Is The Fed Holding Down Growth? (Just The Opposite)

I occasionally get comments suggesting that the Fed is somehow “holding down growth” in the economy. That makes me wonder if the Fed has some sort of magic dust, capable of holding down growth without leaving a trace. So let’s look at some of the traces the Fed has actually left.

Before doing so, recall that some conservative economists claim that the Fed has no first order impact on growth, because money is neutral. I don’t agree, and neither do those who claim the Fed is holding down growth.

More likely, wages and prices are sticky in the short run. The Fed can temporarily boost growth by increasing the rate of inflation, and thereby reducing the unemployment rate. I’ve argued that we should look at NGDP growth rather than inflation, which can be distorted by supply shocks.

So let’s look at the data:

1. Over the past two years, the unemployment rate has fallen all the way to 3.7%, one of the lowest rates in modern history. Other employment indicators have also been quite strong, with employment rising far faster than the working age population.

2. Over the last two years, inflation has risen up to around 2%, roughly the Fed’s target.

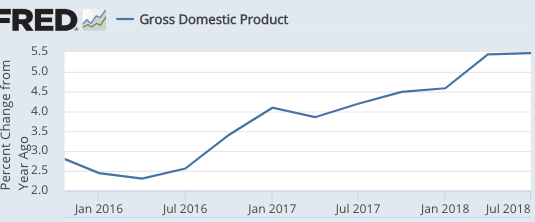

3. Most importantly in my view, the rate of NGDP growth has been increasing rapidly, from well below trend to above trend:

One can’t just argue that the Fed is holding down growth, without providing any evidence. All the evidence points in the other direction, that the Fed has been juicing the economy. Perhaps that will change in the future, time will tell. But they have certainly not been holding down growth in the recent past, precisely because they haven’t been taking the steps that would be necessary to hold down growth—slowing NGDP and inflation in order to raise the unemployment rate.

Some will inevitably argue that there has been a supply-side “miracle” that’s hard to see because the Fed refuses to “let the economy rip”. Supply-side miracles leave very specific tracks in the data, such as a slowdown in inflation. But inflation has been rising. And of course, that doesn’t explain the strong NGDP data.

I encourage people not to go with their gut instincts, rather to look very closely at the actual data and think about what it means. You can’t just make up any old story and be expected to be taken seriously.

Everything in this post is past tense. Obviously, the Fed may start holding down growth in the future, and if so we’d see the unemployment rate rise to a level above the natural rate. I can’t rule out that possibility, indeed I’d expect it to occur at some point in the next decade. But as of now it’s clear that they have not been holding down growth, and indeed have been stimulating the economy. In fairness, that stimulus was appropriate, as for years we’ve been running well below the Fed’s 2% inflation target.

PS. At the risk of saying “I told you so”, I’d like to remind readers of a half dozen posts I did around 2016-17, where I said I was not convinced that the Fed was trying to keep inflation below 2% and that it might have been a mistake on their part. I pointed out that the consensus of private sector forecasters had also erred, not just the Fed. I said I’d defer judgment for another year to see if they could make further progress on inflation. And now we are at 2% inflation, just as the consensus of private sector forecasters and the Fed predicted. I’m willing to stop deferring judgment and come to a conclusion. I conclude the Fed really does want 2% inflation, which is the average inflation rate since 1990 and also the 30-year TIPS spread.

PPS. After a recent post on neoliberalism, some questioned my definition of the term. I was mostly responding to how others use the term. In other words:

1. Most intellectuals describe the current economic system in most developed countries as neoliberal.

2. Lots of populists on the left and the right have been running against that regime.

3. And yet the regime seems hard to dislodge, in any significant way.

Again, I was responding to the way that others define neoliberalism (usually with a negative connotation). Among opponents of neoliberalism, there is enormous surprise and disappointment that so little has changed over the past ten years. I see that disappointment frequently expressed in essays on the topic. They expected the aftermath of the Great Recession to produce the sort of change we saw during and after the Great Depression. It didn’t happen.

PPPS. China bleg: I’m looking for empirical studies of Chinese theft of American intellectual property. Any links would be appreciated.