ISM Prices And Production Packing A Punch

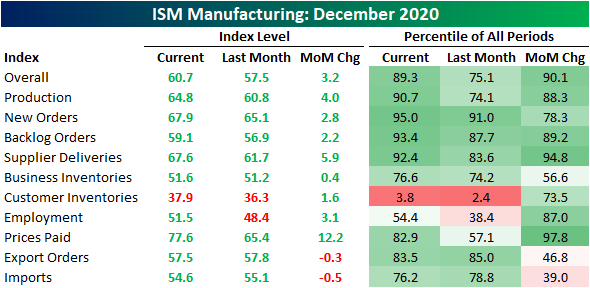

This morning saw the release of an impressive reading on the manufacturing sector from ISM’s Manufacturing PMI for the month of December. For the seventh month in a row, the index was consistent with growth in the manufacturing sector (readings above 50 generally indicate month over month growth). Not only did the ISM’s reading show yet another month of growth but that growth accelerated as the index rose to 60.7 – the highest level since August of 2018. Prior to that, you would need to go all the way back to January and May of 2004 to find readings as high as this past month.

(Click on image to enlarge)

Along with one of the highest readings in two decades for the headline index, breadth in the report was very strong. The only indices to fall were those for Exports and Imports, and even those declines were minor. Meanwhile, the indices for Production, New Orders, Order Backlogs, and Supplier Deliveries all came in the top decile of readings of their respective histories. To summarize, overall conditions continued to improve with strong demand and production on the rise to meet that demand. There are some supply issues like low inventories and longer lead times, though and that’s contributing to sharply rising prices.

(Click on image to enlarge)

The commentary section gives a bit more color into this. Comments frequently mention that there are supply chain issues due to recent COVID outbreaks. Such issues include logistics and supplier delays, as well as labor shortages. On the bright side, there are also several mentions that sales have not only gotten back on track but have actually passed levels from prior to COVID.

(Click on image to enlarge)

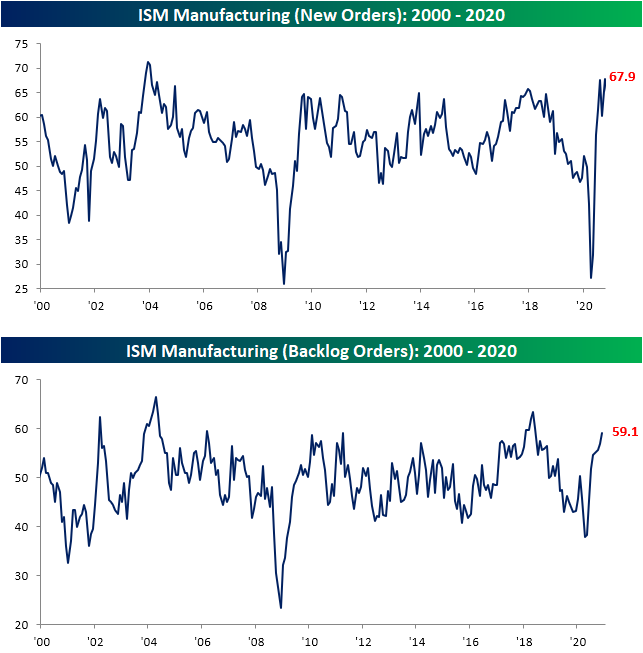

The data from the report backs up that strength in sales noted in the commentary section.The New Orders Index rose 2.8 points to 67.9.That is back up to where the index stood in October which was/is also the highest level since late 2003/early 2004. As New Orders have come in at such a strong pace, order backlogs have continued to rise. The index for Backlog Orders rose to 59.1 in December, the highest level since June of 2018.

