Is The Post-Crash Reflation Trade Fading?

Last month the Federal Reserve announced that it was adjusting its monetary policy in a bid to push inflation higher. Based on recent trading in the Treasuries market, the crowd remains unconvinced and may be in the early stages of unwinding a months-long rise in pricing inflation expectations higher.

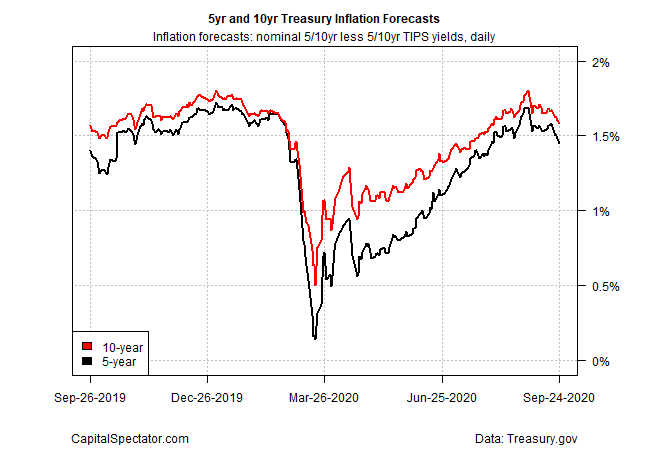

After crashing in March, the Treasury market’s implied inflation forecast (based on the yield spread for nominal less inflation-indexed maturities) clawed back the loss. But the bounce appears to be reversing.

Consider that in March, as coronavirus panic shook markets, the 10-year’s inflation outlook fell sharply, dropping to 0.5% on Mar. 19, based on daily data published by Treasury.gov. That marked a dramatic change from the start of the year, when the forecast was 1.8%, just below the Fed’s 2% inflation target.

But since that epic collapse, the forecast has been steadily rebounding and at the end of August the outlook had come full circle, returning to 1.80% for the 10-year spread. September trading, however, suggests that the long-running disinflation trend may be returning.

The motivation for the Fed’s policy change, after all, is partly (if not primarily) an effort to address the low-flation bias that’s taken root in the economy in recent years. Reviewing the historical core rate of consumer price inflation reminds that a downside bias has been in force for several decades.

Although the slide stabilized over the past decade around the Fed’s 2% target, the question is whether the coronavirus crisis has shattered the stability and unleashed a new wave of disinflationary pressure?

It’s too soon to know, but the Treasury market’s latest downside revision in inflation expectations suggests that it’s premature to dismiss this possibility. One view of the recent reversal in the inflation forecasts is that the market is expressing new doubts that the Fed’s revised monetary policy will be successful in lifting inflation expectations.

In the near term, the economy will drive the outlook for inflation. The good news is that economists are still projecting that the broad macro trend will rebound in the upcoming third-quarter GDP report (due Oct 29). The Atlanta Fed’s GDPNow model is among the most bullish nowcasts—Q3 growth by this measure is on track to rise 32% (as of the Sep. 17 estimate) after falling 31.7% in Q2 (using seasonally adjusted annual rates of change).

But the aftershocks of the pandemic continue to persist on several fronts. Notably, yesterday’s update on jobless claims shows that the labor market continues to suffer from an usually high pace of new layoffs, week after week. New filings for unemployment benefits rose 870,000 last week. The ongoing surge in claims represents a substantial risk for the economy and threatens to fuel the disinflation trend.

The Treasury market is hardly perfect as a tool for inflation forecasting and so it’s always advisable to take the implied estimates with a grain of salt in the short run. Nonetheless, these numbers offer a real-time estimate that reflects a relatively deep pool of market participants.

The bottom line: the Treasury market’s inflation outlook suffers short-term noise, but eventually the implied forecast aligns with the CPI trend, as shown below. Based on this relationship, the risk appears to be rising that disinflation momentum will pick up in the months ahead. In turn, the potential for even lower (or perhaps negative) interest rates will receive a fresh hearing as markets reassess the macro outlook in the final months of 2020 and reprice assets accordingly.

Disclosure: None.