Is Your Portfolio Safe When The Momentum Stops?

What comes up must come down, right? As the seven-year bull market finds its strength tested the past two weeks, many momentum stocks, which have seen their share prices soar, found their valuations crashing back to earth rather abruptly. Investors placing their bets on high-flying momentum stocks are putting their portfolios at significant risk. Most investors will agree that we are closer to the end of the bull market than the beginning, and so it is time to put momentum stocks in the Danger Zone.

Momentum Stocks Are Risky Bets

The main idea behind momentum investing is that yesterday’s price movement will repeat in the future. As a stock moves up, momentum increases, and investors pile in, driving the price even higher. This investment strategy overlooks the actual economics of the business underlying the stock. As such, momentum strategies are based on speculation. The problem with speculation is that there tends not to be any method for predicting when the speculative fervor will end and, when it ends, it tends to swing from positive to negative very quickly, and stocks get crushed.

When The Bull Market Takes A Rest, Momentum Stocks Get Wiped Out

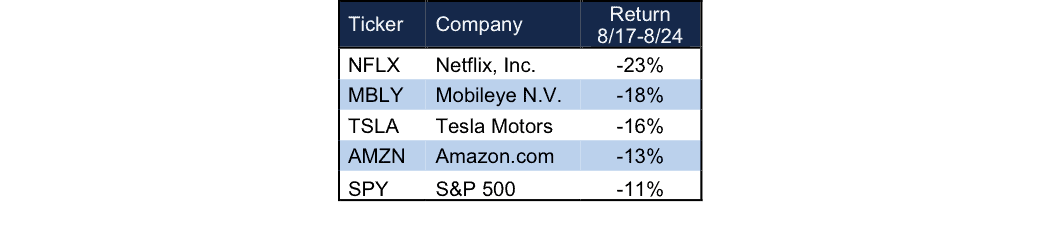

Prior to August 17, the markets had traded relatively flat on the year. However in the following six days, the three major market indices, The Dow Jones, S&P 500, and Nasdaq would each enter correction territory. When the dust settled, a total of $2 trillion in market value had been wiped away. Figure 1 shows how some of the market’s best performing stocks of the year faired much worse than the overall market.

Figure 1: High Flyers’ Valuations Slashed in Correction

Sources: New Constructs, LLC and market data

The four stocks in Figure 1 receive our Dangerous-or-worse rating; yet all of them had seen year-to-date share increases ranging from 30% to over 150%. These stocks were trading, not based on fundamentals, but on momentum. When the overall market’s momentum stopped, these stocks felt the brunt of the decline.

However, it didn’t have to be this way. Netflix (NFLX), Amazon (AMZN), and Tesla (TSLA) have been in the Danger Zone in the past. We’ve warned of rampant overvaluation and even problems with the business. Momentum stocks that we put in the Danger Zone are not only risky due to their reliance on speculation but also due to the issues in their underlying business models.

Momentum Stocks Can Suddenly Drop Without A Market Correction

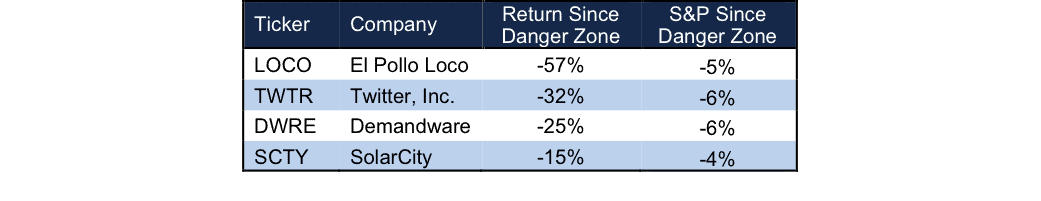

Figure 2 shows stocks that were once market darlings with oversized valuations that sank before the recent market correction. When the momentum in these stocks ended, the speculators sold in droves and the valuations tanked in a hurry. These stocks were also recently in the Danger Zone. Investors who followed our research and sold those stocks likely saved themselves lots of money. Note the declines in these stocks were only amplified during the recent market correction.

Figure 2: Once Market Stars, Now Market Dogs

Sources: New Constructs, LLC and market data

The takeaway for many momentum stocks is; it’s not a matter of if, but when. It is only a matter of time before valuations will sync with cash flows. Companies with no true cash flows, aka economic earnings, are destroying shareholder value. In bull markets, this fact often gets overlooked, as investors would rather “join the ride.” To keep your portfolio safe, avoid momentum stocks and focus on those with strong cash flows and cheap valuations.

Disclosure: New Constructs staff receive no compensation to write about any specific stock, sector, or theme.