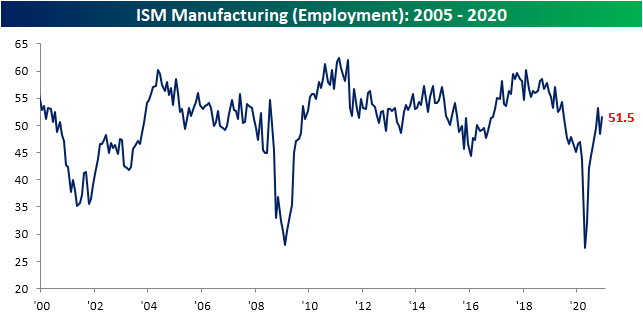

To meet that surging demand, manufacturers continue to massively ramp up production. The Production Index rose to its highest level in nearly a decade in December. At 64.8, the index is only half a point below the January of 2011 high. Once again, prior to that the last time the index was at these levels was in 2004. Additionally, manufacturers are taking on more workers as the index for Employment rose back into expansionary territory, although it remains below its October high. Looking to the future, these two indices should continue to have the wind in their sails given new orders remain strong and inventories remain low. With regards to inventories, the index for Customer Inventories was higher this month but continues to indicate that a high share of respondents report that customer inventories are too low.

(Click on image to enlarge)

As the commentary section made abundantly clear, that is not to say the supply side does not currently have issues. The index for Supplier Deliveries sharply rose in December rising to 67.6 from 61.7. Higher readings in this index indicate longer lead times. The index is now at its highest levels since the worst of the lockdowns back in the spring while the 5.9 point increase month over month is near the top 5% of all monthly moves in the index’s history. In other words, there is evidence that supply chains are once again under strain due to a mix of strong demand and COVID related issues.

(Click on image to enlarge)

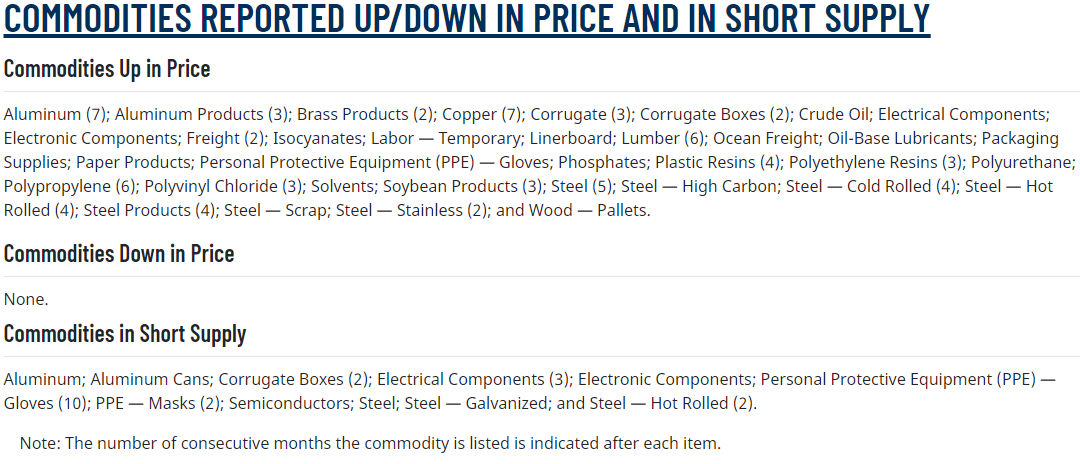

Not only are products from suppliers taking longer to reach their destinations, but they are also costing more. The index for Prices Paid topped 77.6 in December indicating that price growth accelerated to the fastest pace since May of 2018.

(Click on image to enlarge)

ISM also surveys on what products exactly manufacturers are observing to have moved up or down in price. As the index for prices paid surged, not a single commodity was noted as moving down in price. On the other hand, there was a long list of commodities up in price. Aluminum, copper, and various steel products were all noted as costing more and being in short supply. Similarly, shipping has seemed to have gotten more expensive. Freight, packaging supplies, corrugated boxes, and wood pallets all saw price increases with some also being observed as in short supply. As COVID cases continue to surge, personal protective equipment (PPE) has also seen price increases but only for gloves.

(Click on image to enlarge)

Click here to view Bespoke’s premium membership options for our best research ...

more