It Looks Like The Smart Money Isn't Buying Stocks Now

I've always believed in watching what people do more than what they say. Folks can talk all they want, but if they're not buying what they're recommending, then they either have a conflict of interest or they're probably just being disingenuous.

In the case of the smart money - hedge funds and other institutional investors, who have much greater access to capital, talent, and data than the typical retail investor - their actions bespeak a great deal of fear and loathing regarding the future of the equities markets.

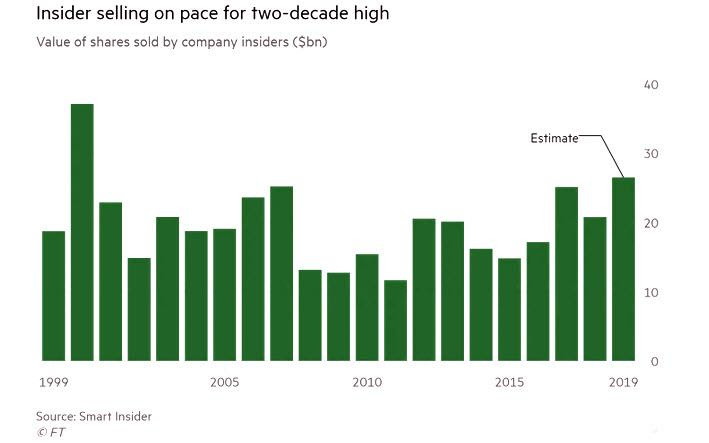

With the S&P 500 hovering near all-time highs, the retail crowd persists in bidding up large-caps while the insiders - the ones privy to the vitals of those large-cap companies - are selling at a pace we haven't seen in a couple of decades:

Courtesy: Smart Insider, Financial Times

They're stockpiling cash, and as Capital Asset Management senior vice president Samuel Boyd observes, "Cash is king, and it can mitigate portfolio risk as well provide a fulcrum to capture opportunities when the world is on sale." Evidently, the smart money believes the world will be on sale in the near future - not an event to fear if you've got plenty of dry powder.

Equity Group Investments hedge-fund manager and billionaire Sam Zell is among the ultra-cautious, conceding that "We certainly never had a cash position like we have now" and "We think there's going to be some significant opportunities." That's a polite way of saying that equities prices are going to be cheaper, and since bonds yield very little nowadays, cash is an attractive option at the moment.

Besides retail investors, I suspect that the only ones buying stocks at the current valuations are corporations that are buying their own shares:

.jpg)

Courtesy: Bank of America Merrill Lynch

After all, corporate share buybacks are one of the few things - along with accommodative Fed policy, of course - that are holding up the stock market. When that structure collapses, I'll be ready - me and the smart money, wherever they are - with cash in hand and greed in my heart.

Disclosure: David Moadel is not a licensed or registered investment advisor, and has no position in any securities listed herein.