Is The Recent Surge In US Inflation Peaking?

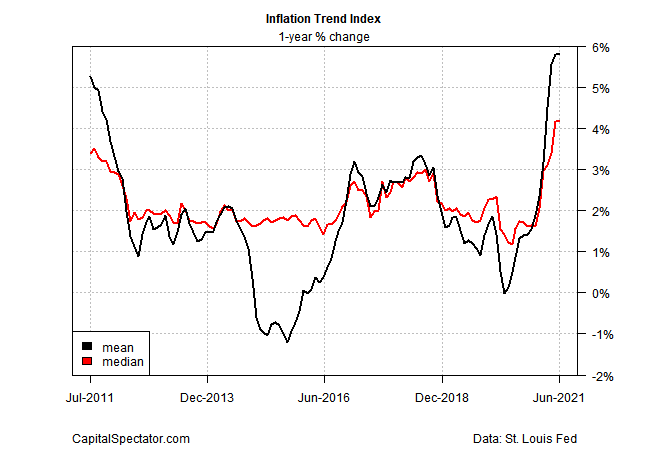

Inflation pressures remain relatively high for the US but the rebound after pandemic lows may be peaking, according to the latest update of the Inflation Trend Index (ITI), a seven-factor benchmark that’s designed to provide a degree of forward guidance on the directional bias of pricing activity.

Even if inflation is peaking, the recent increase in pricing pressure may endure. But if the peaking process is confirmed in upcoming data, the news would support the case, if only on the margins, that the transitory forecast for inflation is still viable if not strengthening.

Meantime, revised data for ITI indicate that the median and average measures of the trend are holding steady for the first time this year. That compares with persistent increases in ITI previously. The update is based on a mix of reported and estimated data for the index’s seven inputs through yesterday, June 7. (For a list of ITI’s factors, see here.)

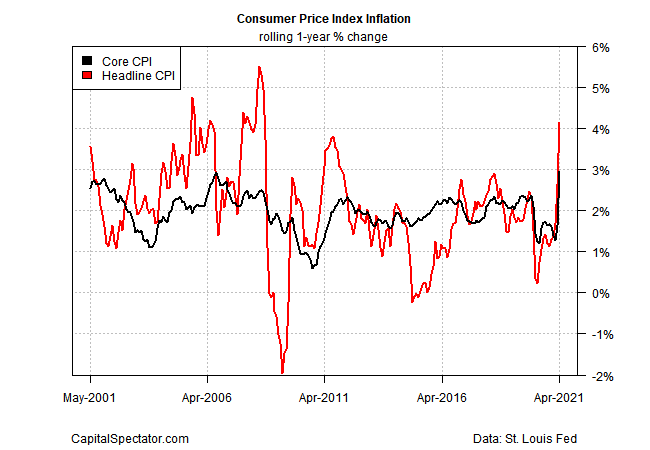

If ITI is peaking, that may be a sign of things to come for the Consumer Price Index (CPI), which will be updated on Thursday, June 10, with figures for May. Economists, however, expect that higher inflation is still the likely path. Headline and core CPI are expected to post higher year-over-year increases for May (+4.6% and +3.4%, respectively), based on Econoday.com’s consensus point forecasts. Using ITI as a guide implies that the accelerating inflation trend will peak in June.

The Treasury market appears to be pricing in the possibility that the recent surge in inflation is cresting. The benchmark 10-year rate has been gently slipping over the past two months after a sharp rise from last summer’s low, which suggests that the crowd is pricing in rising odds that most if not all of the recent runup in inflation is behind us.

The debate over inflation’s outlook, however, remains fierce. One camp, which includes the Federal Reserve, argues that the recent increase in inflation is transitory and triggered by the economic rebound after a deep recession linked to the pandemic. The alternative view is that a confluence of factors will keep inflation running hot (and perhaps even hotter) for an extended period.

Deutsche Bank economists, for example, forecast that higher inflation will persist and that the Federal Reserve’s decision to tolerate this increase by forgoing rate hikes is a threat to the economy.

“The consequence of delay will be greater disruption of economic and financial activity than would otherwise be the case when the Fed does finally act,” advise Deutsche’s chief economist, David Folkerts-Landau, and his team. “In turn, this could create a significant recession and set off a chain of financial distress around the world, particularly in emerging markets.”

The Federal Reserve and Treasury Secretary Janet Yellen aren’t convinced, at least not yet. “I personally believe that this [higher inflation] represents transitory factors,” she said over the weekend. Even so, she expects that inflation will hold at a relatively elevated level of 3% year-over-year through the end of 2021.

Disclosures: None.