the Christmas Eve update, when the HMM probability estimate of a bear market was modest above 50%, the model now assesses the likelihood at 93% (as of Jan. 22’s S&P close).

The methodology is based on modeling rolling one-year returns for the S&P on two fronts. The first is a slower but more reliable framework of using average monthly data (updated daily for the current month). The second application uses daily numbers, which is faster to react to trends but more vulnerable to noise. Taking the average of the two on a daily basis provides a relatively robust estimate that attempts to find the sweet spot between timeliness and reliability.

There’s no assurance that this methodology will be accurate, of course. But as one attempt to generate a relatively objective evaluation of the stock market’s current regime state it’s not easily dismissed.

The bear may continue to roar, but it’s reasonable to wonder if the deepest bite has passed. The S&P’s current drawdown is still a steep -10.2%, but the peak-to-trough decline has eased significantly from the near-20% decline at the Christmas Eve close.

Has the worst of the bear market passed? Perhaps, but the unusually high level of uncertainty in Washington leaves room for staying cautious. Notably, the Economic Policy Uncertainty Index for United States surged to a 2-1/2 year high yesterday.

The mounting evidence that US economic growth is slowing doesn’t help. For now, recession risk remains low, based on data published to date, but the added complication of delayed economic reports doesn’t inspire confidence that peak uncertainty is in the rear-view mirror.

The good news is that a big slice of the macro challenges are self-inflicted, including the partial government shutdown that’s slowly but surely creating headwinds for the economy. As a result, the potential to resolve Washington’s political impasse is, in theory, waiting in the wings: several bills in Congress are set for votes this week to end the shutdown.

Reopening the shuttered government offices isn’t a silver bullet, but it would surely give Mr. Market a new reason to cheer.

Will the Washington circus fold its tents this week? The upcoming votes in the Senate offer hope, but with limits. As Bloomberg reminds, the fog of uncertainty is still thick.

Donald Trump’s closest advisers have competing senses of what the president would be willing to accept as part of a deal with Democrats to reopen government, underscoring the difficulty negotiators face in bridging the impasse over border security funding.

Disclosure: None.