Is The Trump Economic Agenda Falling Apart Before It Even Gets Underway?

Although it is early days in the Trump administration, there are visible signs that its economic agenda is falling by the way side. Those investors who are looking to this agenda as a panacea for renewed growth need to step back and consider carefully the agenda and its constraints which are becoming more evident every day.

Two of the linchpins in the economic agenda are: a border tax and corporate tax cuts. They are intertwined and, as such, are subject to the same set of constraints.[1]

Border Tax. Comments coming out Congressional leaders are that the border tax will not be implemented. It was designed to break up the worldwide supply chains established by the U.S. multinationals in such a way as to encourage greater investment at home rather than abroad. Alas, large retailers such as Wal-Mart, Target and Best Buy, stand to lose greatly if they have to hike their prices. Given the precarious situation for many large chain stores as they contend with e-commerce sales, the last thing they need are higher tariffs.Now, we see that the administration has gone radio silence regarding a border tax. Bloomberg.com reports that Gary Cohn, chief economic adviser, says that the White House no longer supports this initiative. No doubt the prospect of killing so many retail jobs could no longer be ignored.[2] The demise of the border tax leads right into the question of how the corporate tax cuts are going to be financed.

Corporate Taxes. The border tax was considered the best means to offset the revenue losses from corporate tax cuts. But it appears that there is no broad-based agreement among House Republicans on how to keep any tax cuts from deepening the federal deficit. The deficit problem worsens should the President’s wish to increase defense spending is approved. The Congress is a long way off from coming together on taxes, spending and deficit management. This raises the broader issue of whether there is fiscal room to cut corporate taxes.

Fiscal Capacity and the Deficit.Fiscal policy has very little room to expand. The net federal debt- to- GDP is 80 per cent and the annual deficit- to- GDP is 3 per cent. Both measures restrain the effectiveness of fiscal policy. That constraint is worsening, given that the bulk of government spending is devoted to ever growing entitlement programs. The pressure will be on Congress to adopt tax policies that are revenue neutral, and those proposed by Trump have none of the earmarks of a balanced approach to taxes and spending.

Monetary Policy and the Dollar. Unlike other major central banks, the Fed is biased towards raising short-term rates. This has put upward pressure on the dollar and this will lead to a widening of the U.S. current account deficit.[3]

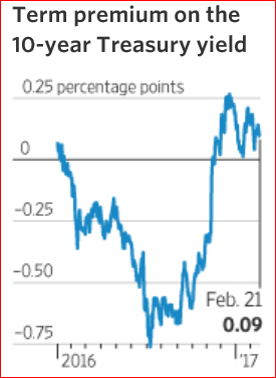

So far, the stock market participants believe that the Trump agenda can be implemented this year. The market has reached new highs recently and seems to be comfortable at these levels. The bond market, however, remains very skeptical on this point. As the accompanying chart indicates the term premium for the 10-year bond has come down considerably this month. Bond investors do not need the additional rate of return to guard against growth and accompanying inflation.

Many are now looking for further declines in the nominal 10-yr rate to 2 per cent or even lower, largely on the basis that these constraints are going result in GDP growth of 2 per cent. This a far cry from the administration’s forecasts of 3-4 per cent for 2017-18.[4] It is time that investors take off their rose colored glasses.

[1] David Rosenberg: Cautious on the Trump Rally

[2] Trump’s Medical Prescription Will Kill The Patient, Instead Of Curing The Disease

[3] Retail Stocks Jump on Report GOP Border Tax Plan Doesn't Have White House Support

Great Read! I think that President has the notion that economic recovery is instantaneous, this is untrue. Moreover, the stock market is not necessarily representative of the economy overall, we must look at other factors such as inflation, unemployment, etc.

Considering the appreciation of the #dollar, volatile #oil prices and decrease in the #Gold Spot Market, this activity is signalling a market change. Could be that as we exit the recession, business activity is picking up.

Fully in agreement with you.

Humble is a word that is not in #Trump's vocabulary.

The more dysfunctional the Congress and Trump become, the more likely we will bounce around zero growth. The incoming data, so far, shows nothing to support the level of euphoria.

"Humble is a word that is not in #Trump's vocabulary...." That's an understatement! But I enjoyed the article and comments.

True, but #Trump does deserve some credit for the speech last night. He may not have written it, but he learned to not go off topic with horrific rants and untruths.

I noticed POTUS spoke of a border tax last night. He seems to really want it. If it isn't in the plans it is fake news from a prideful man. If it is in the plans, retail will take a beating.

The lack of specifics on everything tells me that POTUS does not have anything ready to submit to Congress. Still rhetoric prevails. How long can the markets hold up without any concrete plans.?

If Donald Trump is eating humble pie he must be boiling mad. It is infinitely more difficult to manage the US economy than it is to manage a hotel. I just hope we don't bounce along zero or negative once this euphoria wears off.